- Singapore

- /

- Real Estate

- /

- SGX:C09

City Developments Limited's (SGX:C09) P/E Is Still On The Mark Following 25% Share Price Bounce

The City Developments Limited (SGX:C09) share price has done very well over the last month, posting an excellent gain of 25%. Looking further back, the 19% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

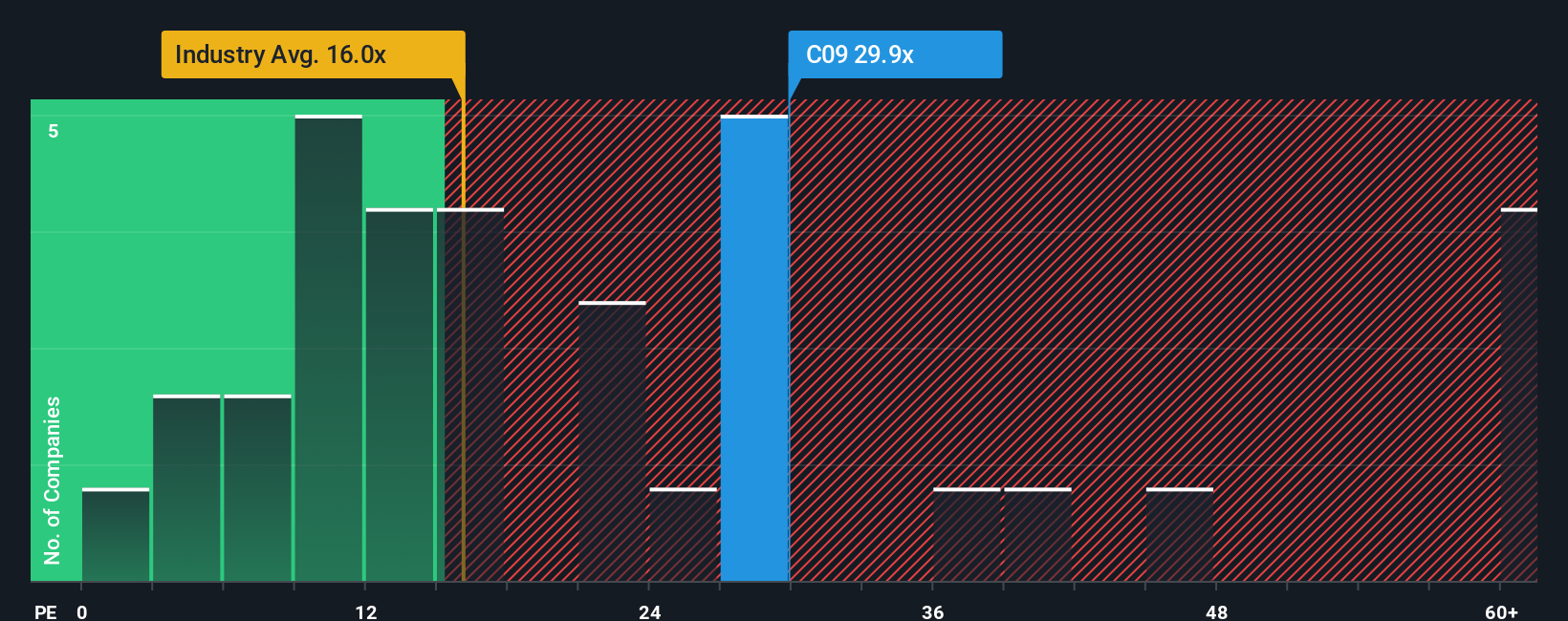

After such a large jump in price, City Developments may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 29.9x, since almost half of all companies in Singapore have P/E ratios under 13x and even P/E's lower than 8x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, City Developments' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for City Developments

What Are Growth Metrics Telling Us About The High P/E?

City Developments' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. Even so, admirably EPS has lifted 170% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 34% each year over the next three years. That's shaping up to be materially higher than the 7.9% per year growth forecast for the broader market.

In light of this, it's understandable that City Developments' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From City Developments' P/E?

The strong share price surge has got City Developments' P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of City Developments' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with City Developments (at least 1 which is significant), and understanding them should be part of your investment process.

You might be able to find a better investment than City Developments. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:C09

City Developments

City Developments Limited (CDL) is a leading global real estate company with a network spanning 168 locations in 29 countries and regions.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026