- Singapore

- /

- Real Estate

- /

- SGX:CY6U

CapitaLand India Trust (SGX:CY6U) stock falls 4.3% in past week as five-year earnings and shareholder returns continue downward trend

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. So we wouldn't blame long term CapitaLand India Trust (SGX:CY6U) shareholders for doubting their decision to hold, with the stock down 33% over a half decade.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for CapitaLand India Trust

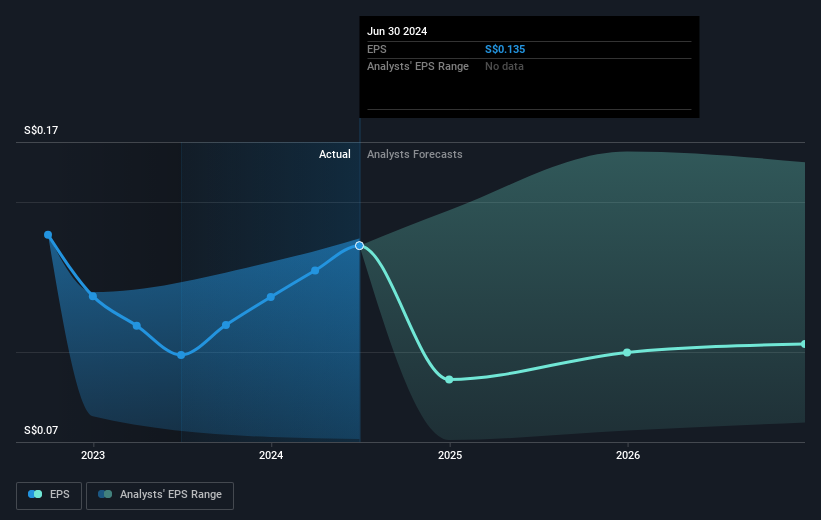

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both CapitaLand India Trust's share price and EPS declined; the latter at a rate of 6.3% per year. Notably, the share price has fallen at 8% per year, fairly close to the change in the EPS. This suggests that market participants have not changed their view of the company all that much. Rather, the share price change has reflected changes in earnings per share.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that CapitaLand India Trust has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of CapitaLand India Trust, it has a TSR of -6.4% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

CapitaLand India Trust's TSR for the year was broadly in line with the market average, at 22%. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 1.2%, which was endured over half a decade. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with CapitaLand India Trust (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:CY6U

CapitaLand India Trust

CapitaLand India Trust (CLINT) was listed on the Singapore Exchange Securities Trading Limited (SGX-ST) in August 2007 as the first Indian property trust in Asia.

Undervalued established dividend payer.