- South Korea

- /

- Biotech

- /

- KOSDAQ:A394800

Asian Value Stocks Trading Below Estimated Worth In December 2025

Reviewed by Simply Wall St

As we approach December 2025, Asian markets have shown resilience, with investor optimism in technology and artificial intelligence sectors helping to offset concerns about economic slowdowns in regions like China. Amidst this backdrop, identifying undervalued stocks requires a keen eye for companies that demonstrate strong fundamentals and potential for growth despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥156.00 | CN¥303.70 | 48.6% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥82.62 | CN¥162.30 | 49.1% |

| STI (KOSDAQ:A039440) | ₩25900.00 | ₩51536.57 | 49.7% |

| Nippon Thompson (TSE:6480) | ¥720.00 | ¥1399.87 | 48.6% |

| Morimatsu International Holdings (SEHK:2155) | HK$8.08 | HK$16.11 | 49.8% |

| Meitu (SEHK:1357) | HK$7.29 | HK$14.56 | 49.9% |

| Japan Eyewear Holdings (TSE:5889) | ¥1931.00 | ¥3851.42 | 49.9% |

| H.U. Group Holdings (TSE:4544) | ¥3397.00 | ¥6592.59 | 48.5% |

| China Ruyi Holdings (SEHK:136) | HK$2.41 | HK$4.82 | 50% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥27.31 | CN¥53.35 | 48.8% |

Let's review some notable picks from our screened stocks.

3billion (KOSDAQ:A394800)

Overview: 3billion, Inc. specializes in developing technology for rare disease drug discovery through bioinformatics and machine learning, with a market cap of approximately ₩451.71 billion.

Operations: 3billion, Inc. generates revenue through its innovative use of bioinformatics and machine learning technology in the field of rare disease drug discovery.

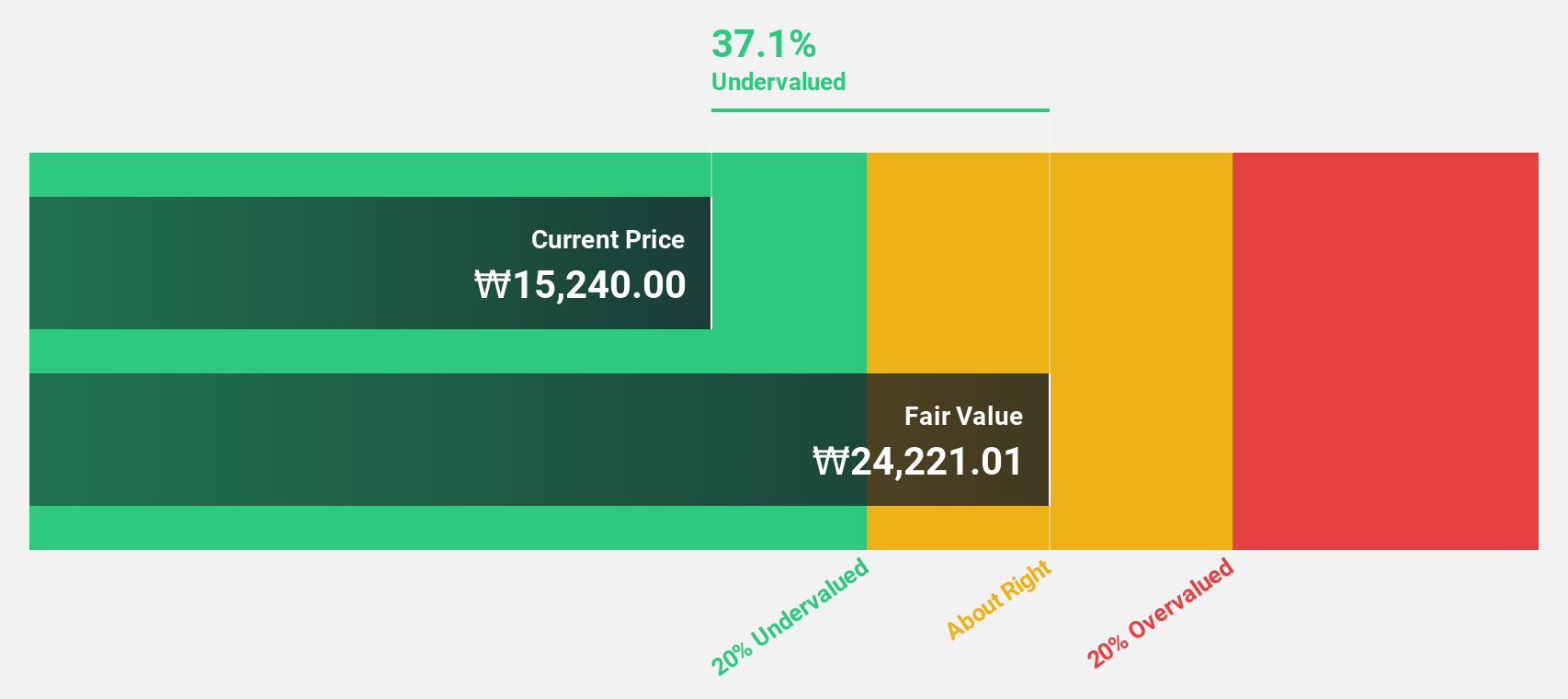

Estimated Discount To Fair Value: 41.4%

3billion is trading at ₩14,240, significantly below its estimated fair value of ₩24,296.22. Despite a highly volatile share price recently, the company's revenue is forecast to grow at 54.7% annually, outpacing the Korean market's 10.5% growth rate. Earnings are expected to increase by over 100% per year and become profitable within three years, marking above-average market growth despite a low future return on equity of 16.6%.

