- Singapore

- /

- Capital Markets

- /

- SGX:S68

3 High Yield Dividend Stocks On SGX With Yields Up To 6.1%

Reviewed by Simply Wall St

Amidst a dynamic global retail landscape, innovations like Mastercard's AI-driven Shopping Muse are setting new benchmarks for consumer engagement and revenue growth. As market conditions evolve with such technological advancements, investors might consider the stability offered by high-yield dividend stocks on the SGX, which can provide consistent returns in a fluctuating economy.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| Civmec (SGX:P9D) | 5.99% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.55% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.18% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.77% | ★★★★★☆ |

| BRC Asia (SGX:BEC) | 7.69% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.98% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.10% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

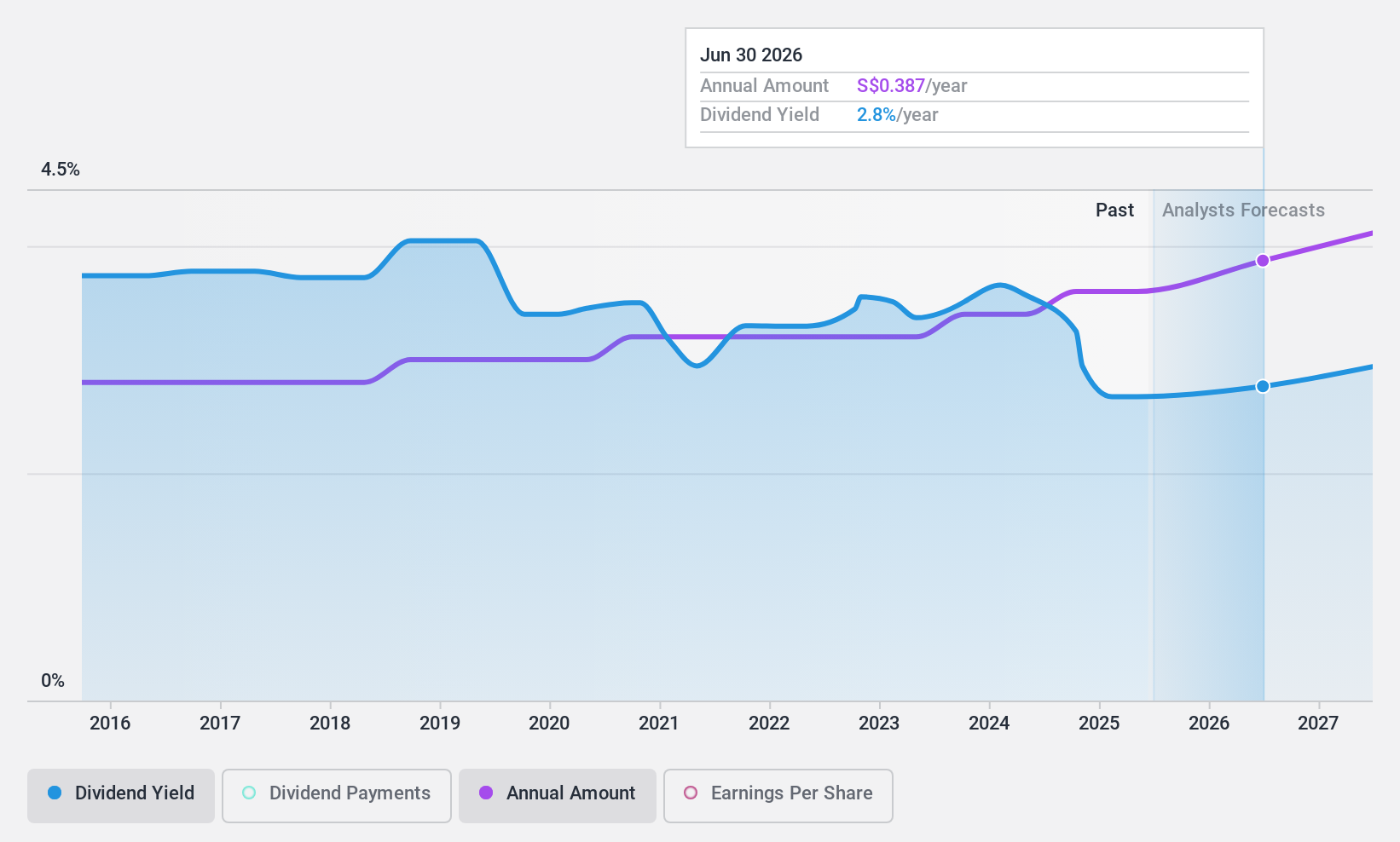

Civmec (SGX:P9D)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited, an investment holding company based in Australia, offers construction and engineering services across sectors such as energy, resources, infrastructure, and marine and defense, with a market capitalization of approximately SGD 416.22 million.

Operations: Civmec Limited generates revenue from three primary segments: Energy (A$46.02 million), Resources (A$752.82 million), and Infrastructure, Marine & Defence (A$105.52 million).

Dividend Yield: 6%

Civmec, a Singapore-based company, has demonstrated reliable and stable dividend payments over the past decade with a growth in dividends during this period. Trading at 46.3% below its estimated fair value, it offers potential value. Dividends are well-supported by both earnings and cash flows, with payout ratios of 45.4% and 27% respectively. However, its dividend yield of 5.99% is slightly below the top quartile in the Singapore market.

- Dive into the specifics of Civmec here with our thorough dividend report.

- Upon reviewing our latest valuation report, Civmec's share price might be too pessimistic.

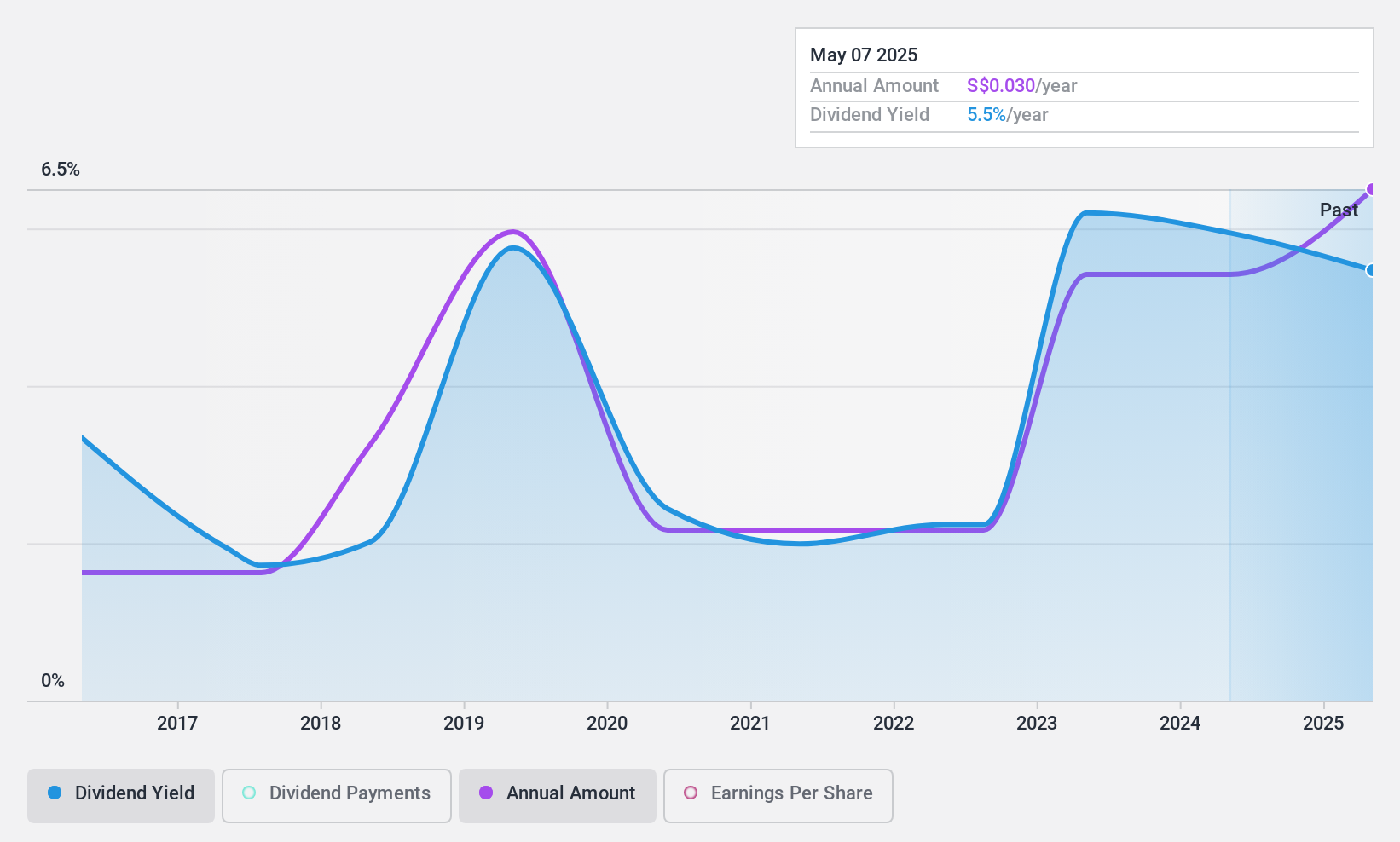

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that specializes in manufacturing and selling specialty chemicals across the People’s Republic of China, other parts of Asia, the United States, and Europe, with a market capitalization of approximately SGD 377.83 million.

Operations: China Sunsine Chemical Holdings Ltd. generates revenue primarily through its Rubber Chemicals segment, which accounted for CN¥4.38 billion, followed by smaller contributions from Heating Power and Waste Treatment segments totaling CN¥221.29 million and CN¥29.76 million respectively.

Dividend Yield: 6.2%

China Sunsine Chemical Holdings offers a dividend yield slightly above the top quartile in Singapore at 6.18%, signaling attractiveness to income-focused investors. Despite trading at 74.9% below its estimated fair value, suggesting potential undervaluation, the company has a history of unstable dividends over the past decade. Dividend sustainability is supported by a low payout ratio of 20.8% and cash flow coverage at 30.2%. Recent share buyback initiatives could indicate confidence from management but also reflect on its commitment to return value to shareholders.

- Get an in-depth perspective on China Sunsine Chemical Holdings' performance by reading our dividend report here.

- The valuation report we've compiled suggests that China Sunsine Chemical Holdings' current price could be quite moderate.

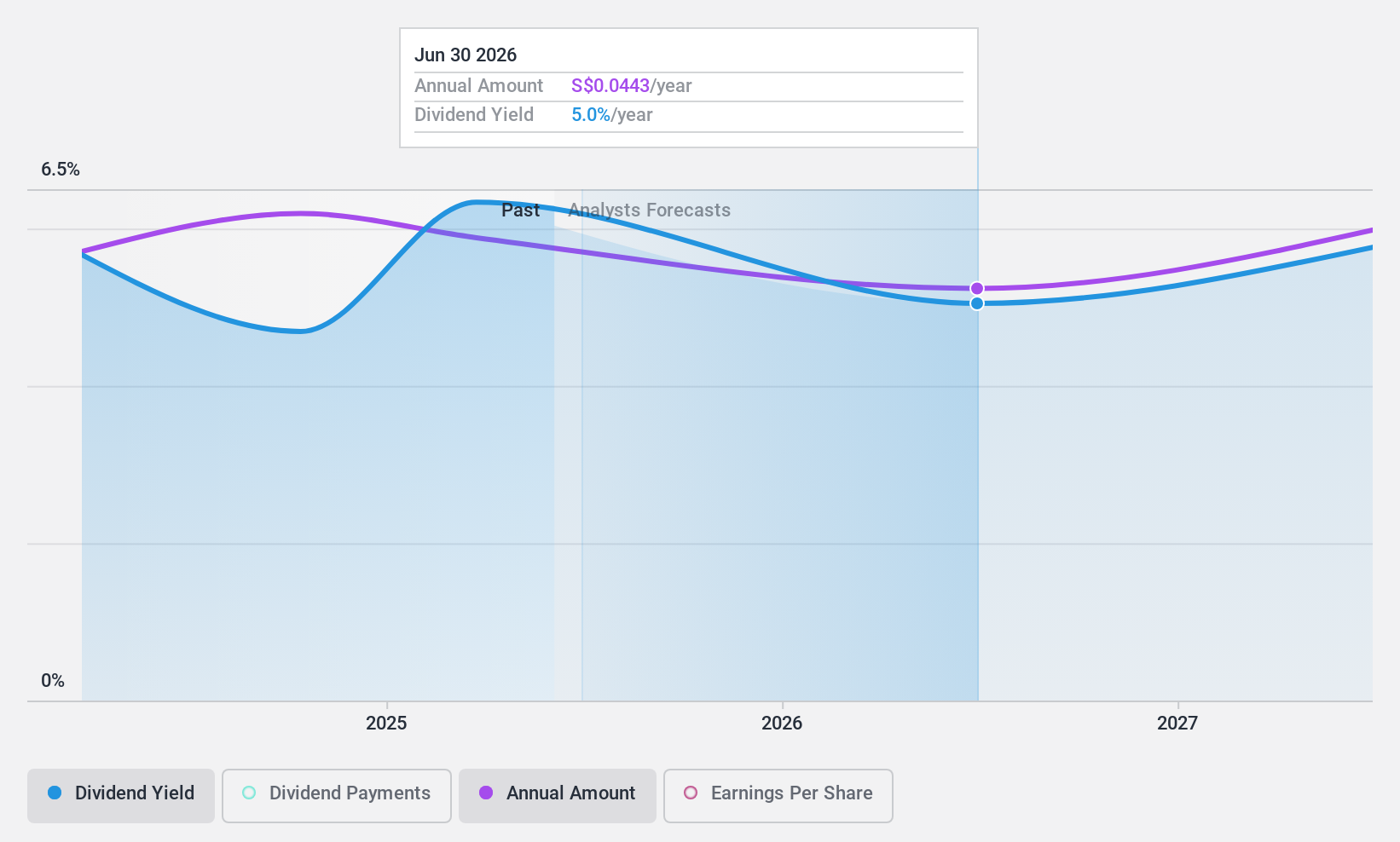

Singapore Exchange (SGX:S68)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited operates as an integrated securities and derivatives exchange with related clearing houses in Singapore, boasting a market capitalization of SGD 10.26 billion.

Operations: Singapore Exchange Limited generates revenue primarily from segment adjustments, totaling SGD 843.68 million, and fixed income, currencies, and commodities activities, which contribute SGD 371.53 million.

Dividend Yield: 3.6%

Singapore Exchange (SGX) maintains a stable dividend profile with a 63% payout ratio and 79.1% cash payout ratio, ensuring dividends are well-covered by both earnings and cash flows. Although its dividend yield of 3.55% is lower compared to the top quartile in the Singapore market, SGX has consistently grown its dividends over the past decade. Recent trading suggests it is undervalued by approximately 8.6%, potentially offering value to investors seeking reliable income streams from dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Singapore Exchange.

- According our valuation report, there's an indication that Singapore Exchange's share price might be on the expensive side.

Taking Advantage

- Embark on your investment journey to our 19 Top SGX Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S68

Singapore Exchange

An investment holding, engages in the operation of integrated securities and derivatives exchange, related clearing houses, and an electricity market in Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives