- Netherlands

- /

- Food

- /

- ENXTAM:FFARM

ForFarmers Leads The Charge With 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of rising treasury yields and fluctuating consumer confidence, investors are seeking opportunities that can offer both stability and potential growth. Penny stocks, despite their somewhat outdated name, continue to capture interest for their ability to provide surprising value when backed by strong financials. This article will explore three penny stocks that stand out for their financial strength and potential long-term promise amidst the current market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.57 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £153.96M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ForFarmers N.V. is a company that offers feed solutions for conventional and organic livestock farming across various European countries and internationally, with a market cap of €310.72 million.

Operations: The company's revenue from its Food Processing segment amounts to €2.72 billion.

Market Cap: €310.72M

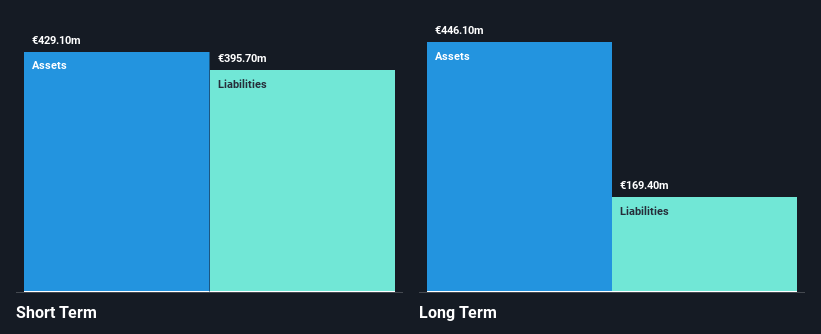

ForFarmers, with a market cap of €310.72 million and revenue of €2.72 billion, has seen its debt to equity ratio rise over the past five years but maintains satisfactory net debt levels. The company's short-term assets exceed both short and long-term liabilities, indicating solid liquidity. Despite becoming profitable recently, ForFarmers' earnings have declined by 32.3% annually over the past five years and are trading significantly below estimated fair value. The company faces challenges with interest coverage on its debt and an unstable dividend history but benefits from experienced board oversight while having a relatively new management team.

- Navigate through the intricacies of ForFarmers with our comprehensive balance sheet health report here.

- Gain insights into ForFarmers' outlook and expected performance with our report on the company's earnings estimates.

Raffles Medical Group (SGX:BSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raffles Medical Group Ltd offers integrated private healthcare services across Singapore, Greater China, Vietnam, Cambodia, and Japan with a market capitalization of SGD1.56 billion.

Operations: The company's revenue segments comprise Hospital Services (SGD337.82 million), Insurance Services (SGD163.78 million), and Healthcare Services (SGD257.49 million), along with Investment Holdings generating SGD45.03 million.

