- Singapore

- /

- Semiconductors

- /

- SGX:AWX

Spotlight On Strong Petrochemical Holdings And 2 Other Prominent Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate cuts from the ECB and SNB, alongside expectations for a similar move by the Federal Reserve, investors are assessing opportunities amidst mixed index performances. The Nasdaq Composite's record high contrasts with declines in other major indexes, highlighting the varied responses to economic indicators such as inflation and jobless claims. In this context, penny stocks—often smaller or newer companies—remain an intriguing investment area due to their potential for growth when backed by strong financials. Despite being considered an outdated term, these stocks can offer affordability and significant upside potential for those willing to explore them further.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.12 | £798.74M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.97 | HK$44.05B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.775 | £180.04M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.97 | £153.01M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,760 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Strong Petrochemical Holdings (SEHK:852)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Strong Petrochemical Holdings Limited is an investment holding company engaged in trading commodities, with a market cap of HK$339.74 million.

Operations: The company's revenue is primarily derived from its Trading Business, which generated HK$1.64 billion, and its Storage Business, contributing HK$36.21 million.

Market Cap: HK$339.74M

Strong Petrochemical Holdings faces challenges typical of its market segment, evidenced by its unprofitability and volatile share price. Despite generating HK$1.64 billion in revenue from trading, it struggles with profitability, reflected in a negative return on equity and increased debt levels over the past five years. The company has sufficient cash runway for over three years but is entangled in legal issues concerning share issuance procedures following a court order involving Mr. Wang Jian Sheng, an executive director. Recent board changes aim to enhance governance amidst these legal proceedings and financial instability.

- Take a closer look at Strong Petrochemical Holdings' potential here in our financial health report.

- Explore historical data to track Strong Petrochemical Holdings' performance over time in our past results report.

Gain Plus Holdings (SEHK:9900)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gain Plus Holdings Limited is an investment holding company that provides construction contracting services for public and private sectors in Hong Kong, with a market cap of HK$751.44 million.

Operations: The company generates revenue of HK$1.29 billion from providing building construction and RMAA services.

Market Cap: HK$751.44M

Gain Plus Holdings Limited operates in the construction contracting sector with a market cap of HK$751.44 million and reported half-year sales of HK$620.58 million, showing growth from the previous year. Despite stable weekly volatility, its net profit margin decreased to 2.4% from 4.2%. The company is debt-free, which reduces financial risk, but insider selling has been significant recently. While it has high-quality earnings and short-term assets exceeding liabilities, negative earnings growth over the past year poses challenges compared to industry averages. The board's experience is a positive aspect amidst these mixed financial indicators.

- Click here and access our complete financial health analysis report to understand the dynamics of Gain Plus Holdings.

- Assess Gain Plus Holdings' previous results with our detailed historical performance reports.

AEM Holdings (SGX:AWX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AEM Holdings Ltd. and its subsidiaries offer application-specific intelligent system tests and handling solutions for semiconductor and electronics companies, with a market capitalization of SGD425.71 million.

Operations: No specific revenue segments are reported for AEM Holdings Ltd.

Market Cap: SGD425.71M

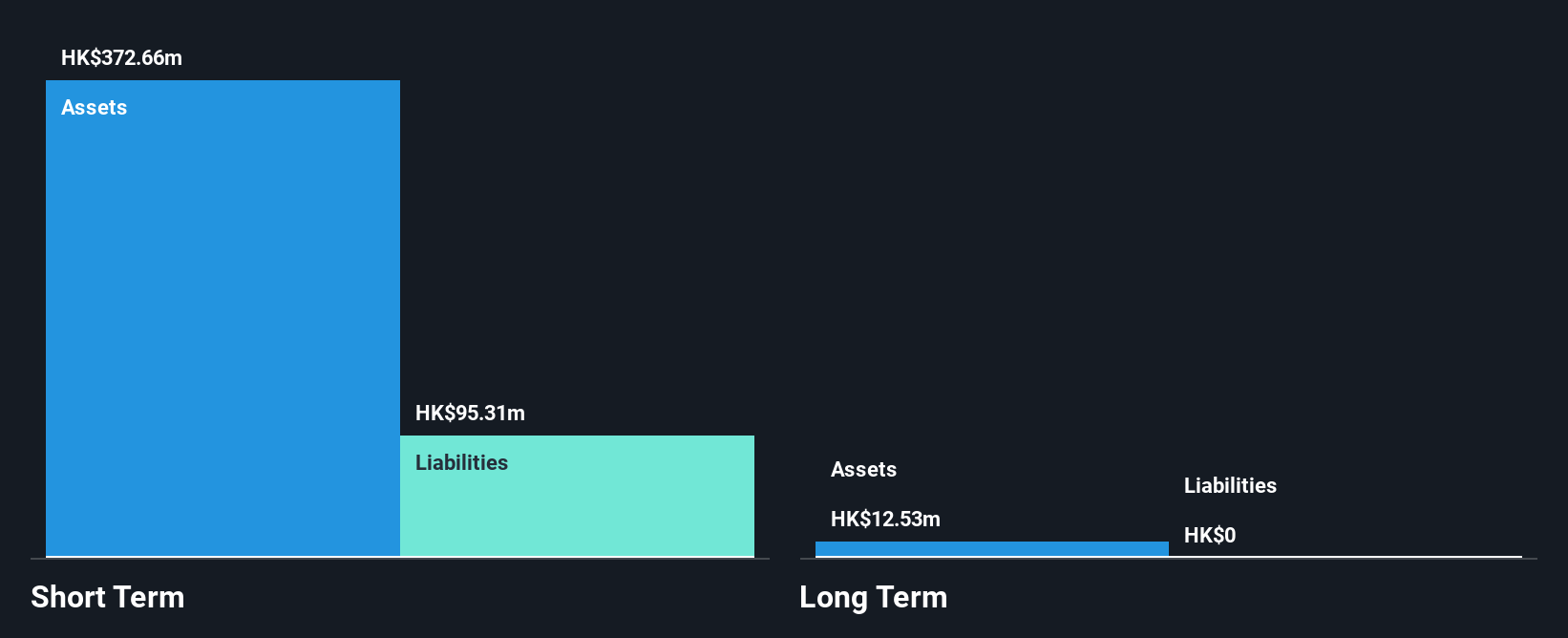

AEM Holdings Ltd., with a market cap of SGD425.71 million, operates in the semiconductor and electronics sector, reporting sales of SGD74.22 million for Q3 2024 but incurring a net loss of SGD0.917 million. Despite being unprofitable with negative returns on equity, AEM's financial stability is supported by short-term assets surpassing both short- and long-term liabilities significantly. The company's debt is well-covered by operating cash flow, maintaining a satisfactory net debt to equity ratio of 8.4%. Recent executive changes include the resignation of Mr. Oei Jun Long as Joint Company Secretary, reflecting ongoing corporate restructuring efforts.

- Jump into the full analysis health report here for a deeper understanding of AEM Holdings.

- Gain insights into AEM Holdings' outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Reveal the 5,760 hidden gems among our Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AWX

AEM Holdings

Provides semiconductor and electronics test solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives