- Singapore

- /

- Oil and Gas

- /

- SGX:T13

RH PetroGas' (SGX:T13) five-year earnings growth trails the 44% YoY shareholder returns

We think all investors should try to buy and hold high quality multi-year winners. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held RH PetroGas Limited (SGX:T13) shares for the last five years, while they gained 520%. If that doesn't get you thinking about long term investing, we don't know what will. It's even up 21% in the last week. This could be related to the recent financial results, released less than a week ago -- you can catch up on the most recent data by reading our company report. We love happy stories like this one. The company should be really proud of that performance!

Since it's been a strong week for RH PetroGas shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for RH PetroGas

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

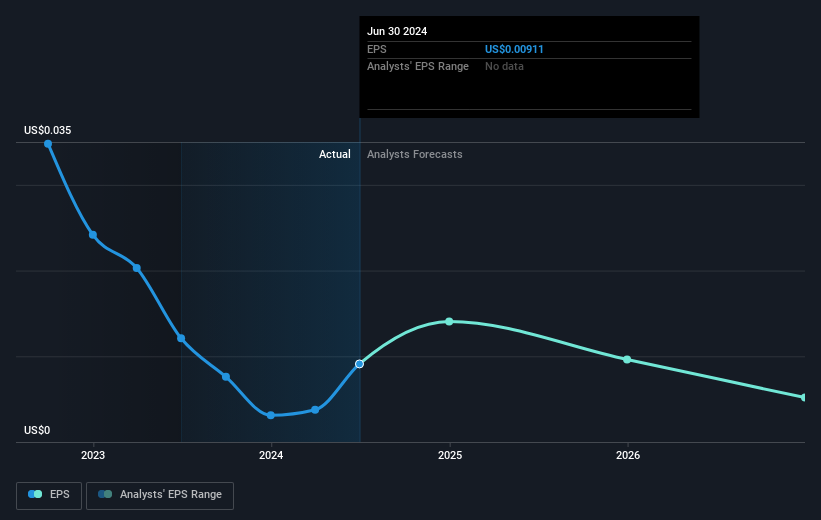

Over half a decade, RH PetroGas managed to grow its earnings per share at 29% a year. This EPS growth is lower than the 44% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on RH PetroGas' earnings, revenue and cash flow.

A Different Perspective

RH PetroGas shareholders are down 19% for the year, but the market itself is up 2.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 44% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand RH PetroGas better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for RH PetroGas you should be aware of, and 1 of them is significant.

But note: RH PetroGas may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:T13

RH PetroGas

An investment holding company, engages in the exploration, development, and production of oil and gas resources in Indonesia.

Flawless balance sheet with proven track record.