Here's Why Asian Pay Television Trust (SGX:S7OU) Has A Meaningful Debt Burden

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Asian Pay Television Trust (SGX:S7OU) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Asian Pay Television Trust

How Much Debt Does Asian Pay Television Trust Carry?

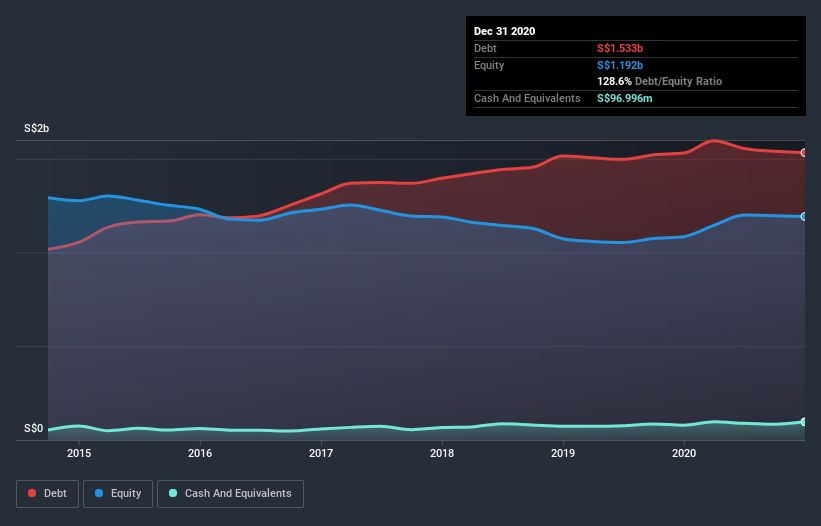

As you can see below, Asian Pay Television Trust had S$1.53b of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has S$97.0m in cash leading to net debt of about S$1.44b.

A Look At Asian Pay Television Trust's Liabilities

Zooming in on the latest balance sheet data, we can see that Asian Pay Television Trust had liabilities of S$289.1m due within 12 months and liabilities of S$1.47b due beyond that. Offsetting these obligations, it had cash of S$97.0m as well as receivables valued at S$14.5m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by S$1.65b.

This deficit casts a shadow over the S$200.5m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Asian Pay Television Trust would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Asian Pay Television Trust shareholders face the double whammy of a high net debt to EBITDA ratio (8.5), and fairly weak interest coverage, since EBIT is just 1.8 times the interest expense. The debt burden here is substantial. Fortunately, Asian Pay Television Trust grew its EBIT by 3.7% in the last year, slowly shrinking its debt relative to earnings. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Asian Pay Television Trust's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Asian Pay Television Trust generated free cash flow amounting to a very robust 88% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

To be frank both Asian Pay Television Trust's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the bigger picture, it seems clear to us that Asian Pay Television Trust's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Asian Pay Television Trust (including 1 which can't be ignored) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Asian Pay Television Trust, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Asian Pay Television Trust, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:S7OU

Asian Pay Television Trust

Engages in the pay-TV and broadband businesses in Taiwan, Hong Kong, Japan, and Singapore.

Good value average dividend payer.

Market Insights

Community Narratives