- Singapore

- /

- Real Estate

- /

- SGX:OYY

March 2025 Asian Penny Stocks With Promising Potential

Reviewed by Simply Wall St

Amidst global market uncertainties, such as trade policy concerns and fluctuating economic indicators, the Asian markets have shown resilience with some indices maintaining steady growth. Penny stocks, often perceived as relics of past market eras, continue to hold potential due to their affordability and growth prospects. This article will explore several promising penny stocks in Asia that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.38 | SGD9.4B | ★★★★★☆ |

| Lever Style (SEHK:1346) | HK$1.28 | HK$812.53M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.10 | HK$46.99B | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.88 | HK$655.37M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.03 | CN¥3.51B | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.24 | THB2.54B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.475 | SGD452.86M | ★★★★★★ |

| Interlink Telecom (SET:ITEL) | THB1.52 | THB2.11B | ★★★★☆☆ |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.08 | HK$4.3B | ★★★★★★ |

Click here to see the full list of 1,165 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

PropNex (SGX:OYY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PropNex Limited is a company that offers real estate services both in Singapore and internationally, with a market cap of SGD865.80 million.

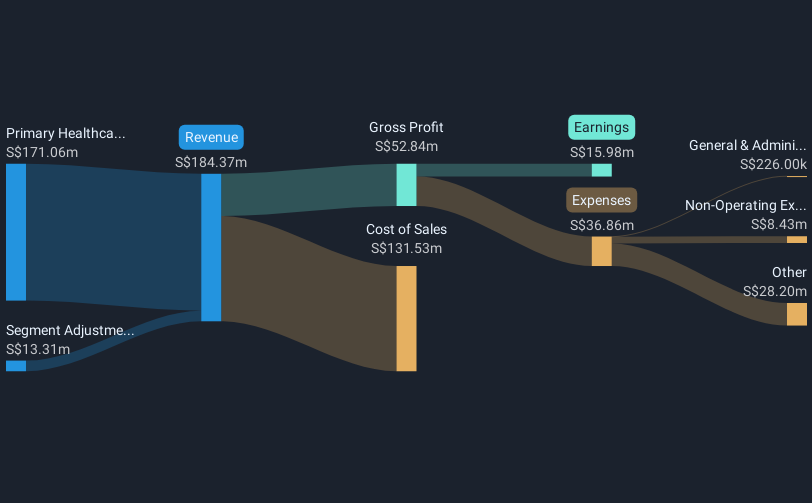

Operations: The company's revenue is primarily derived from Agency Services at SGD591.61 million and Project Marketing Services at SGD185.57 million, with additional contributions from Training Services at SGD3.48 million and Administrative Support Services at SGD2.29 million.

Market Cap: SGD865.8M

PropNex Limited, a prominent real estate service provider, reported a decline in earnings and net income for 2024, with sales at SGD782.95 million. Despite this setback, the company maintains no debt and boasts strong short-term asset coverage over liabilities. Recent leadership changes aim to bolster strategic growth and innovation within its market-leading position in Singapore's property sector. However, the dividend yield of 4.49% is not well covered by earnings or free cash flows, raising sustainability concerns. The proposed special dividend highlights shareholder value focus amidst fluctuating financial metrics and evolving management dynamics.

- Take a closer look at PropNex's potential here in our financial health report.

- Gain insights into PropNex's future direction by reviewing our growth report.

Q & M Dental Group (Singapore) (SGX:QC7)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Q & M Dental Group (Singapore) Limited is an investment holding company that offers private dental healthcare services in Singapore, Malaysia, China, and internationally, with a market capitalization of SGD289.42 million.

Operations: The company generates revenue primarily from its Core Dental Business, which accounts for SGD173.79 million.

Market Cap: SGD289.42M

Q & M Dental Group (Singapore) Limited has shown a substantial earnings growth of 27.1% over the past year, despite a historical decline in profits. The company's net profit margin improved to 8.1%, and its short-term assets significantly exceed short-term liabilities, indicating robust liquidity. However, long-term liabilities are not fully covered by these assets, posing potential financial challenges. The dividend track record is unstable but recently increased with a payout ratio of 71%. While the management team is experienced, the board lacks tenure stability. A large one-off loss impacted recent financial results, yet debt coverage by operating cash flow remains strong at 54.4%.

- Dive into the specifics of Q & M Dental Group (Singapore) here with our thorough balance sheet health report.

- Assess Q & M Dental Group (Singapore)'s future earnings estimates with our detailed growth reports.

Goody Science and Technology (SZSE:002694)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Goody Science and Technology Co., Ltd. focuses on the research, development, production, and sale of plastic pipes in China with a market capitalization of CN¥3.50 billion.

Operations: The company's revenue primarily comes from its operations in China, amounting to CN¥851.20 million.

Market Cap: CN¥3.5B

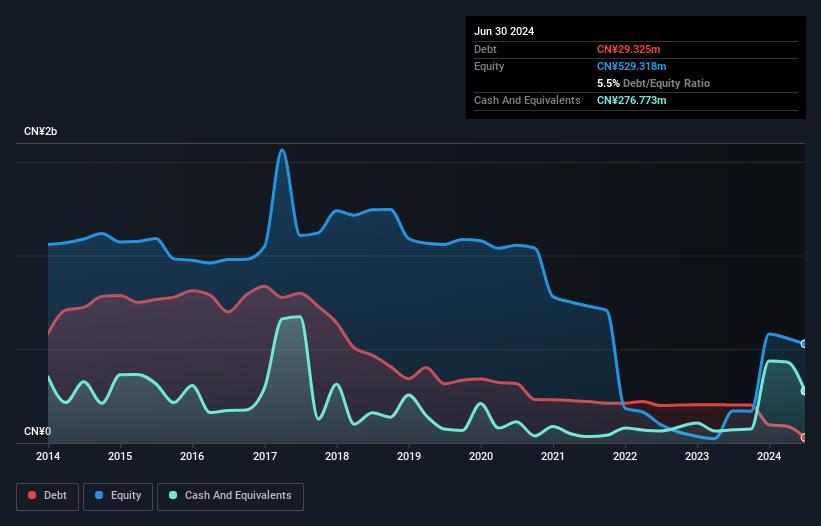

Goody Science and Technology Co., Ltd. operates in China with a market capitalization of CN¥3.50 billion, generating revenue of CN¥851.20 million from its plastic pipe business. Despite being unprofitable, the company has reduced its losses over the past five years by 7.8% annually and improved its debt-to-equity ratio significantly to 5.8%. Short-term assets cover both short- and long-term liabilities, indicating solid liquidity management, though it faces challenges with less than a year of cash runway if current cash flow trends persist. The management and board are relatively new, averaging just over a year in tenure each.

- Click here to discover the nuances of Goody Science and Technology with our detailed analytical financial health report.

- Explore historical data to track Goody Science and Technology's performance over time in our past results report.

Where To Now?

- Access the full spectrum of 1,165 Asian Penny Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade PropNex, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:OYY

Flawless balance sheet with reasonable growth potential.