Chemical Industries (Far East) Limited's (SGX:C05) P/S Still Appears To Be Reasonable

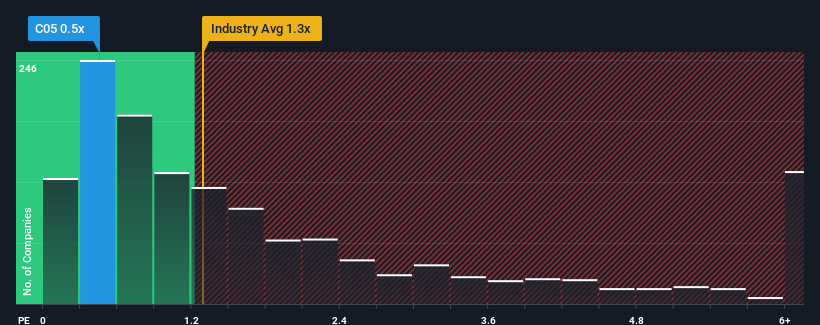

It's not a stretch to say that Chemical Industries (Far East) Limited's (SGX:C05) price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in Singapore, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Chemical Industries (Far East)

What Does Chemical Industries (Far East)'s Recent Performance Look Like?

As an illustration, revenue has deteriorated at Chemical Industries (Far East) over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Chemical Industries (Far East), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Chemical Industries (Far East)'s Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chemical Industries (Far East)'s to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. Even so, admirably revenue has lifted 43% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

With this information, we can see why Chemical Industries (Far East) is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On Chemical Industries (Far East)'s P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we've seen, Chemical Industries (Far East)'s three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you settle on your opinion, we've discovered 5 warning signs for Chemical Industries (Far East) (2 are significant!) that you should be aware of.

If you're unsure about the strength of Chemical Industries (Far East)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:C05

Chemical Industries (Far East)

An investment holding company, manufactures and sells chemicals in Singapore and Myanmar.

Flawless balance sheet moderate.

Market Insights

Community Narratives