- Singapore

- /

- Real Estate

- /

- SGX:U14

3 SGX Dividend Stocks Offering Up To 7.4% Yield

Reviewed by Simply Wall St

In recent developments, the Singapore market has shown a keen interest in innovative sectors, highlighted by Mastercard's inclusion of Singapore-based peaq in its Start Path program focusing on blockchain and cryptocurrency. This move underscores a broader acceptance and integration of emerging technologies within the local economic landscape. In this context, identifying dividend stocks that not only offer attractive yields but also demonstrate resilience and adaptability to new market dynamics becomes crucial for investors looking to capitalize on current trends.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| Singapore Exchange (SGX:S68) | 3.70% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.25% | ★★★★★☆ |

| Civmec (SGX:P9D) | 6.25% | ★★★★★☆ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.63% | ★★★★★☆ |

| BRC Asia (SGX:BEC) | 7.41% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.58% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 7.27% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

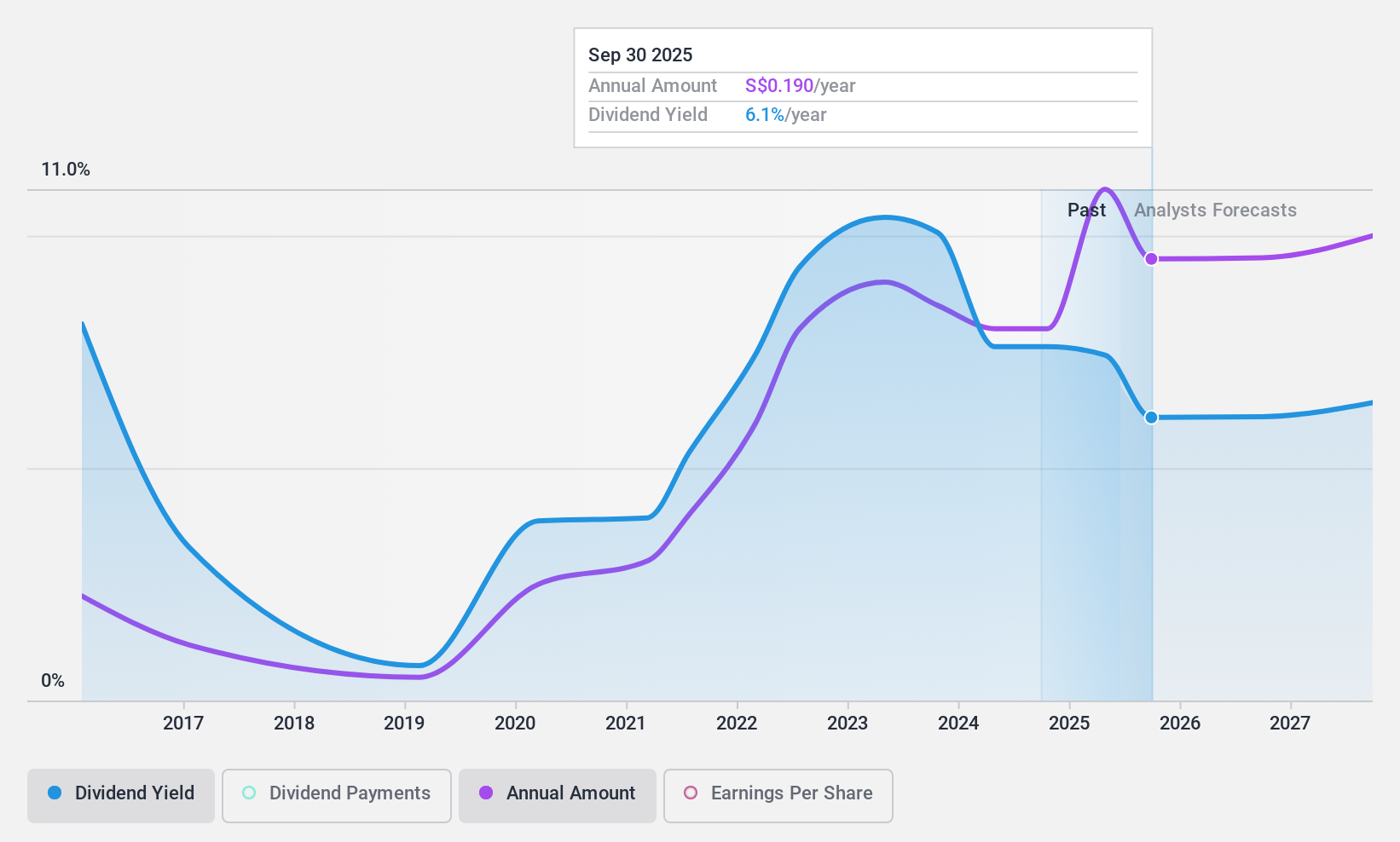

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for concrete, serving markets in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and other international locations with a market capitalization of approximately SGD 592.60 million.

Operations: BRC Asia Limited generates revenue primarily through two segments: Trading, which brought in SGD 413.27 million, and Fabrication and Manufacturing, contributing SGD 1.21 billion.

Dividend Yield: 7.4%

BRC Asia offers a compelling 7.41% dividend yield, ranking in the top 25% of Singapore's dividend payers. Despite its attractive yield and valuation at 54% below estimated fair value, investors should note the inconsistency in dividend payments over the past decade and a high debt level. However, dividends are well-supported by both earnings and cash flows, with payout ratios of 38% and 28.1%, respectively, suggesting sustainability from a financial standpoint.

- Get an in-depth perspective on BRC Asia's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that BRC Asia is priced lower than what may be justified by its financials.

