- Singapore

- /

- Real Estate

- /

- SGX:O10

Undervalued Small Caps With Insider Buying In Global For October 2025

Reviewed by Simply Wall St

In October 2025, global markets are navigating a complex landscape marked by the U.S. government shutdown and mixed economic signals, yet small-cap stocks have shown resilience with the Russell 2000 Index outperforming larger indices like the S&P 500. This environment of potential rate cuts and shifting investor sentiment presents opportunities for discerning investors to explore small-cap stocks that demonstrate strong fundamentals and insider confidence.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Aurelia Metals | 9.0x | 1.3x | 32.84% | ★★★★★★ |

| Bytes Technology Group | 17.4x | 4.4x | 12.04% | ★★★★☆☆ |

| Nickel Asia | 21.8x | 2.3x | 42.65% | ★★★★☆☆ |

| BWP Trust | 10.1x | 13.2x | 13.45% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 42.94% | ★★★★☆☆ |

| Sagicor Financial | 7.2x | 0.4x | -73.50% | ★★★★☆☆ |

| Chinasoft International | 26.2x | 0.8x | -1435.40% | ★★★☆☆☆ |

| Cettire | NA | 0.4x | 12.45% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.8x | 1.8x | 19.80% | ★★★☆☆☆ |

| CVS Group | 46.2x | 1.3x | 36.54% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Chinasoft International (SEHK:354)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chinasoft International is a leading IT services provider specializing in software development, cloud computing, and digital transformation solutions with a market cap of approximately CN¥17.56 billion.

Operations: Chinasoft International generates revenue primarily through its services, with a significant portion attributed to cost of goods sold (COGS). Over recent periods, the net income margin has shown variability, reaching as high as 6.90% and as low as 2.92%. Operating expenses are largely driven by general and administrative costs, alongside sales and marketing efforts. The company's gross profit margin has exhibited fluctuations, recently recorded at 21.59%.

PE: 26.2x

Chinasoft International, a smaller player in the tech sector, has shown insider confidence with Yuhong Chen purchasing 2 million shares for HK$11.22 million between January and May 2025. Despite relying entirely on external borrowing for funding, their earnings are slated to grow by 21% annually. For the first half of 2025, sales rose to CNY8.51 billion from CNY7.93 billion a year earlier, with net income climbing to CNY315.56 million from CNY285.72 million previously—indicating potential growth opportunities amidst financial challenges.

- Unlock comprehensive insights into our analysis of Chinasoft International stock in this valuation report.

Assess Chinasoft International's past performance with our detailed historical performance reports.

Far East Orchard (SGX:O10)

