Thai Beverage (SGX:Y92) Eyes Growth with BeerCo IPO and Synergies Despite Market Challenges

Reviewed by Simply Wall St

Thai Beverage (SGX:Y92) continues to demonstrate financial resilience with a reported sales revenue increase of 2.2% to THB 340.29 billion for the fiscal year ending September 2024, driven by strong performance in its beverage and food segments. Despite this growth, challenges such as declining net profits in the spirits and food segments, alongside a high net debt to equity ratio, pose significant hurdles. The company report will explore these financial dynamics, emerging market opportunities like the potential BeerCo IPO, and assess external pressures from regulatory changes and competitive market conditions.

Click here to discover the nuances of Thai Beverage with our detailed analytical report.

Innovative Factors Supporting Thai Beverage

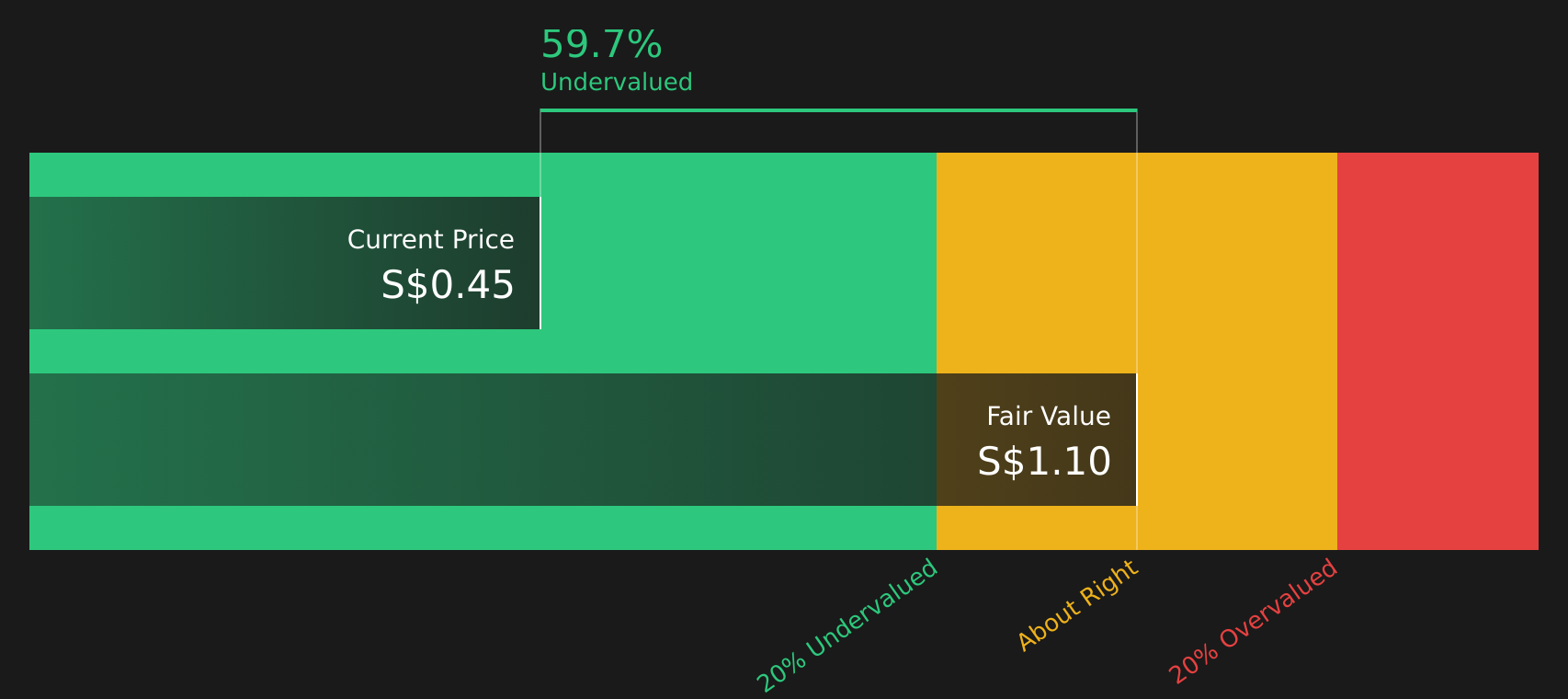

Thai Beverage's financial health is underscored by its revenue and profit growth. For the fiscal year ending September 30, 2024, the company reported total sales revenue of THB 340.29 billion, marking a 2.2% increase from the previous year, as noted by Namfon Aungsutornrungsi, Head of Investor Relations. This growth was primarily driven by the beverage and food segments, with the beer business alone achieving a net profit of THB 5.22 billion, a 3.9% rise. Operational efficiencies have been enhanced through lower raw material costs and strategic marketing investments, contributing to a more streamlined SG&A, as highlighted by Prapakon Thongtheppairot, Group CFO. Furthermore, the company's market position remains strong, consistently holding the #1 spot for six consecutive months, according to Teck Tan, Executive. This success is reflected in the company's current trading price of SGD0.57, significantly below its estimated fair value of SGD1.12, suggesting potential room for growth.

Challenges Constraining Thai Beverage's Potential

Despite the positive outlook, Thai Beverage faces several challenges. The spirits business experienced a 4.6% year-on-year decline in net profit to THB 21.39 billion due to increased raw material costs and heightened marketing expenses. The food segment also struggled, with net profits falling to THB 301 million, impacted by rising operational costs and investments aimed at boosting brand visibility. Additionally, the publishing and printing segment saw a 6% drop in sales revenue to THB 5.40 billion. The company's ROE remains low at 13.3%, and its net profit margins have decreased to 8% from 8.2% the previous year. These financial challenges are compounded by a high net debt to equity ratio of 78%, posing potential financial risks.

Emerging Markets Or Trends for Thai Beverage

Opportunities for Thai Beverage include potential synergies from a share swap, as Kosit Suksingha, Executive, anticipates benefits from volume aggregations in raw material procurement and supply chain cost reductions. The company is also exploring the possibility of relaunching its BeerCo IPO, with Michael Lau Hwai Keong, Executive, noting increased optimism in the Asia Pacific IPO market. Moreover, a rebound in tourism and increased beer consumption due to warmer weather in Thailand could further bolster the company's growth prospects. These initiatives, if leveraged effectively, could enhance Thai Beverage's market position and capitalize on emerging opportunities.

Market Volatility Affecting Thai Beverage's Position

External threats include regulatory changes, as the Thai parliament considers easing licensing requirements, a development that could impact market dynamics. Economic uncertainty in Myanmar adds another layer of complexity, with fluctuating market rates posing potential challenges. Competitive pressures in Thailand's beer market remain intense, with all major players actively competing for market share. These factors, coupled with concerns over dividend sustainability due to an unstable track record, underscore the need for strategic agility to navigate the evolving environment.

Conclusion

Thai Beverage's current trading price of SGD0.57, significantly below its estimated fair value of SGD1.12, suggests a potential for upward market correction if the company effectively addresses its challenges and capitalizes on emerging opportunities. While the company showcases strong revenue growth driven by its beverage and food segments, it must mitigate the declining profits in its spirits and food sectors by optimizing operational costs and enhancing brand visibility. Additionally, strategic moves such as potential synergies from share swaps and a possible BeerCo IPO could further strengthen its market position, especially with the anticipated rebound in tourism and increased beer consumption. However, the company must remain agile in navigating external threats like regulatory changes and economic uncertainties in Myanmar, which could impact its market dynamics and competitive standing.

Seize The Opportunity

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Thai Beverage, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Thai Beverage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:Y92

Thai Beverage

Produces and distributes alcoholic and non-alcoholic beverages, and food products in Thailand, Vietnam, Malaysia, Myanmar, Singapore, and internationally.

Undervalued average dividend payer.

Market Insights

Community Narratives