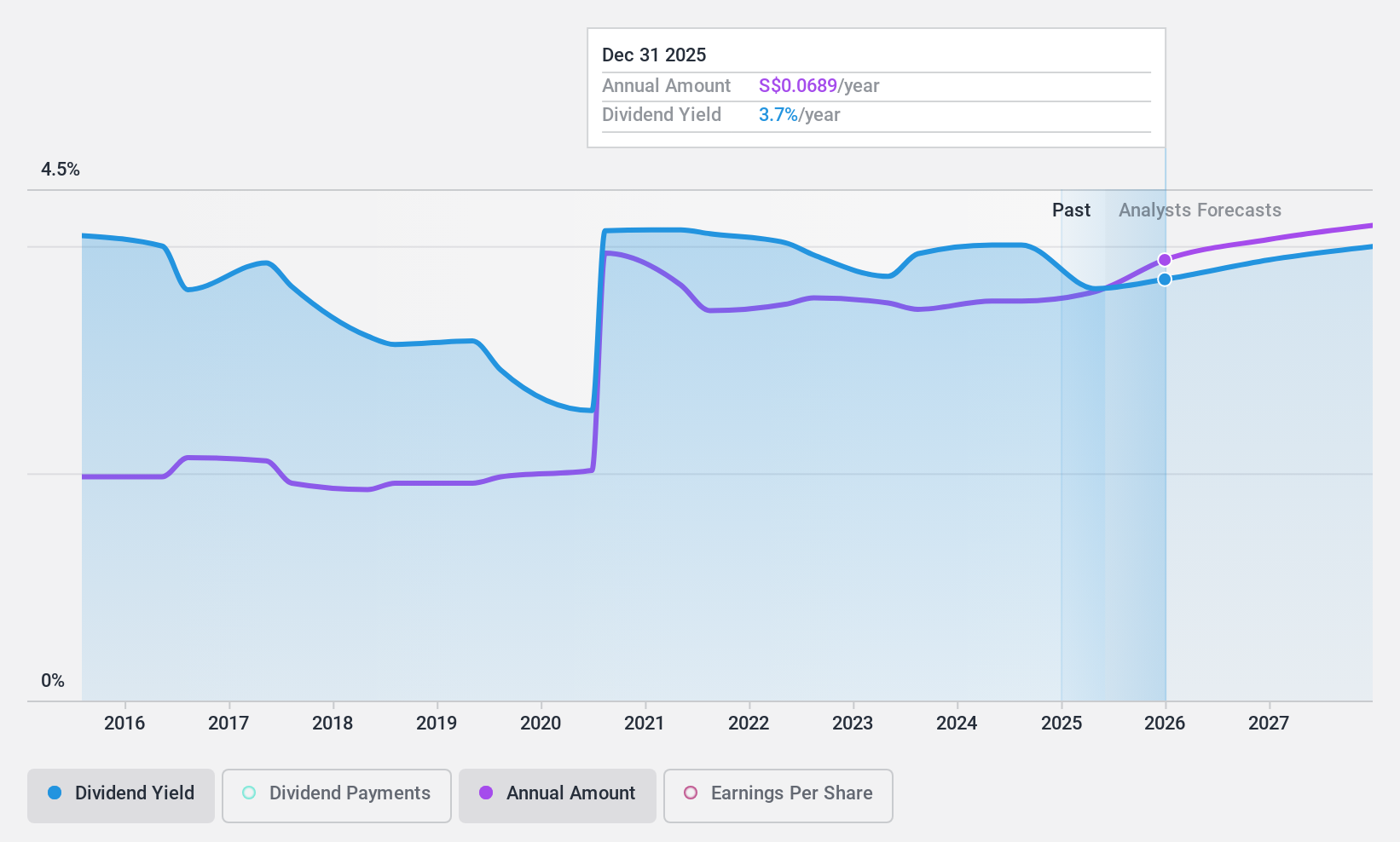

Sheng Siong Group (SGX:OV8)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market capitalization of approximately SGD 2.26 billion.

Operations: Sheng Siong Group Ltd generates its revenue primarily through supermarket operations selling consumer goods, totaling SGD 1.39 billion.

Dividend Yield: 4.2%

Sheng Siong Group recently declared a dividend of 3.20 cents per share, reflecting a stable payout amid modest year-over-year earnings growth from SGD 33.24 million to SGD 36.32 million in Q1 2024. Despite this, the company's dividend yield of 4.17% remains below the top quartile in Singapore's market, and its historical volatility in dividend payments suggests potential concerns for long-term reliability. However, with a payout ratio of 68.7% and cash flow coverage at 50.1%, current dividends appear sustainable based on recent financial performances.

- Click to explore a detailed breakdown of our findings in Sheng Siong Group's dividend report.

- The valuation report we've compiled suggests that Sheng Siong Group's current price could be quite moderate.

