- Singapore

- /

- Basic Materials

- /

- SGX:S44

Even after rising 19% this past week, EnGro (SGX:S44) shareholders are still down 28% over the past three years

EnGro Corporation Limited (SGX:S44) shareholders should be happy to see the share price up 20% in the last month. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 38% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

The recent uptick of 19% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for EnGro

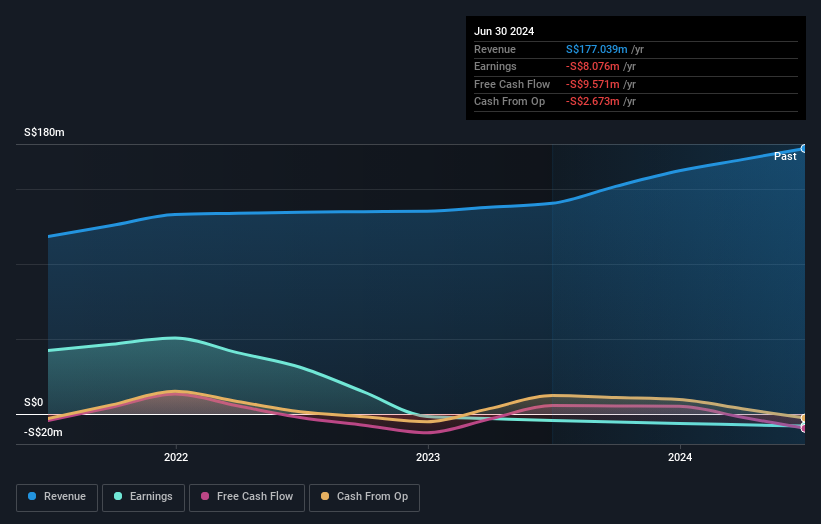

EnGro wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, EnGro grew revenue at 12% per year. That's a pretty good rate of top-line growth. Shareholders have endured a share price decline of 11% per year. This implies the market had higher expectations of EnGro. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at EnGro's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of EnGro, it has a TSR of -28% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

EnGro provided a TSR of 4.8% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 0.8% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for EnGro (of which 3 can't be ignored!) you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

If you're looking to trade EnGro, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EnGro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:S44

EnGro

An investment holding company, engages in the manufacture and sale of cement and building materials, and specialty polymers in Singapore, Malaysia, the People’s Republic of China, and internationally.

Moderate with adequate balance sheet.