Simply Wall St Value Rating: ★★★☆☆☆

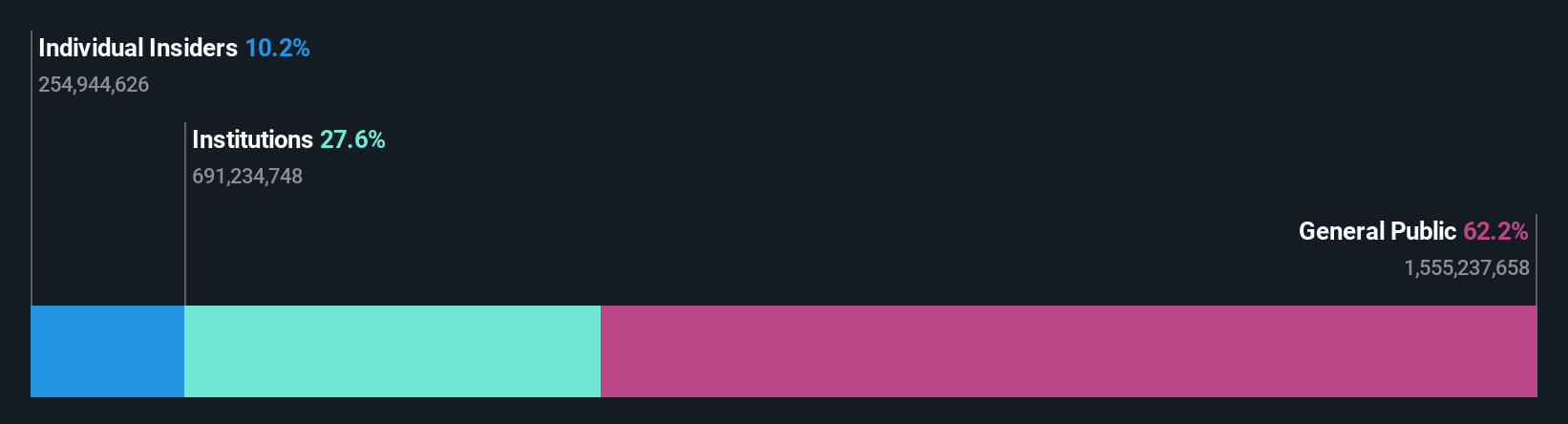

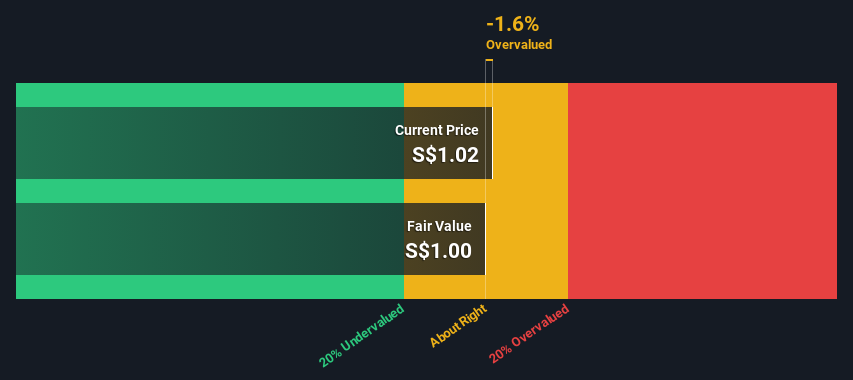

Overview: Far East Orchard is involved in property investment and hospitality operations, management services, and property ownership, with a market cap of approximately SGD 0.73 billion.

Operations: The company derives its revenue primarily from Hospitality - Property Ownership, Hospitality Management Services, and Hospitality - Operations. Over the observed periods, the net income margin showed significant fluctuations with a notable peak at 39.97% in mid-2024. Operating expenses are primarily driven by general and administrative costs, consistently remaining a substantial portion of total expenses.

PE: 10.7x

Far East Orchard, a smaller company, is drawing attention for its potential value. Recent insider confidence is evident with share purchases from March to May 2025. The company's earnings show resilience; net income rose to S$19.59 million in the first half of 2025 despite sales dipping slightly to S$91.35 million. Strategic leadership changes aim to bolster long-term growth, particularly in hospitality and student accommodation sectors, positioning the firm for future expansion under new management expertise.

BTB Real Estate Investment Trust (TSX:BTB.UN)