Market Cap: SGD1.56B

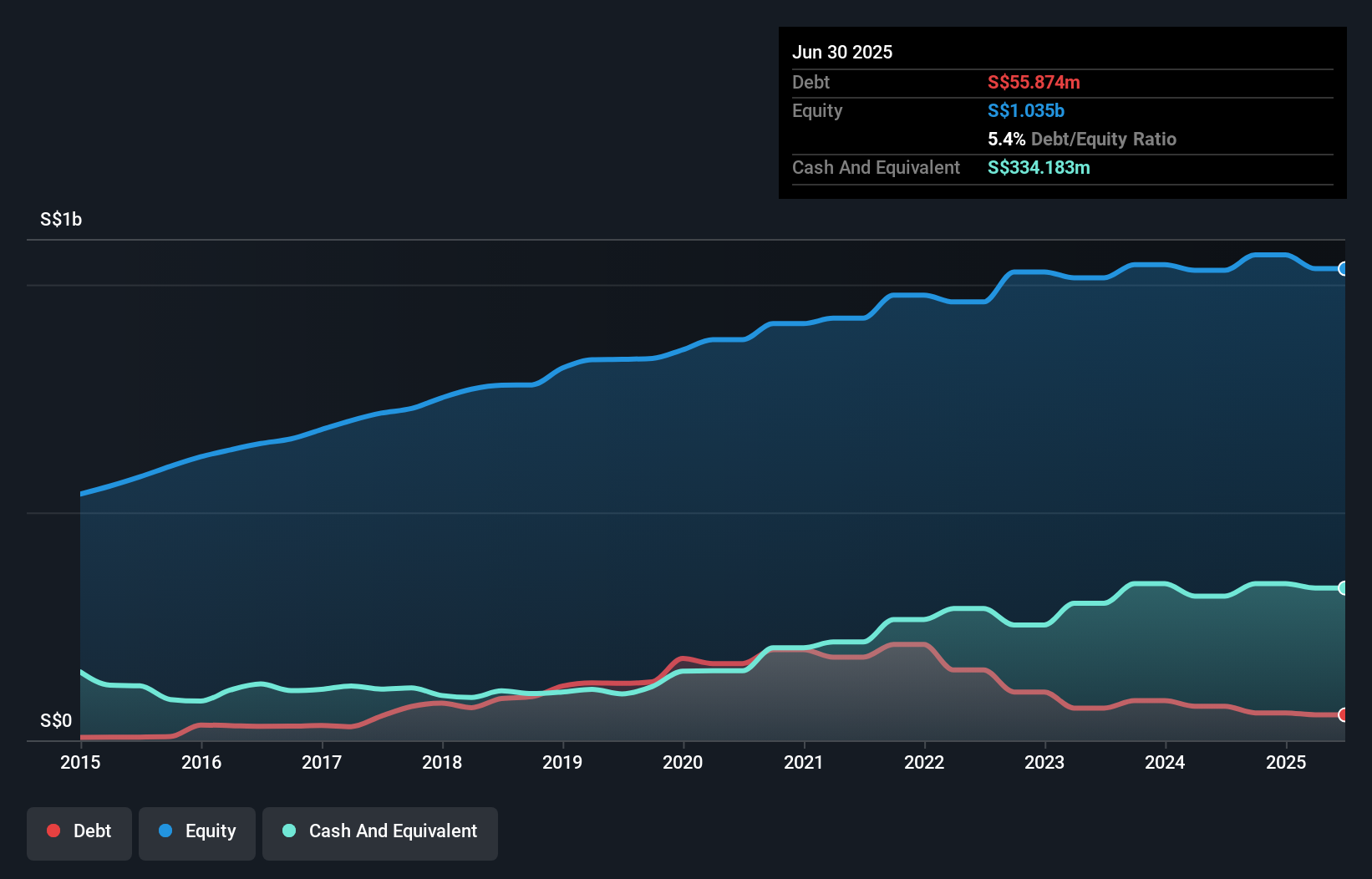

Raffles Medical Group, with a market cap of SGD1.56 billion, generates substantial revenue across its Hospital Services (SGD337.82 million), Insurance Services (SGD163.78 million), and Healthcare Services (SGD257.49 million) segments, indicating strong operational foundations for a penny stock context. Despite recent executive changes, including the re-designation of Mr. Tan Soo Nan and the departure of CFO Ms. Ng Won Lein, the company maintains experienced board oversight with stable short-term assets exceeding liabilities by a significant margin (SGD476 million vs SGD397.1 million). However, profit margins have declined from 18.3% to 8.7%, reflecting potential profitability challenges ahead.

- Click here and access our complete financial health analysis report to understand the dynamics of Raffles Medical Group.

- Review our growth performance report to gain insights into Raffles Medical Group's future.

Frencken Group (SGX:E28)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frencken Group Limited is an investment holding company that offers original design, original equipment, and diversified integrated manufacturing solutions globally, with a market cap of SGD495.42 million.

Operations: The company's revenue is primarily derived from its Mechatronics segment, which generated SGD670.12 million, and the Integrated Manufacturing Services (IMS) segment, contributing SGD91.79 million.

Market Cap: SGD495.42M

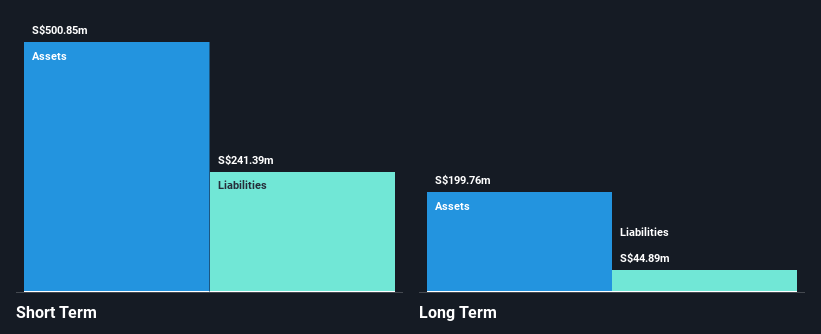

Frencken Group Limited, with a market cap of SGD495.42 million, shows a robust financial position in the context of penny stocks. Its Mechatronics segment drives substantial revenue (SGD670.12 million), complemented by the IMS segment (SGD91.79 million). The company anticipates higher revenue in the second half of 2024 compared to the first half, suggesting positive momentum. Frencken's debt is well-managed with more cash than total debt and operating cash flow covering 69.8% of its obligations. Despite earnings growth being modest at 2% over the past year, it surpasses industry averages and forecasts suggest an 11.53% annual increase moving forward.

- Unlock comprehensive insights into our analysis of Frencken Group stock in this financial health report.

- Examine Frencken Group's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Click here to access our complete index of 5,815 Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:FFARM

ForFarmers

Provides feed solutions for conventional and organic livestock farming under the ForFarmers brand in the Netherlands, the United Kingdom, Germany, Poland, Belgium, and internationally.

Excellent balance sheet and good value.