- Singapore

- /

- Healthcare Services

- /

- SGX:BSL

Raffles Medical Group (SGX:BSL) Seems To Use Debt Rather Sparingly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Raffles Medical Group Ltd (SGX:BSL) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Raffles Medical Group

What Is Raffles Medical Group's Debt?

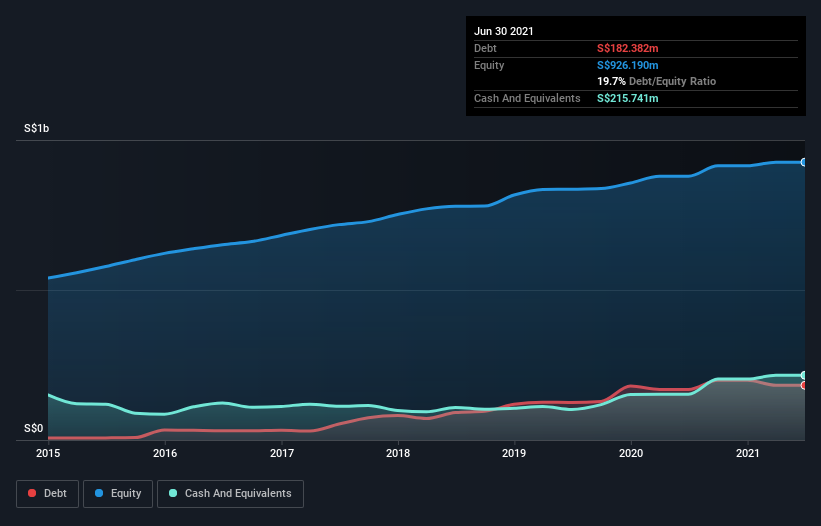

As you can see below, at the end of June 2021, Raffles Medical Group had S$182.4m of debt, up from S$168.4m a year ago. Click the image for more detail. But it also has S$215.7m in cash to offset that, meaning it has S$33.4m net cash.

How Strong Is Raffles Medical Group's Balance Sheet?

The latest balance sheet data shows that Raffles Medical Group had liabilities of S$318.3m due within a year, and liabilities of S$210.6m falling due after that. On the other hand, it had cash of S$215.7m and S$128.3m worth of receivables due within a year. So it has liabilities totalling S$184.9m more than its cash and near-term receivables, combined.

Given Raffles Medical Group has a market capitalization of S$2.88b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Raffles Medical Group boasts net cash, so it's fair to say it does not have a heavy debt load!

Better yet, Raffles Medical Group grew its EBIT by 139% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Raffles Medical Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Raffles Medical Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Raffles Medical Group produced sturdy free cash flow equating to 68% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Raffles Medical Group has S$33.4m in net cash. And it impressed us with its EBIT growth of 139% over the last year. So is Raffles Medical Group's debt a risk? It doesn't seem so to us. Another factor that would give us confidence in Raffles Medical Group would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BSL

Raffles Medical Group

Provides integrated private healthcare services primarily in Singapore, Greater China, Vietnam, Cambodia, and Japan.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives