- Singapore

- /

- Real Estate

- /

- SGX:F86

MYP Ltd.'s (SGX:F86) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- MYP's Annual General Meeting to take place on 30th of July

- Salary of S$179.4k is part of CEO Jonathan Tahir's total remuneration

- Total compensation is 48% below industry average

- MYP's EPS grew by 108% over the past three years while total shareholder loss over the past three years was 40%

Performance at MYP Ltd. (SGX:F86) has been rather uninspiring recently and shareholders may be wondering how CEO Jonathan Tahir plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 30th of July. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for MYP

How Does Total Compensation For Jonathan Tahir Compare With Other Companies In The Industry?

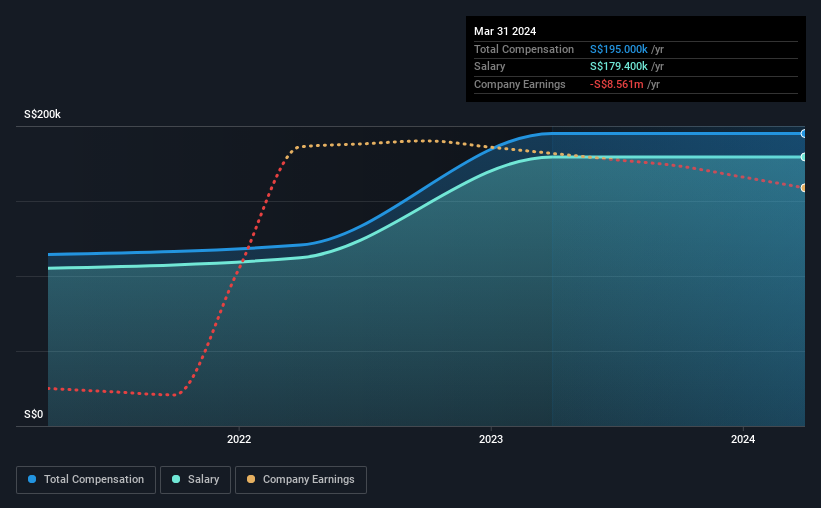

According to our data, MYP Ltd. has a market capitalization of S$75m, and paid its CEO total annual compensation worth S$195k over the year to March 2024. There was no change in the compensation compared to last year. We note that the salary portion, which stands at S$179.4k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Singaporean Real Estate industry with market capitalizations under S$269m, the reported median total CEO compensation was S$373k. That is to say, Jonathan Tahir is paid under the industry median. Furthermore, Jonathan Tahir directly owns S$65m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | S$179k | S$179k | 92% |

| Other | S$16k | S$16k | 8% |

| Total Compensation | S$195k | S$195k | 100% |

On an industry level, around 63% of total compensation represents salary and 37% is other remuneration. According to our research, MYP has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

MYP Ltd.'s Growth

MYP Ltd.'s earnings per share (EPS) grew 108% per year over the last three years. Its revenue is up 5.2% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has MYP Ltd. Been A Good Investment?

The return of -40% over three years would not have pleased MYP Ltd. shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The fact that shareholders are sitting on a loss is certainly disheartening. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. There needs to be more focus by management and the board to examine why the share price has diverged from fundamentals. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for MYP (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:F86

MYP

An investment holding company, invests in real estate assets in Singapore.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026