- Singapore

- /

- Real Estate

- /

- SGX:F17

Assessing GuocoLand (SGX:F17)’s Valuation After DBS Research’s Upbeat Call on Singapore Developers

Reviewed by Simply Wall St

DBS Research just turned more upbeat on Singapore developers, lifting sector valuations and putting fresh attention on GuocoLand (SGX:F17), even though the stock itself ended flat at S$2.02 after the call.

See our latest analysis for GuocoLand.

The upbeat call lands on top of a strong run, with GuocoLand’s share price return up sharply year to date and its one year total shareholder return above 50 percent, suggesting momentum is still building rather than fading.

If this renewed interest in developers has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other ideas with punchy growth stories.

With the shares already up strongly but still trading nearly 40 percent below DBS’s target price, the real question now is whether GuocoLand is still undervalued or if the market is already pricing in future growth.

Price-to-Earnings of 25.1x: Is it justified?

On a price-to-earnings ratio of 25.1 times, GuocoLand appears richly priced versus its last close at S$2.12 and peers that trade on far lower earnings multiples.

The price-to-earnings ratio compares what investors pay today for each dollar of current earnings. It is a key yardstick for mature, earnings-driven property developers like GuocoLand. With earnings only modestly growing over the past five years and forecast to expand at a mid single digit pace, such a premium multiple suggests the market is factoring in more than just steady profit progress.

Stacked against the broader Singapore real estate sector, the premium becomes clearer. GuocoLand trades above both the estimated fair price-to-earnings ratio of 16.4 times and the industry average of 17.9 times, as well as a peer average of just 13.4 times, highlighting how far expectations have run relative to current fundamentals.

Explore the SWS fair ratio for GuocoLand

Result: Price-to-Earnings of 25.1x (OVERVALUED)

However, risks remain, including softer revenue trends, sector wide property headwinds in Singapore and China, and any disappointment versus the optimistic growth assumptions of DBS.

Find out about the key risks to this GuocoLand narrative.

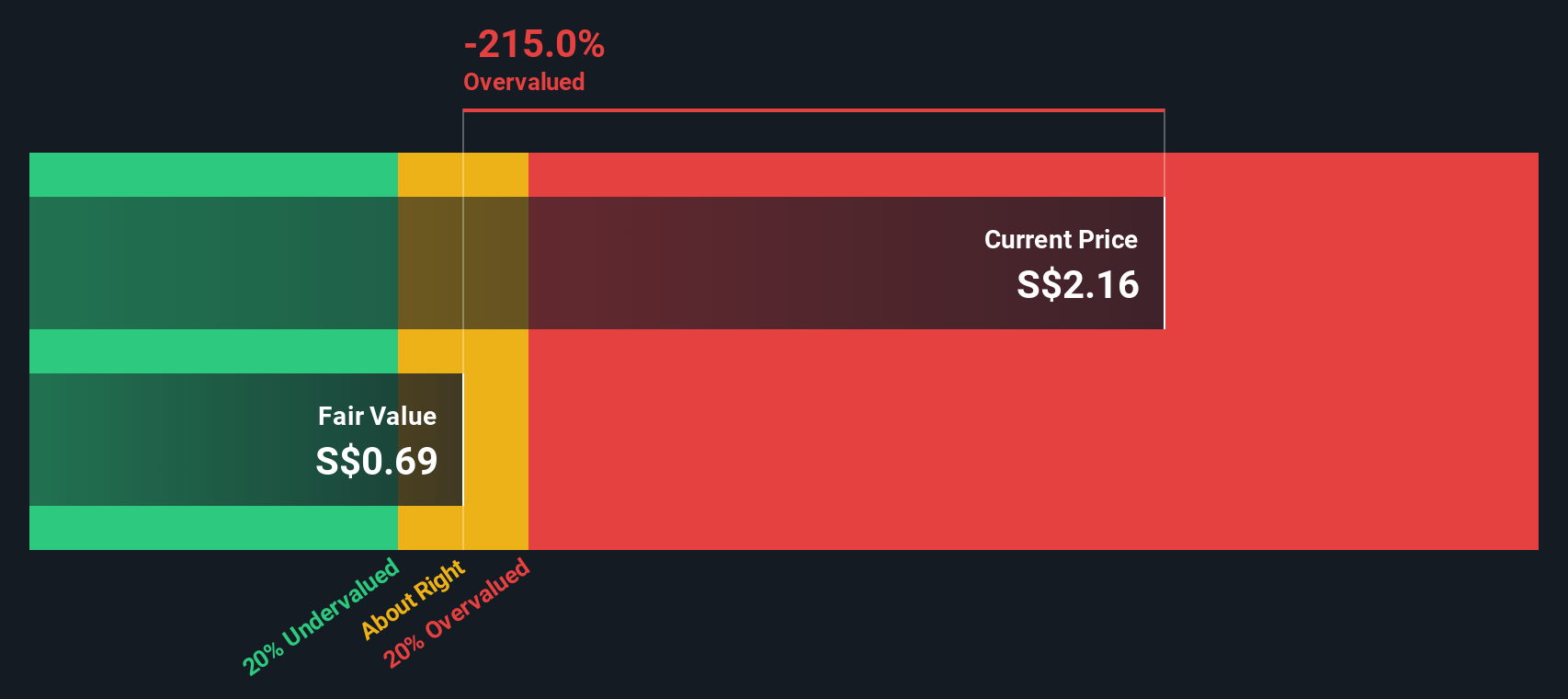

Another Take: SWS DCF Fair Value Looks Far Harsher

While the earnings multiple hints at optimism, our DCF model paints a starker picture. On this view, GuocoLand’s fair value is around SGD0.69 versus the current SGD2.12, implying the shares are materially overvalued and leaving investors asking what has to go right to justify today’s price.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GuocoLand for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GuocoLand Narrative

If you see the numbers differently or want to stress test your own assumptions, you can easily craft a personalised view in minutes: Do it your way.

A great starting point for your GuocoLand research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more high conviction opportunities?

Before you move on, lock in your next moves with focused shortlists built from powerful data, not hunches, so you do not miss standout opportunities.

- Consider early stage growth potential with these 3632 penny stocks with strong financials that already pair their small size with established financial strength and credible momentum.

- Position your portfolio for the AI productivity trend by targeting these 30 healthcare AI stocks that focus on transforming patient outcomes and medical efficiency.

- Seek more resilient income streams by assessing these 13 dividend stocks with yields > 3% that offer yields designed to help support total returns when markets become volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:F17

GuocoLand

An investment holding company, engages in the property investment and development business.

Established dividend payer with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)