- Singapore

- /

- Real Estate

- /

- SGX:BCD

Here's Why China Yuanbang Property Holdings Limited's (SGX:BCD) CEO Might See A Pay Rise Soon

Key Insights

- China Yuanbang Property Holdings to hold its Annual General Meeting on 30th of October

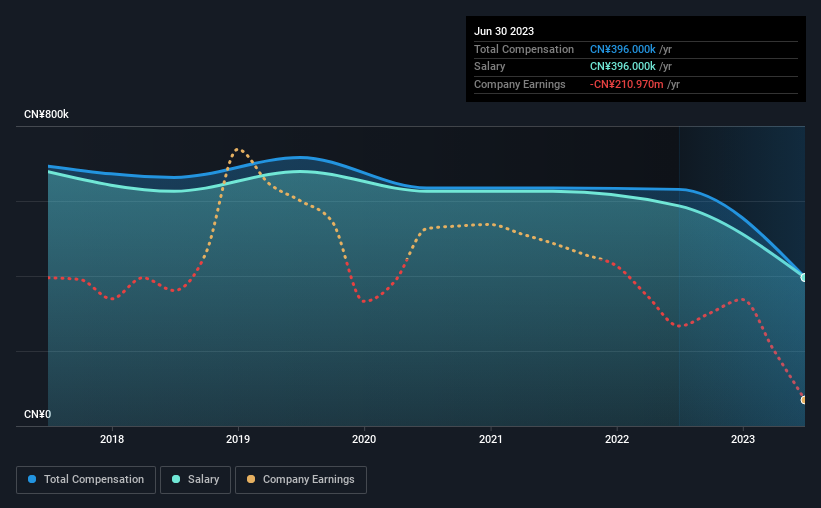

- CEO Sheng Ouyang's total compensation includes salary of CN¥396.0k

- The total compensation is 66% less than the average for the industry

- China Yuanbang Property Holdings' total shareholder return over the past three years was 84% while its EPS was down 118% over the past three years

Shareholders will probably not be disappointed by the robust results at China Yuanbang Property Holdings Limited (SGX:BCD) recently and they will be keeping this in mind as they go into the AGM on 30th of October. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

See our latest analysis for China Yuanbang Property Holdings

Comparing China Yuanbang Property Holdings Limited's CEO Compensation With The Industry

Our data indicates that China Yuanbang Property Holdings Limited has a market capitalization of S$24m, and total annual CEO compensation was reported as CN¥396k for the year to June 2023. That's a notable decrease of 37% on last year. Notably, the salary of CN¥396k is the entirety of the CEO compensation.

On comparing similar-sized companies in the Singaporean Real Estate industry with market capitalizations below S$274m, we found that the median total CEO compensation was CN¥1.2m. In other words, China Yuanbang Property Holdings pays its CEO lower than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥396k | CN¥587k | 100% |

| Other | - | CN¥44k | - |

| Total Compensation | CN¥396k | CN¥631k | 100% |

On an industry level, roughly 53% of total compensation represents salary and 47% is other remuneration. On a company level, China Yuanbang Property Holdings prefers to reward its CEO through a salary, opting not to pay Sheng Ouyang through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at China Yuanbang Property Holdings Limited's Growth Numbers

Over the last three years, China Yuanbang Property Holdings Limited has shrunk its earnings per share by 118% per year. In the last year, its revenue is up 203%.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has China Yuanbang Property Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with China Yuanbang Property Holdings Limited for providing a total return of 84% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

China Yuanbang Property Holdings pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. While the company seems to be headed in the right direction performance-wise, there's always room for improvement. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 4 warning signs for China Yuanbang Property Holdings you should be aware of, and 3 of them are concerning.

Switching gears from China Yuanbang Property Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BCD

China Yuanbang Property Holdings

An investment holding company, develops, manages, markets, and sells residential and commercial properties in the People's Republic of China.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026