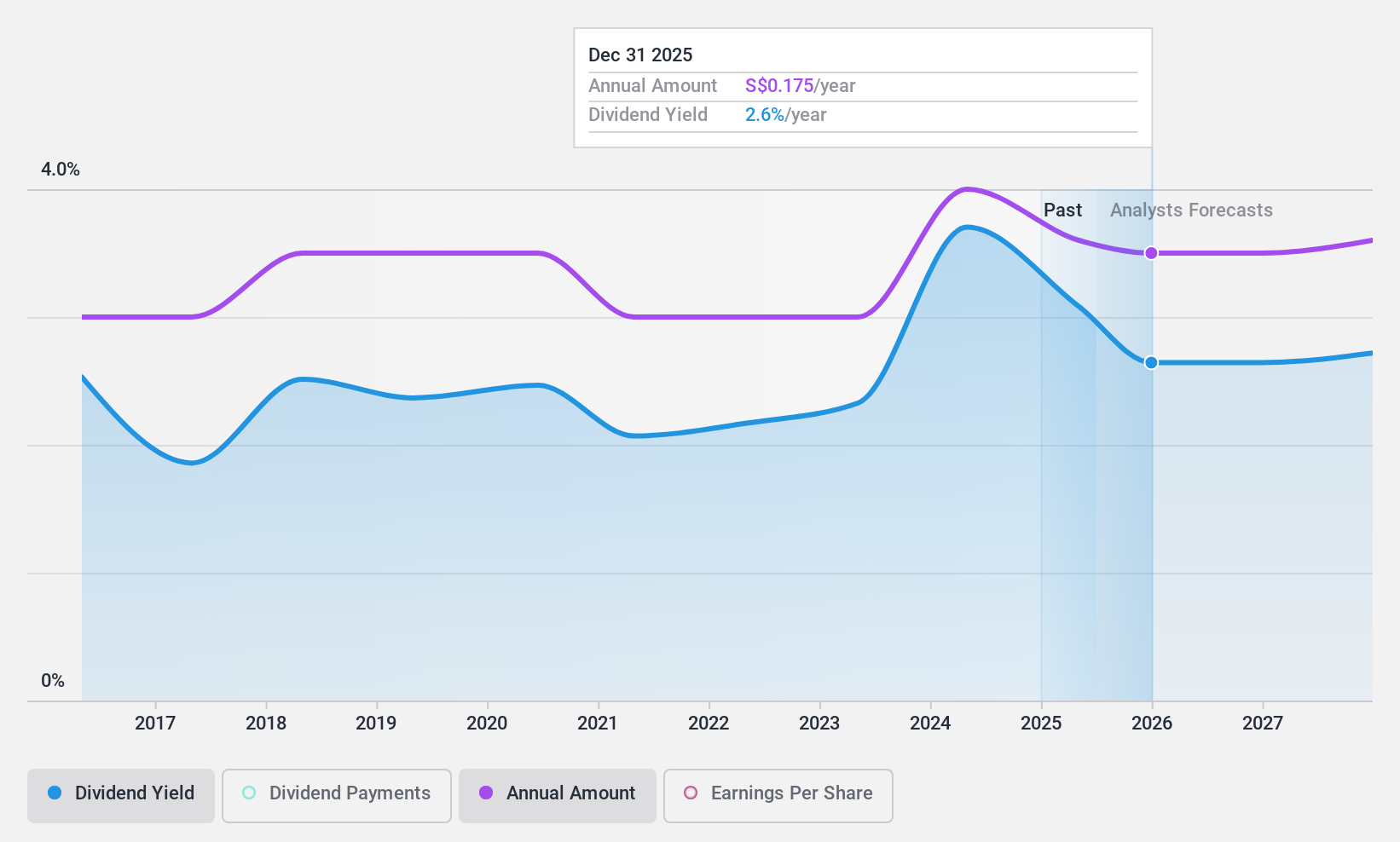

UOL Group (SGX:U14)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOL Group Limited operates in property development and hospitality sectors across multiple countries including Singapore, Australia, the UK, and the US, with a market capitalization of approximately SGD 4.71 billion.

Operations: UOL Group Limited generates its revenue primarily from property development in Singapore (SGD 1.16 billion), property investments (SGD 518.93 million), and hotel operations in Singapore (SGD 464.93 million), Australia (SGD 125.64 million), and other regions (SGD 172.40 million), alongside technology operations which contribute SGD 110.08 million.

Dividend Yield: 3.6%

UOL Group Limited recently affirmed a regular dividend of S$0.15 and a special dividend of S$0.05 per share for FY2023, reflecting its commitment to shareholder returns despite earnings forecasted to decline by 30.3% annually over the next three years. The company's dividends have shown stability and growth over the past decade, with a current yield of 3.58%, which is below the top quartile in Singapore's market (6.25%). However, dividends are well-supported by both earnings and cash flows, with payout ratios at 17.9% and 59.3% respectively, indicating sustainability even if future profitability pressures persist.

- Take a closer look at UOL Group's potential here in our dividend report.

- Our valuation report here indicates UOL Group may be undervalued.

Seize The Opportunity

- Take a closer look at our Top SGX Dividend Stocks list of 20 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U14

UOL Group

UOL Group Limited (UOL) is a leading Singapore-listed property and hospitality group with total assets of about $23 billion.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026