Simply Wall St Value Rating: ★★★★☆☆

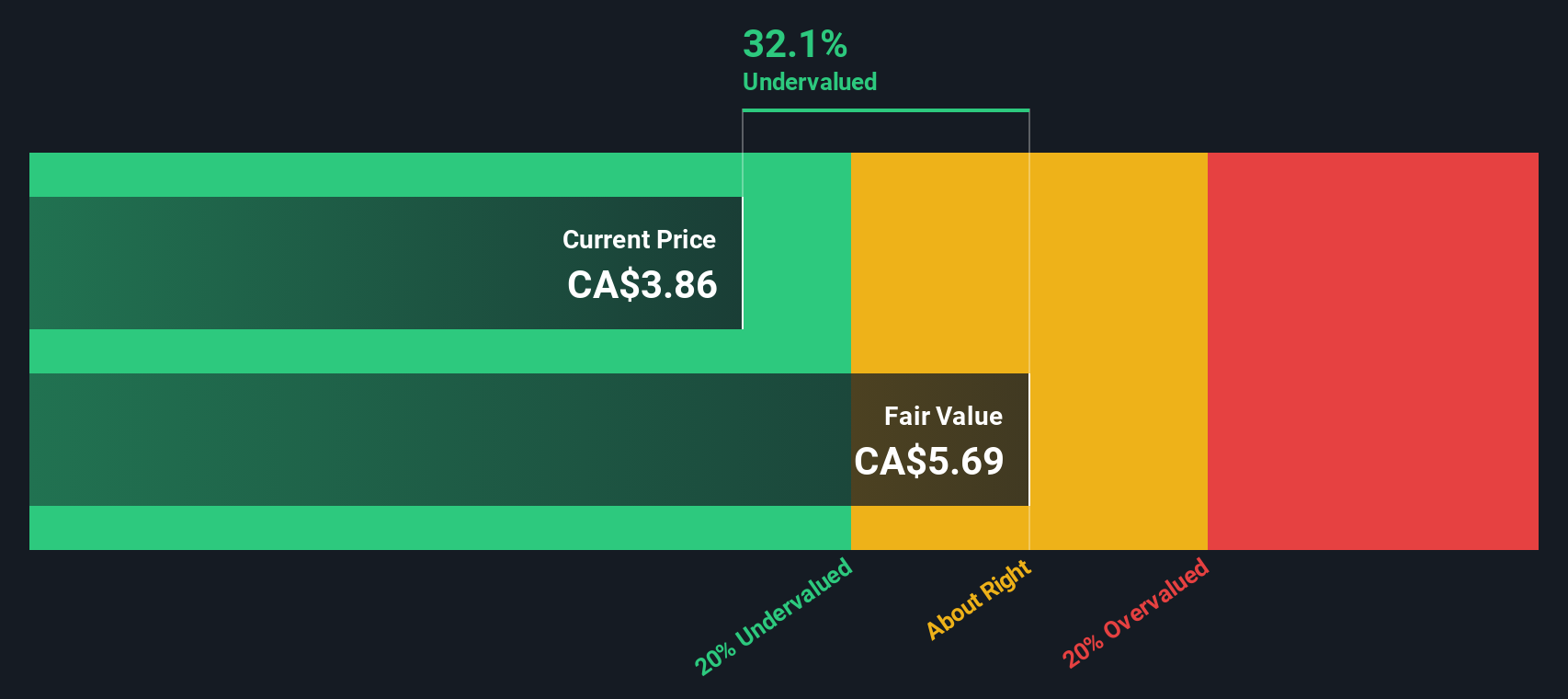

Overview: BTB Real Estate Investment Trust is a Canadian company that focuses on owning and managing a diversified portfolio of industrial, suburban office, and necessity-based retail properties, with a market capitalization of CA$0.31 billion.

Operations: The primary revenue streams for BTB Real Estate Investment Trust are derived from suburban office properties, industrial spaces, and necessity-based retail. The company's gross profit margin has varied over time, with the most recent figure at 58.05%. Operating expenses have consistently included general and administrative costs. Non-operating expenses also play a significant role in the financial structure.

PE: 8.9x

BTB Real Estate Investment Trust, a smaller company in the market, presents an intriguing investment opportunity. Despite recent earnings showing a slight dip with sales at C$30.51 million for Q2 2025 compared to C$32.22 million last year, the consistent monthly dividend of C$0.025 per share underscores its stable income stream. Insider confidence is evident as Ewing Morris Fleetwood LP proposed acquiring an additional 9.06% stake in September 2025 for C$30.4 million, suggesting potential value recognition by insiders amidst external borrowing risks.

Summing It All Up

- Take a closer look at our Undervalued Global Small Caps With Insider Buying list of 110 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O10

Far East Orchard

An investment holding company, engages in the hotel operations and property investment activities in Singapore, Australia, the United Kingdom, Japan, Malaysia, Germany, and Denmark.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives