As global markets navigate a mix of rising treasury yields and fluctuating consumer confidence, investors are seeking stability amidst moderate gains in major stock indices. In this climate, dividend stocks present an appealing option for those looking to balance growth with income, offering potential resilience through regular payouts even as market conditions shift.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1952 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

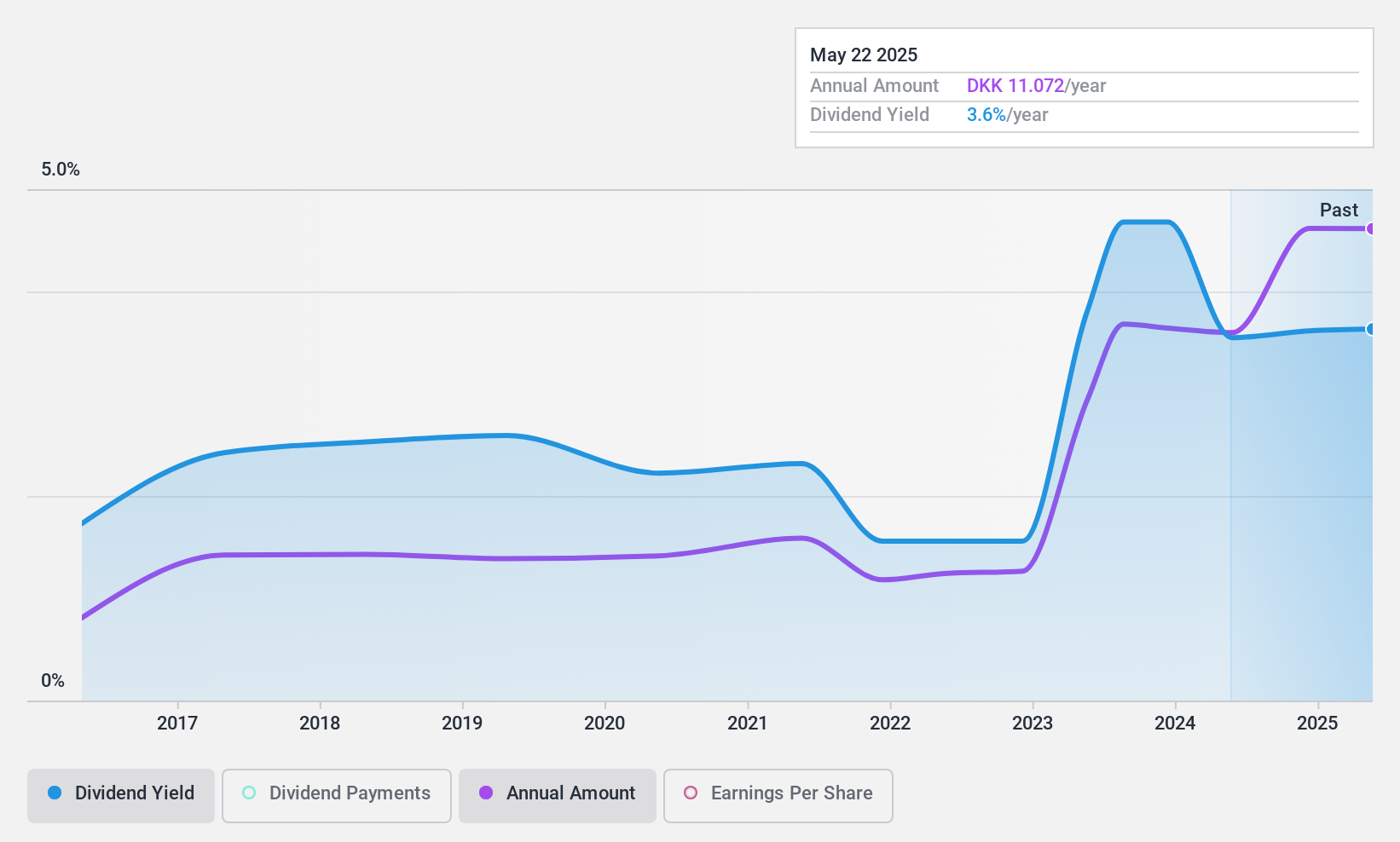

UIE (CPSE:UIE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UIE Plc is an investment company involved in the agro-industrial, industrial, and technology sectors across Malaysia, Indonesia, the United States, Europe, and internationally with a market cap of DKK9.51 billion.

Operations: UIE Plc's revenue primarily stems from its investment in United Plantations Berhad, amounting to $462.25 million.

Dividend Yield: 3.7%

UIE's dividend payments are well covered by earnings and cash flows, with a payout ratio of 22.6% and a cash payout ratio of 37.9%. Despite an unstable dividend track record over the past decade, recent earnings growth of 83.7% suggests potential for future stability. Trading at 30.5% below estimated fair value, UIE offers a yield of 3.68%, which is low compared to top-tier Danish dividend payers but indicates room for capital appreciation.

- Click here to discover the nuances of UIE with our detailed analytical dividend report.

- The analysis detailed in our UIE valuation report hints at an deflated share price compared to its estimated value.

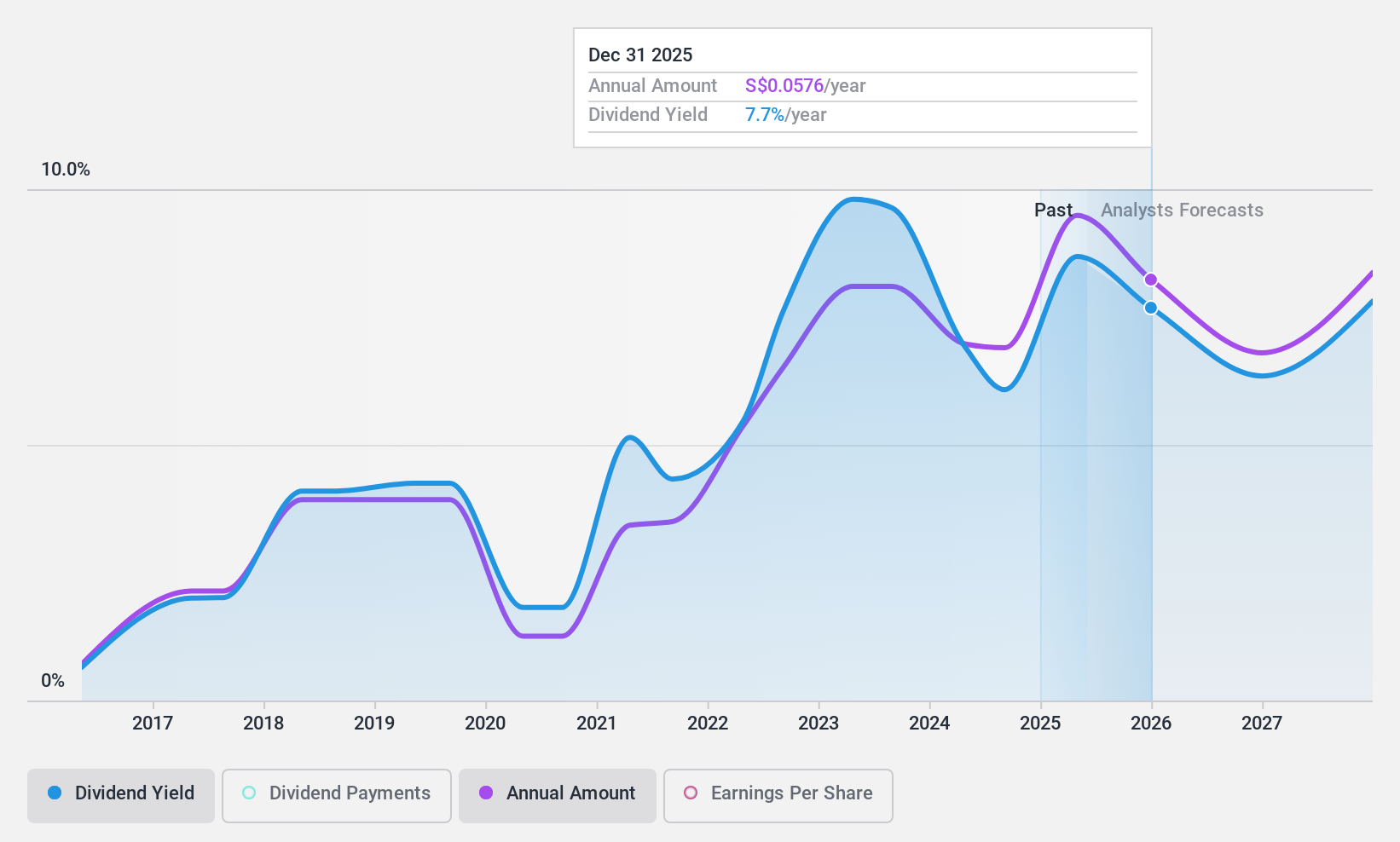

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bumitama Agri Ltd. is an investment holding company involved in the production and trade of crude palm oil, palm kernel, and related products for refineries in Indonesia, with a market capitalization of SGD1.51 billion.

Operations: Bumitama Agri Ltd.'s revenue primarily comes from its Plantations and Palm Oil Mills segment, generating IDR15.55 billion.

Dividend Yield: 5.5%

Bumitama Agri's dividends are well covered by earnings and cash flows, with payout ratios of 47.2% and 54.8%, respectively. Despite a volatile dividend history over the past decade, recent earnings growth of 15.3% supports potential stability. The stock trades at a significant discount to its estimated fair value, enhancing its attractiveness despite offering a lower yield than top-tier Singaporean dividend payers at 5.46%.

- Take a closer look at Bumitama Agri's potential here in our dividend report.

- Our expertly prepared valuation report Bumitama Agri implies its share price may be lower than expected.

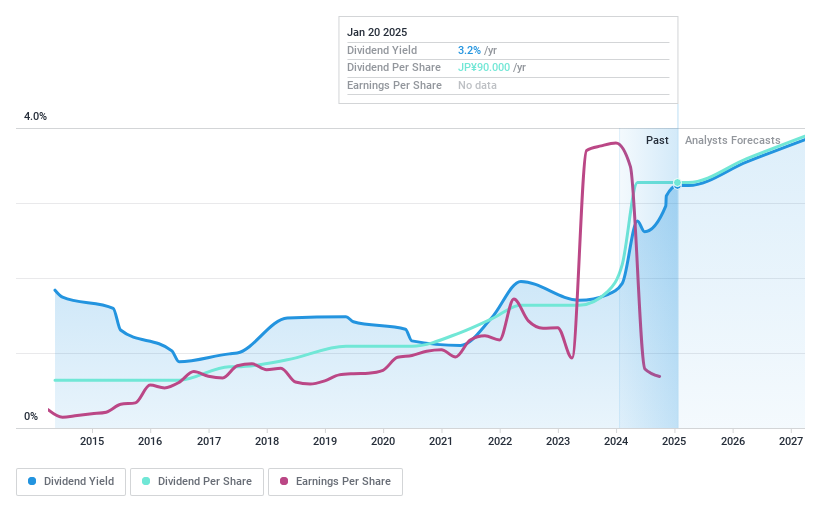

Morinaga Milk Industry (TSE:2264)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morinaga Milk Industry Co., Ltd., along with its subsidiaries, produces and sells various dairy products both in Japan and internationally, with a market cap of approximately ¥235.94 billion.

Operations: Morinaga Milk Industry Co., Ltd. generates revenue primarily from its Foods segment, which accounts for ¥524.90 billion.

Dividend Yield: 3.1%

Morinaga Milk Industry's dividends have been stable and reliable over the past decade, though currently not covered by free cash flows, raising sustainability concerns. The company's payout ratio is 76.4%, indicating coverage by earnings but not cash flows. Recent guidance revisions lowered profit expectations, yet a dividend of ¥45 per share was affirmed for Q2 2024. Despite trading below fair value estimates, its yield of 3.07% lags behind top Japanese dividend payers at 3.75%.

- Click here and access our complete dividend analysis report to understand the dynamics of Morinaga Milk Industry.

- Insights from our recent valuation report point to the potential undervaluation of Morinaga Milk Industry shares in the market.

Seize The Opportunity

- Explore the 1952 names from our Top Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:UIE

UIE

Engages invests in the agro-industrial, and industrial and technology sectors in Malaysia, Indonesia, the United States, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives