Asian Penny Stocks: Zhejiang Shibao And 2 Promising Market Contenders

Reviewed by Simply Wall St

As global markets react positively to the recent U.S.-China tariff pause, investor sentiment has been buoyed by easing trade tensions and slowing inflation. In this context, penny stocks—often representing smaller or newer companies—remain a compelling area for potential growth despite being considered a niche investment. By focusing on those with strong financial health and solid fundamentals, investors can uncover opportunities in these underappreciated stocks that may offer stability alongside significant upside potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| T.A.C. Consumer (SET:TACC) | THB4.48 | THB2.69B | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.18 | SGD35.86M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.14 | SGD8.42B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.14 | SGD861.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.87 | HK$3.23B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.42 | HK$50.6B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.20 | HK$2B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.16 | HK$1.8B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,171 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Zhejiang Shibao (SEHK:1057)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Shibao Company Limited, with a market cap of HK$9.17 billion, engages in the research, design, development, production, and sale of automotive steering systems and accessories in the People’s Republic of China.

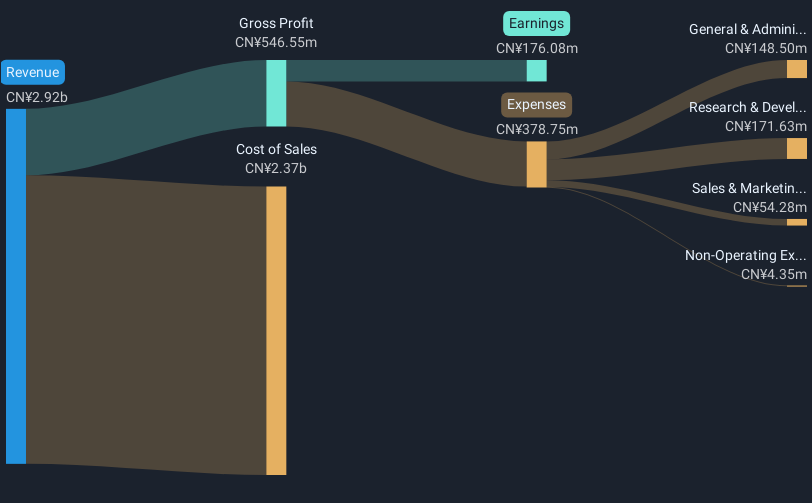

Operations: No specific revenue segments are reported for Zhejiang Shibao Company Limited.

Market Cap: HK$9.17B

Zhejiang Shibao has demonstrated strong financial performance, with earnings growing significantly by 95.8% over the past year, outpacing the Auto Components industry. The company’s debt is well-covered by operating cash flow, and it maintains more cash than total debt, indicating robust financial health. Its seasoned management and board of directors add to its stability. Despite these strengths, Zhejiang Shibao's share price has been highly volatile recently and its Return on Equity remains low at 9.8%. Recent dividend increases signal confidence in sustained profitability as evidenced by improved net profit margins from last year.

- Get an in-depth perspective on Zhejiang Shibao's performance by reading our balance sheet health report here.

- Examine Zhejiang Shibao's past performance report to understand how it has performed in prior years.

JBM (Healthcare) (SEHK:2161)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: JBM (Healthcare) Limited is an investment holding company involved in the manufacture, marketing, distribution, and sale of branded healthcare and wellness products across Hong Kong, Macau, Mainland China, and internationally with a market cap of approximately HK$2.11 billion.

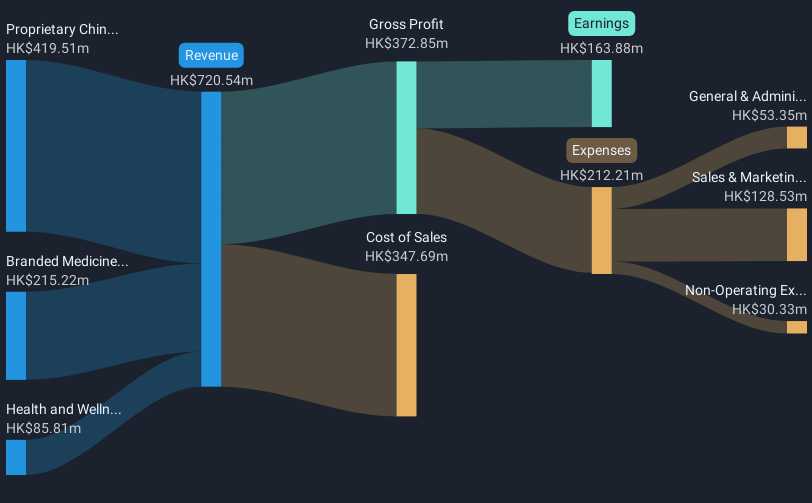

Operations: The company generates revenue from three main segments: Branded Medicines (HK$215.22 million), Health and Wellness Products (HK$85.81 million), and Proprietary Chinese Medicines (HK$419.51 million).

Market Cap: HK$2.11B

JBM (Healthcare) Limited shows promising growth potential with earnings forecasted to grow 13.27% annually. The company has demonstrated significant earnings growth of 67.2% over the past year, surpassing industry averages, and maintains high-quality past earnings. Its financial health is solid, with short-term assets exceeding liabilities and more cash than total debt, ensuring interest payments are well-covered by EBIT. Management and board members bring experience to the table, while stable weekly volatility adds a layer of predictability for investors. Despite a low Return on Equity of 16.1%, JBM trades significantly below estimated fair value, highlighting potential investment appeal in the penny stock space.

- Click here and access our complete financial health analysis report to understand the dynamics of JBM (Healthcare).

- Assess JBM (Healthcare)'s future earnings estimates with our detailed growth reports.

Food Empire Holdings (SGX:F03)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Food Empire Holdings Limited is an investment holding company that manufactures and distributes food and beverage products across Russia, Ukraine, Kazakhstan, CIS markets, South-East Asia, South Asia, and internationally with a market cap of SGD929.20 million.

Operations: The company's revenue is primarily derived from South Asia ($264.76 million), Russia ($147.23 million), Ukraine, Kazakhstan and CIS markets ($124.68 million), and South-East Asia ($83.01 million).

Market Cap: SGD929.2M

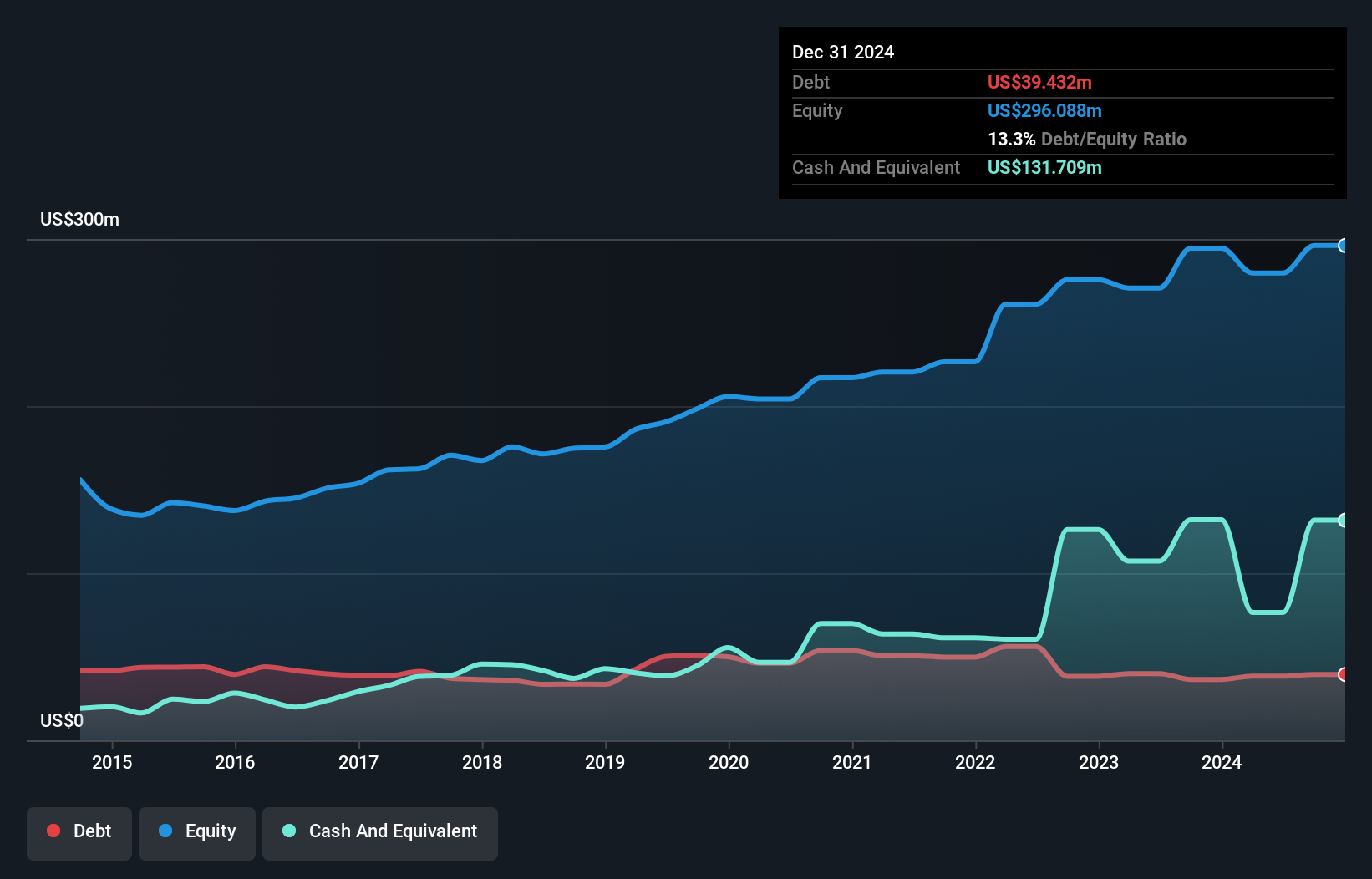

Food Empire Holdings Limited, with a market cap of SGD929.20 million, has shown resilience in its financial structure despite recent negative earnings growth. The company's short-term assets significantly exceed both its short and long-term liabilities, indicating strong liquidity. While the Return on Equity is relatively low at 17.9%, debt levels are well-managed with cash exceeding total debt and interest payments covered by EBIT multiple times over. Recent strategic moves include securing a USD10 million loan for a new manufacturing facility in Kazakhstan, expected to enhance production capabilities and export potential in Central Asia. However, dividend sustainability remains questionable as it isn't well-covered by free cash flows.

- Navigate through the intricacies of Food Empire Holdings with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Food Empire Holdings' future.

Turning Ideas Into Actions

- Explore the 1,171 names from our Asian Penny Stocks screener here.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2161

JBM (Healthcare)

An investment holding company, engages in the manufacture, marketing, distribution, and sale of branded healthcare and wellness products in Hong Kong, Macau, Mainland China, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives