As global markets navigate a landscape of rate cuts and mixed economic signals, with the Nasdaq reaching new heights even as most major indexes decline, investors are increasingly seeking stability amid volatility. In this environment, dividend stocks offer a compelling option for those looking to balance income generation with potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.12% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.42% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.12% | ★★★★★★ |

Click here to see the full list of 1851 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

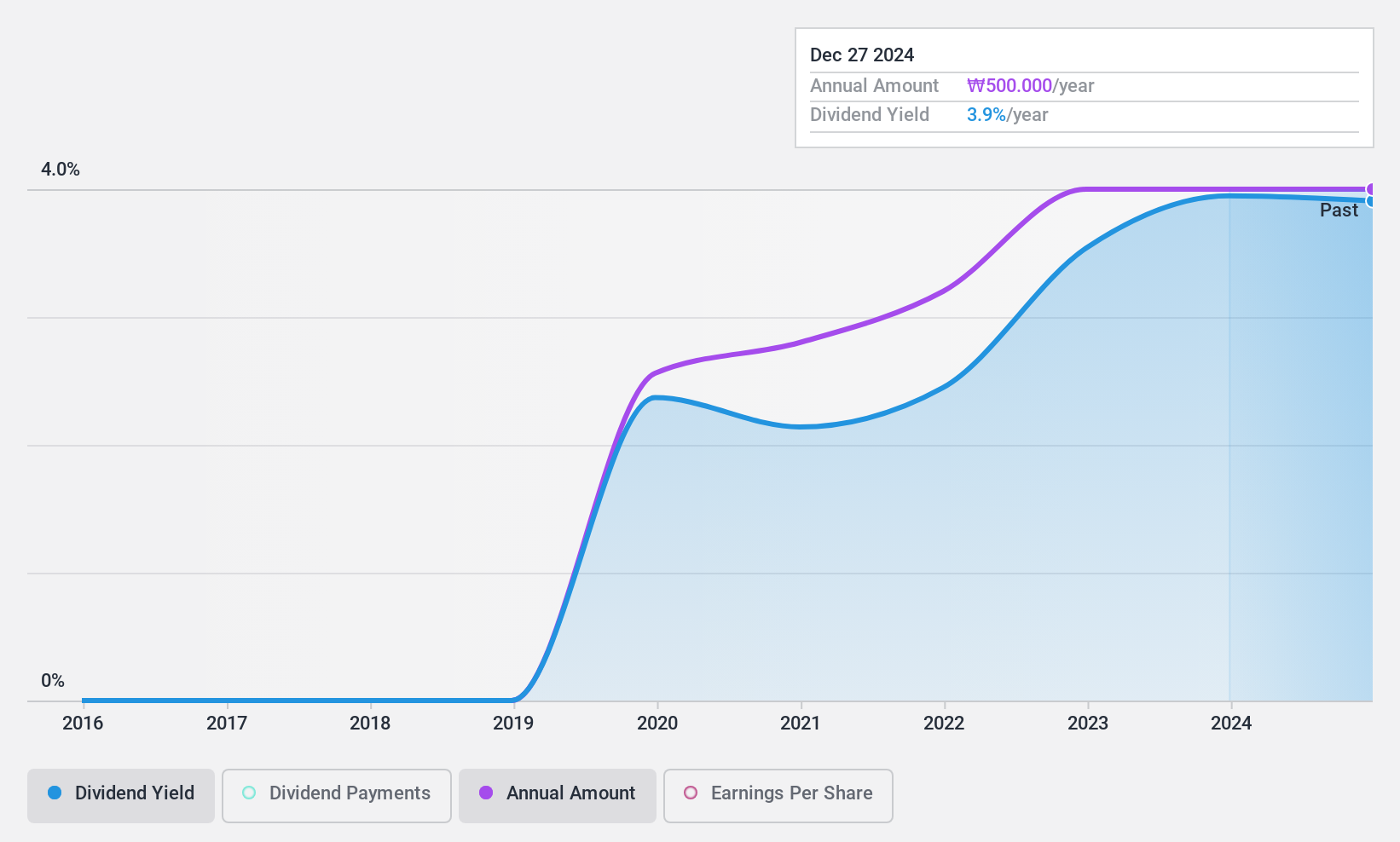

WINS (KOSDAQ:A136540)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WINS Co., Ltd. offers information security solutions and services in South Korea with a market cap of ₩157.25 billion.

Operations: WINS Co., Ltd. generates revenue from its Security Software & Services segment, amounting to ₩105.85 billion.

Dividend Yield: 4%

WINS Co., Ltd has shown a commitment to enhancing shareholder value, recently completing a share buyback of 1.36 million shares for KRW 21.83 billion, which may support its dividend strategy. The company offers a competitive dividend yield in the top 25% of the KR market, supported by earnings and cash flow with payout ratios of 30% and 64.7%, respectively. Despite only five years of dividends, payments have been stable and growing without volatility.

- Delve into the full analysis dividend report here for a deeper understanding of WINS.

- Insights from our recent valuation report point to the potential overvaluation of WINS shares in the market.

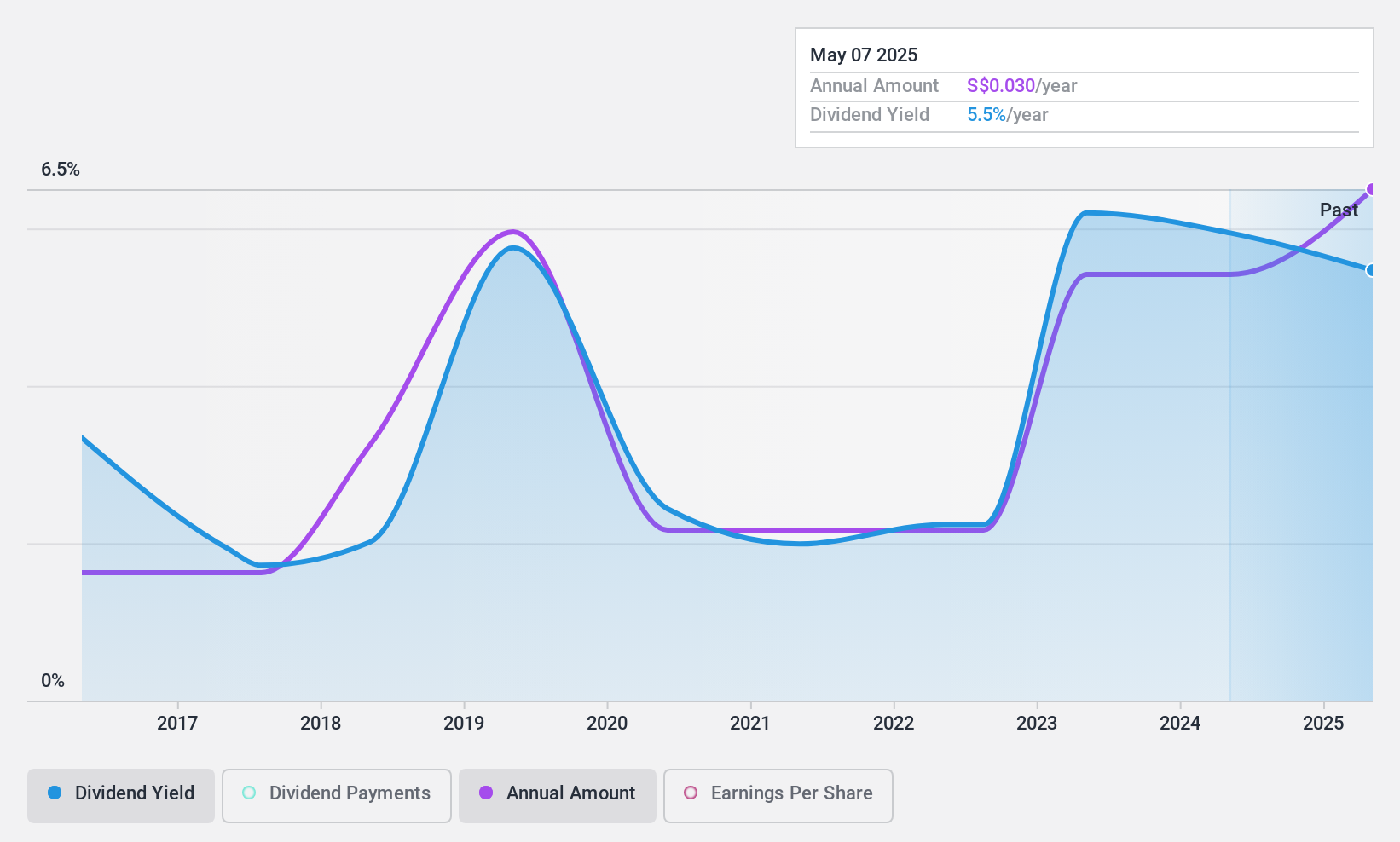

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals across various regions including the People's Republic of China, Asia, the United States, and Europe, with a market capitalization of approximately SGD448.09 million.

Operations: China Sunsine Chemical Holdings Ltd. generates its revenue primarily from the sale of rubber chemicals amounting to CN¥4.39 billion, along with contributions from heating power at CN¥202.99 million and waste treatment services totaling CN¥25.06 million.

Dividend Yield: 5.2%

China Sunsine Chemical Holdings' dividend yield is below the top quartile in the SG market, reflecting a lower payout compared to leading dividend payers. While dividends have grown over a decade, they have been volatile and unreliable. However, with a low payout ratio of 21.1%, dividends are well covered by earnings and cash flows (34% cash payout), indicating sustainability despite past instability. Recent leadership changes and capacity expansion plans could impact future performance.

- Click here and access our complete dividend analysis report to understand the dynamics of China Sunsine Chemical Holdings.

- In light of our recent valuation report, it seems possible that China Sunsine Chemical Holdings is trading behind its estimated value.

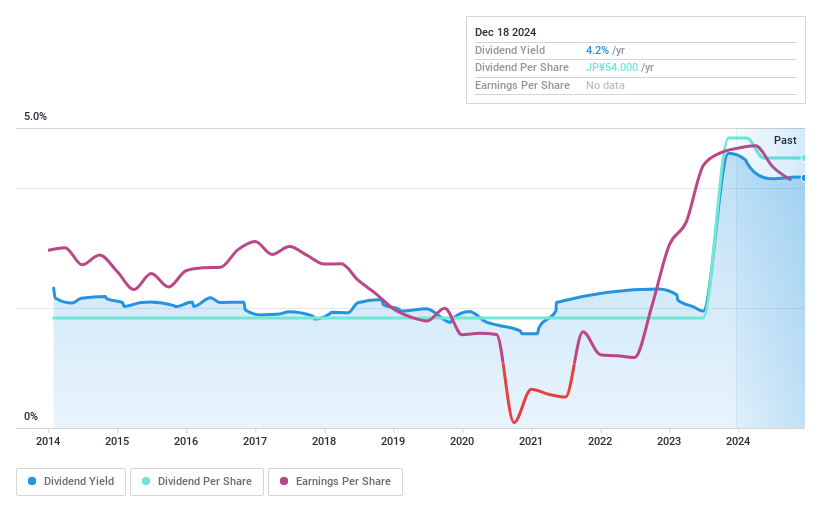

Shimojima (TSE:7482)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shimojima Co., Ltd. operates in Japan as a wholesaler and retailer of paper products, plastic products, packaging materials, and in-store materials with a market cap of ¥30.58 billion.

Operations: Shimojima Co., Ltd.'s revenue is derived from three main segments: Chemical Products and Packaging Materials at ¥35.21 billion, Store Supplies at ¥13.71 billion, and Paper Products at ¥10.04 billion.

Dividend Yield: 4.1%

Shimojima's recent dividend increase to JPY 27.00 per share reflects growth but highlights volatility, as past payments have been inconsistent and unreliable. The current yield of 4.13% is among the top in Japan, yet sustainability concerns arise with a high cash payout ratio of 171.6%, indicating dividends are not well covered by free cash flows despite being covered by earnings at a 78% payout ratio.

- Unlock comprehensive insights into our analysis of Shimojima stock in this dividend report.

- The analysis detailed in our Shimojima valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Embark on your investment journey to our 1851 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:QES

China Sunsine Chemical Holdings

An investment holding company, manufactures and sells specialty chemicals in the People’s Republic of China, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.