- Singapore

- /

- Real Estate

- /

- SGX:F1E

Vocento And 2 Other Promising Penny Stocks For Your Watchlist

Reviewed by Simply Wall St

As global markets continue to react to political developments and economic shifts, major indices like the S&P 500 and Nasdaq Composite are reaching new highs, fueled by optimism around trade policies and AI investments. In this context, penny stocks may seem like a relic of the past, but they remain a vital area for investors seeking growth opportunities in smaller or newer companies. These stocks can offer significant potential when backed by strong financial health and solid fundamentals, making them an intriguing option for those looking beyond traditional market leaders.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.11B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

Click here to see the full list of 5,723 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Vocento (BME:VOC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vocento, S.A. is a multimedia communications company in Spain with a market cap of €77.78 million.

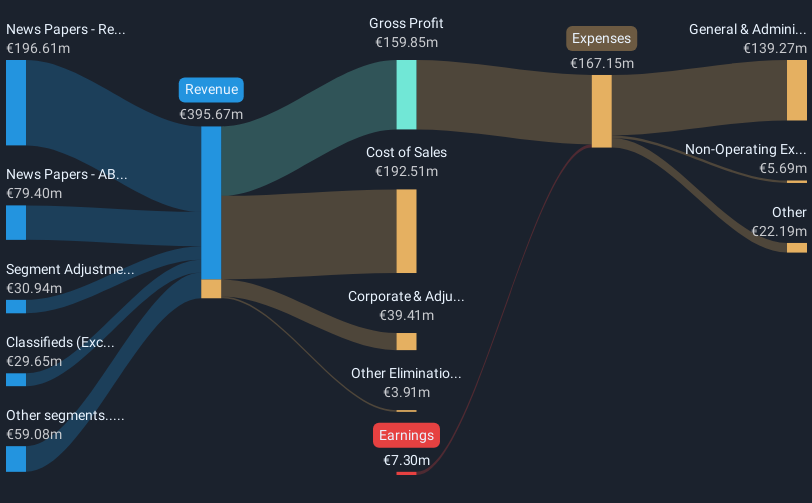

Operations: The company's revenue is primarily derived from its regional newspapers (€196.61 million), ABC newspaper (€79.40 million), agencies and others (€26.33 million), classifieds excluding digital services (€29.65 million), food segment (€14.78 million), digital services (€2.91 million), and supplements & magazines (€15.06 million).

Market Cap: €77.78M

Vocento, S.A., though unprofitable, presents a mixed profile for penny stock investors. The company reported a net loss increase to €26.97 million for the nine months ending September 2024, with revenues slightly declining to €249.6 million from the previous year. Despite this, Vocento trades significantly below its estimated fair value and has managed to reduce its debt-to-equity ratio over five years while maintaining sufficient cash runway exceeding three years. However, its dividend is not well-covered by earnings or free cash flow, and it experiences high share price volatility compared to other Spanish stocks.

- Navigate through the intricacies of Vocento with our comprehensive balance sheet health report here.

- Learn about Vocento's future growth trajectory here.

Best Mart 360 Holdings (SEHK:2360)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Best Mart 360 Holdings Limited is an investment holding company that operates as a leisure food retailer with chain stores under the Best Mart 360 and FoodVille brands in Hong Kong, Macau, and the People's Republic of China, with a market cap of HK$1.70 billion.

Operations: The company generates revenue primarily from retailing sales of food and beverage, household, and personal care products amounting to HK$2.57 billion.

Market Cap: HK$1.7B

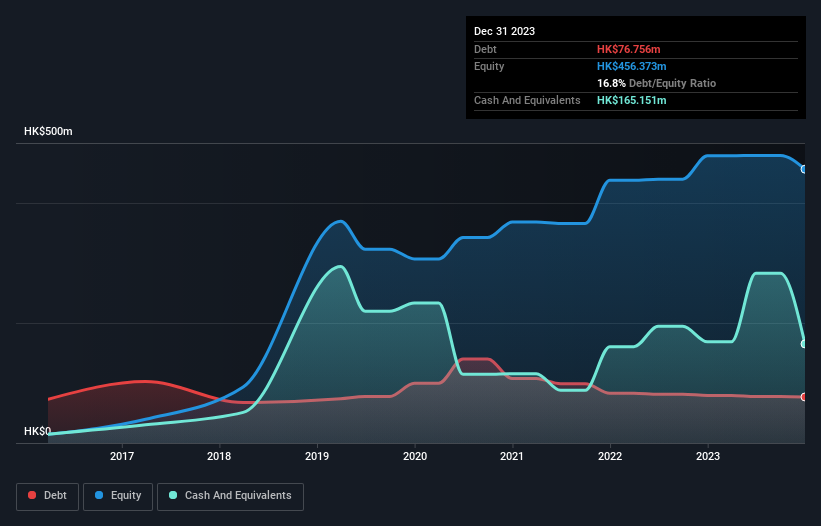

Best Mart 360 Holdings offers a compelling profile for penny stock investors, trading significantly below its estimated fair value and demonstrating robust financial health with short-term assets exceeding liabilities. The company's return on equity is outstanding at 49.2%, and it has successfully reduced its debt-to-equity ratio over the past five years, now having more cash than total debt. Recent developments include a new three-year sales and procurement agreement with CMHT, potentially enhancing revenue streams. However, the management team and board lack experience, which could impact strategic execution. Despite this, Best Mart's earnings growth outpaces industry averages.

- Unlock comprehensive insights into our analysis of Best Mart 360 Holdings stock in this financial health report.

- Assess Best Mart 360 Holdings' previous results with our detailed historical performance reports.

Low Keng Huat (Singapore) (SGX:F1E)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Low Keng Huat (Singapore) Limited is an investment holding company involved in property development and investment activities across Singapore, Australia, and Malaysia, with a market capitalization of SGD236.42 million.

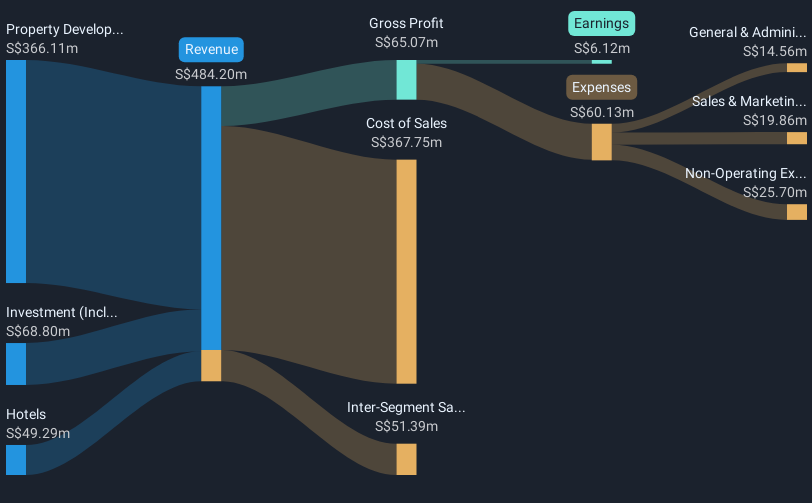

Operations: The company's revenue is primarily derived from property development at SGD366.11 million, followed by investment activities including construction at SGD68.80 million, and hotel operations contributing SGD49.29 million.

Market Cap: SGD236.42M

Low Keng Huat (Singapore) Limited presents a mixed picture for penny stock investors. The company has recently become profitable, though its earnings growth over the past five years has been negative. It trades significantly below its estimated fair value, suggesting potential undervaluation. Despite having a seasoned management team and board, its return on equity remains low at 1%. While short-term assets comfortably cover both short- and long-term liabilities, interest payments are not well covered by earnings. Additionally, the company's debt level is high but reduced over time with operating cash flow adequately covering debt obligations.

- Dive into the specifics of Low Keng Huat (Singapore) here with our thorough balance sheet health report.

- Explore historical data to track Low Keng Huat (Singapore)'s performance over time in our past results report.

Next Steps

- Gain an insight into the universe of 5,723 Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:F1E

Low Keng Huat (Singapore)

An investment holding company, engages in property development, hotel, and investment business in Singapore, Australia, and Malaysia.

Excellent balance sheet and good value.

Market Insights

Community Narratives