- Hong Kong

- /

- Real Estate

- /

- SEHK:81

3 Penny Stocks To Watch With Market Caps Under US$800M

Reviewed by Simply Wall St

As global markets react to political developments and economic indicators, U.S. stocks are reaching new heights, buoyed by optimism around potential trade deals and advancements in artificial intelligence. Amidst this backdrop, investors often seek opportunities in various market segments, including the often-overlooked realm of penny stocks. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still present valuable opportunities when backed by solid financials and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.75 | £176.46M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.40 | £82.39M | ★★★★☆☆ |

| Starflex (SET:SFLEX) | THB2.82 | THB2.19B | ★★★★☆☆ |

Click here to see the full list of 5,708 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Freelance.com (ENXTPA:ALFRE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Freelance.com SA facilitates connections between companies and intellectual service providers across several countries including France, Germany, and the United Kingdom, with a market cap of €152.00 million.

Operations: The company generates revenue of €955.18 million from its Business Services segment.

Market Cap: €152M

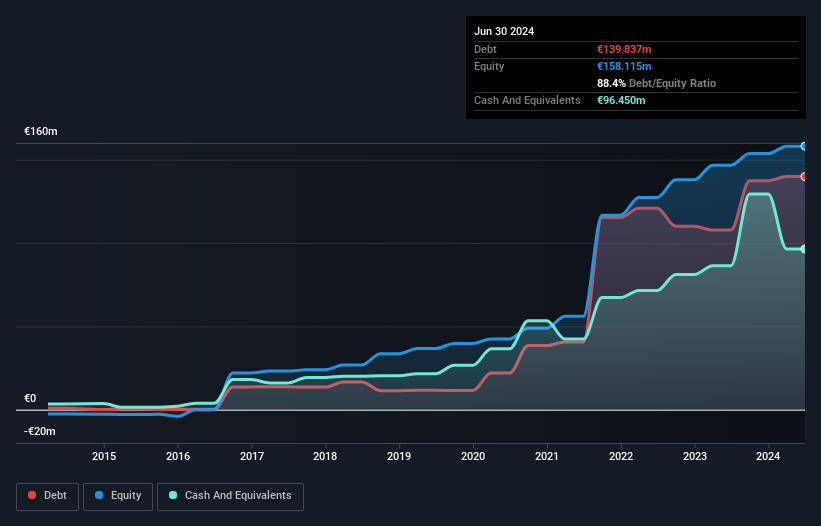

Freelance.com SA, with a market cap of €152 million and revenue of €955.18 million, presents an intriguing opportunity within the penny stock realm. Despite its satisfactory net debt to equity ratio of 27.4% and coverage of both short-term (€266.6M) and long-term liabilities (€127.1M) by short-term assets (€319.2M), challenges persist due to negative earnings growth over the past year and low return on equity at 9.8%. The company's dividend yield is not well supported by free cash flows, yet it trades significantly below its estimated fair value, indicating potential for appreciation if financial performance stabilizes or improves.

- Dive into the specifics of Freelance.com here with our thorough balance sheet health report.

- Explore Freelance.com's analyst forecasts in our growth report.

China Overseas Grand Oceans Group (SEHK:81)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Overseas Grand Oceans Group Limited is an investment holding company that focuses on investing in, developing, and leasing real estate properties in the People’s Republic of China and Hong Kong, with a market cap of HK$6.19 billion.

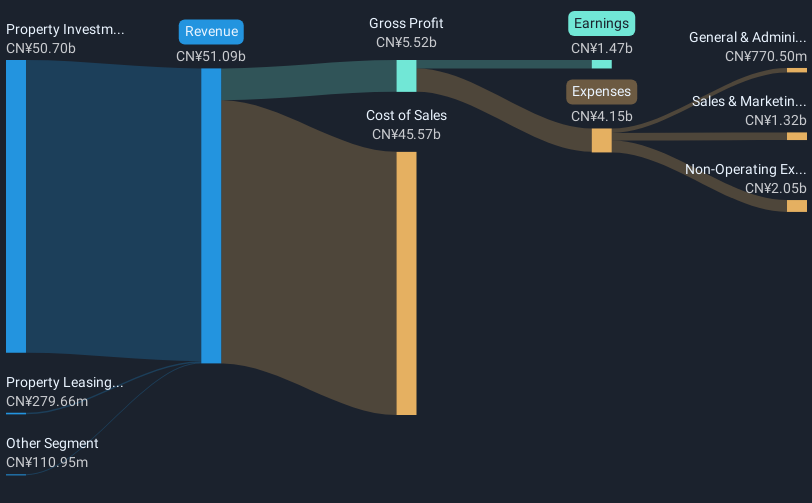

Operations: The company generates revenue primarily from Property Investment and Development, amounting to CN¥50.70 billion, and Property Leasing, contributing CN¥279.66 million.

Market Cap: HK$6.19B

China Overseas Grand Oceans Group, with a market cap of HK$6.19 billion, faces challenges typical of penny stocks despite its substantial revenue from property investment and development. Recent sales figures show mixed performance, with December 2024 property contracted sales reaching RMB 4.58 billion but overall annual sales declining by 6.3%. The company's debt is not well covered by operating cash flow, and it has experienced negative earnings growth and low return on equity at 2.4%. However, short-term assets exceed liabilities significantly, providing some financial stability amidst volatile profit margins impacted by large one-off losses.

- Take a closer look at China Overseas Grand Oceans Group's potential here in our financial health report.

- Gain insights into China Overseas Grand Oceans Group's outlook and expected performance with our report on the company's earnings estimates.

Q & M Dental Group (Singapore) (SGX:QC7)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Q & M Dental Group (Singapore) Limited is an investment holding company offering private dental healthcare services in Singapore, Malaysia, China, and internationally with a market cap of SGD270.44 million.

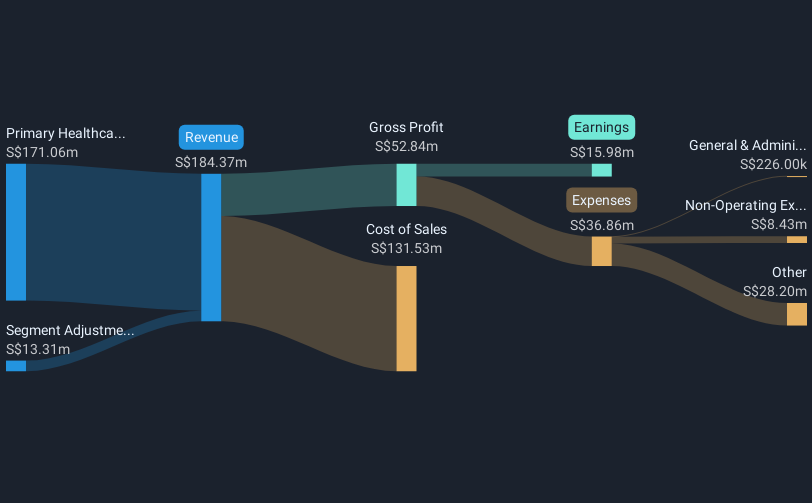

Operations: The company generates revenue primarily from its Primary Healthcare segment, amounting to SGD171.06 million.

Market Cap: SGD270.44M

Q & M Dental Group (Singapore) Limited, with a market cap of SGD270.44 million, presents a mixed picture typical of penny stocks. The company has shown significant earnings growth over the past year at 135.2%, outpacing its industry peers despite declining profits over five years. Its net debt to equity ratio is high at 40.8%, though interest payments are well covered by EBIT and operating cash flow covers debt adequately. While the board's inexperience may be concerning, the management team is seasoned with an average tenure of 2.7 years, and short-term assets comfortably exceed liabilities, providing some financial stability amidst an unstable dividend track record.

- Jump into the full analysis health report here for a deeper understanding of Q & M Dental Group (Singapore).

- Review our growth performance report to gain insights into Q & M Dental Group (Singapore)'s future.

Key Takeaways

- Dive into all 5,708 of the Penny Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:81

China Overseas Grand Oceans Group

An investment holding company, invests in, develops, and leases real estate properties in the People’s Republic of China and Hong Kong.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives