Returns On Capital At Wilmar International (SGX:F34) Have Hit The Brakes

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at Wilmar International (SGX:F34) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Wilmar International:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

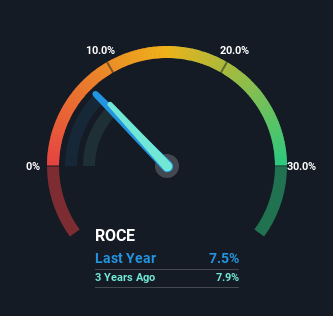

0.075 = US$2.4b ÷ (US$62b - US$30b) (Based on the trailing twelve months to December 2023).

Thus, Wilmar International has an ROCE of 7.5%. In absolute terms, that's a low return but it's around the Food industry average of 8.6%.

View our latest analysis for Wilmar International

In the above chart we have measured Wilmar International's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Wilmar International for free.

What Can We Tell From Wilmar International's ROCE Trend?

The returns on capital haven't changed much for Wilmar International in recent years. The company has employed 41% more capital in the last five years, and the returns on that capital have remained stable at 7.5%. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

Another thing to note, Wilmar International has a high ratio of current liabilities to total assets of 48%. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

The Bottom Line

In summary, Wilmar International has simply been reinvesting capital and generating the same low rate of return as before. Unsurprisingly, the stock has only gained 28% over the last five years, which potentially indicates that investors are accounting for this going forward. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

If you want to know some of the risks facing Wilmar International we've found 3 warning signs (1 is a bit concerning!) that you should be aware of before investing here.

While Wilmar International isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Wilmar International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:F34

Wilmar International

Operates as an agribusiness company in Singapore, South East Asia, the People's Republic of China, India, Europe, Australia/New Zealand, Africa, and internationally.

Fair value with moderate growth potential.