- Our growth report here indicates 3billion may be poised for an improving outlook.

- Navigate through the intricacies of 3billion with our comprehensive financial health report here.

UltraGreen.ai (SGX:ULG)

Overview: UltraGreen.ai Limited (SGX:ULG) manufactures fluorescence imaging surgical devices and pharmaceutical agents, with a market cap of SGD1.68 billion.

Operations: The company's revenue segments include $6.84 million from Ultralinq, $173.98 million from Dxg - Americas, and $113.36 million from Dxg - Rest of World.

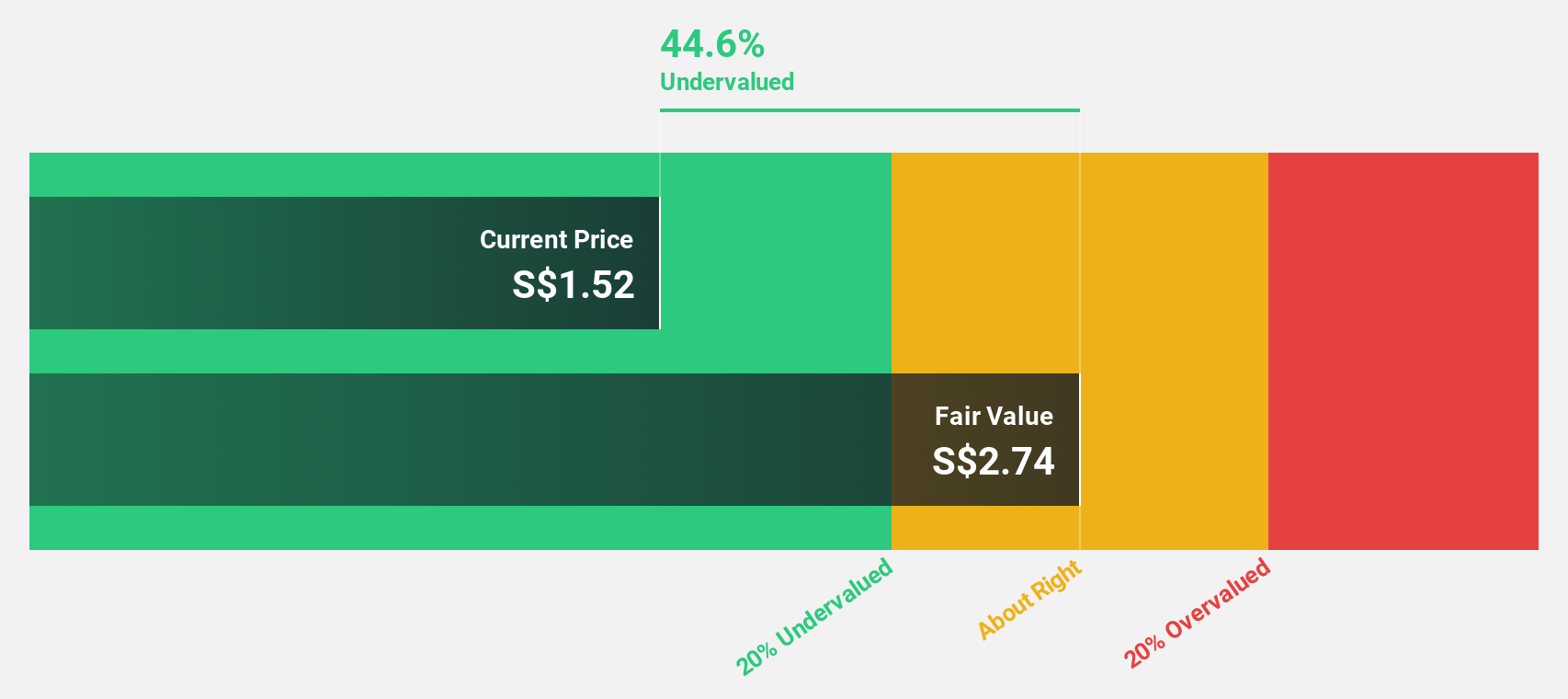

Estimated Discount To Fair Value: 44.6%

UltraGreen.ai is trading at SGD 1.52, significantly below its estimated fair value of SGD 2.74, indicating it may be undervalued based on cash flows. Despite a high debt level and illiquid shares, the company’s earnings are expected to grow significantly at 26.2% annually over the next three years, outpacing the Singapore market's growth rate of 7.5%. Recent IPO completion raised US$400 million, enhancing its financial position for future expansion.

- The growth report we've compiled suggests that UltraGreen.ai's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of UltraGreen.ai.

Guilin Layn Natural Ingredients (SZSE:002166)

Overview: Guilin Layn Natural Ingredients Corp. produces and sells plant-based sweeteners and natural flavors in China and internationally, with a market cap of CN¥6.44 billion.

Operations: The company's revenue is primarily derived from the production and sale of plant-based sweeteners and natural flavors, both domestically and abroad.

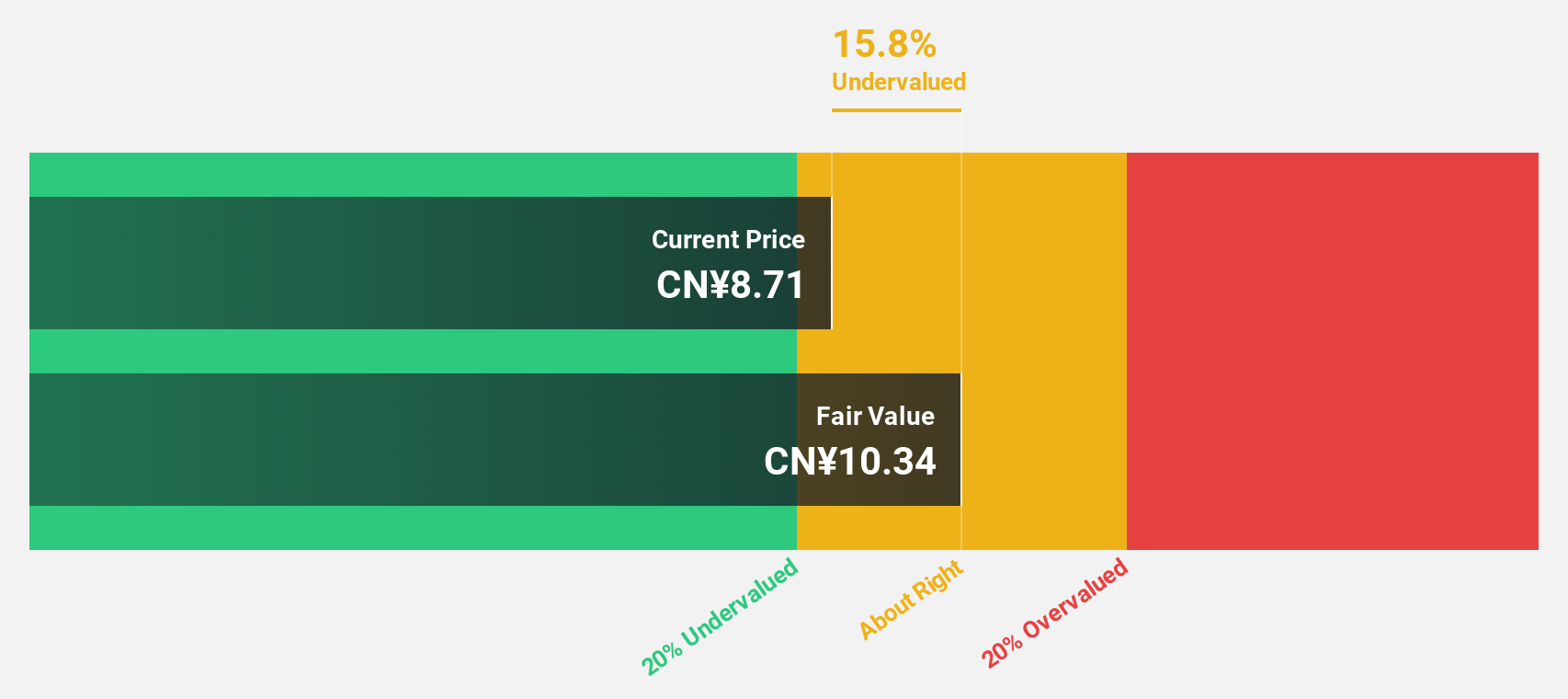

Estimated Discount To Fair Value: 16.1%

Guilin Layn Natural Ingredients, trading at CN¥8.68, is undervalued relative to its fair value of CN¥10.34 based on cash flow analysis. The company's revenue growth forecast of 15.5% annually surpasses the broader Chinese market's 14.6%, although earnings have declined recently with net income dropping to CN¥70.4 million from CN¥101.62 million year-on-year. Despite an unstable dividend history and a low future return on equity projection of 9.2%, significant earnings growth is anticipated over the next three years at 37%.

- According our earnings growth report, there's an indication that Guilin Layn Natural Ingredients might be ready to expand.

- Dive into the specifics of Guilin Layn Natural Ingredients here with our thorough financial health report.

Make It Happen

- Unlock our comprehensive list of 270 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3billion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A394800

3billion

Develops technology for rare disease drug discovery using bioinformatics and machine learning technology.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026