Is Great Eastern Holdings (SGX:G07) Still Undervalued? A Fresh Look Following Renewed Share Price Momentum

Reviewed by Simply Wall St

It is no surprise that Great Eastern Holdings (SGX:G07) has stirred up some fresh debate among investors this week. With no single event grabbing headlines, the recent moves in the share price could easily be dismissed as business as usual. For those keeping an eye on valuation, it is worth pausing to reassess what the market is signaling about future prospects.

Over the year, the stock has delivered a year-to-date return of 10%, and its longer-term numbers have also impressed with returns of 75% in the past three years and 93% over five years. While short-term moves often reflect shifting sentiment or positioning, this kind of multi-year momentum hints at a company that either continues to deliver or is seeing its potential priced in more aggressively. Recent trading has seen the share price up 4% in the past day and 8% over the past week, suggesting renewed investor interest rather than fading momentum.

After such steady gains, is Great Eastern Holdings offering a genuine value opportunity, or is the market already factoring in stronger growth ahead?

Price-to-Earnings of 7.5x: Is it justified?

Great Eastern Holdings is currently trading at a Price-To-Earnings (P/E) ratio of 7.5x, which is below both its peer group average of 8.5x and the Asian Insurance industry average of 11.7x. This suggests the stock is undervalued compared to sector competitors based on current earnings.

The P/E ratio measures a company’s current share price relative to its per-share earnings. In the insurance industry, this ratio is widely used to compare valuation among similar firms because it captures the relationship between market expectations and recent profitability.

This lower multiple may indicate that investors are underestimating Great Eastern Holdings’ earnings potential, or it could reflect concerns about the company’s profitability outlook. Given that earnings have shown signs of growth in the past year after a five-year decline, the discount could attract value-focused investors looking for a turnaround story.

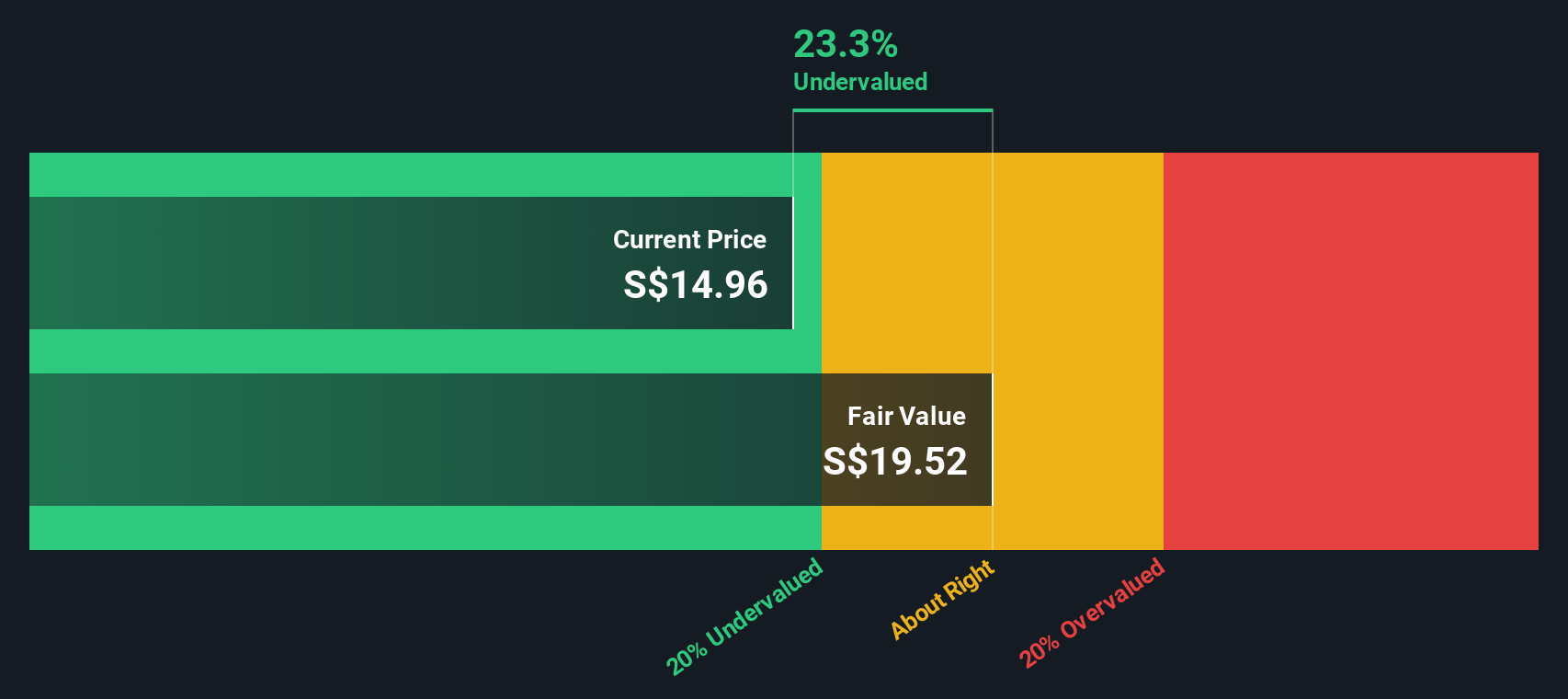

Result: Fair Value of $19.52 (UNDERVALUED)

See our latest analysis for Great Eastern Holdings.However, there remains a risk that profitability may falter again or that market sentiment could shift and undermine the value-focused thesis.

Find out about the key risks to this Great Eastern Holdings narrative.Another Perspective: What Does the SWS DCF Model Suggest?

The SWS DCF model offers a different lens on Great Eastern Holdings’ valuation by focusing on future cash flows instead of current earnings. This approach also points to the stock being undervalued. The question remains whether this supports the case or simply introduces another layer of uncertainty.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Great Eastern Holdings Narrative

If you see things differently or want to test your own assumptions, you can dive into the data yourself and build a narrative in just a few minutes. Do it your way

A great starting point for your Great Eastern Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment opportunities?

Smart investors never limit their watchlist. Miss out on the hottest themes and you could miss your next big win. Put your capital to work in places where momentum, innovation, and value are all in your favor.

- Unlock high-yield potential by targeting companies with consistent payouts using dividend stocks with yields > 3%.

- Ride the AI wave and get ahead of tomorrow’s tech leaders by filtering for the next generation of game changers with AI penny stocks.

- Maximize returns by spotting stocks priced below their intrinsic value through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:G07

Great Eastern Holdings

An investment holding company, provides insurance products in Singapore, Malaysia, and rest of Asia.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026