- Singapore

- /

- Energy Services

- /

- SGX:DU4

Earnings growth outpaced the impressive 191% return delivered to Mermaid Maritime (SGX:DU4) shareholders over the last year

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Mermaid Maritime Public Company Limited (SGX:DU4) share price has soared 191% return in just a single year. It's also good to see the share price up 100% over the last quarter. Looking back further, the stock price is 168% higher than it was three years ago.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Mermaid Maritime

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

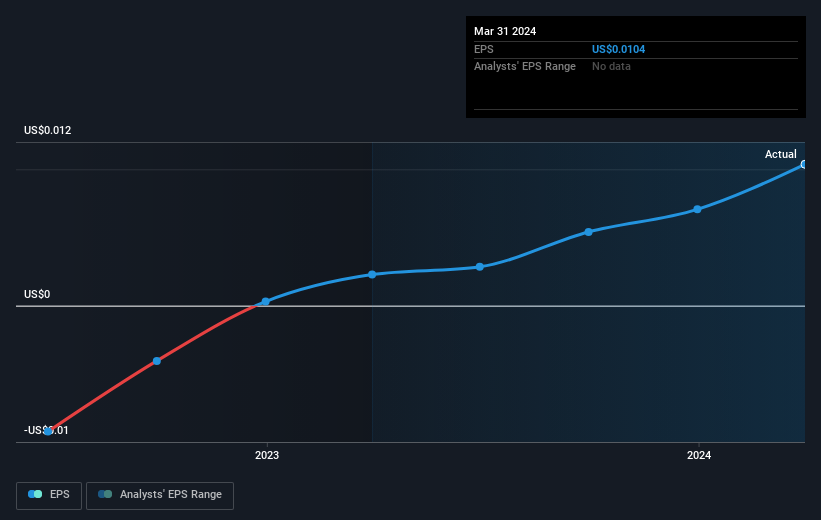

During the last year Mermaid Maritime grew its earnings per share (EPS) by 354%. This EPS growth is significantly higher than the 191% increase in the share price. Therefore, it seems the market isn't as excited about Mermaid Maritime as it was before. This could be an opportunity.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We're pleased to report that Mermaid Maritime shareholders have received a total shareholder return of 191% over one year. That's better than the annualised return of 23% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Mermaid Maritime better, we need to consider many other factors. For example, we've discovered 1 warning sign for Mermaid Maritime that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:DU4

Mermaid Maritime

Provides subsea and offshore drilling services to the offshore oil and gas industries primarily in Saudi Arabia, Thailand, the United Arab Emirates, the United Kingdom, Qatar, Vietnam, Myanmar, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives