- Singapore

- /

- Energy Services

- /

- SGX:C13

CH Offshore Ltd. (SGX:C13) Soars 29% But It's A Story Of Risk Vs Reward

Those holding CH Offshore Ltd. (SGX:C13) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 65% share price drop in the last twelve months.

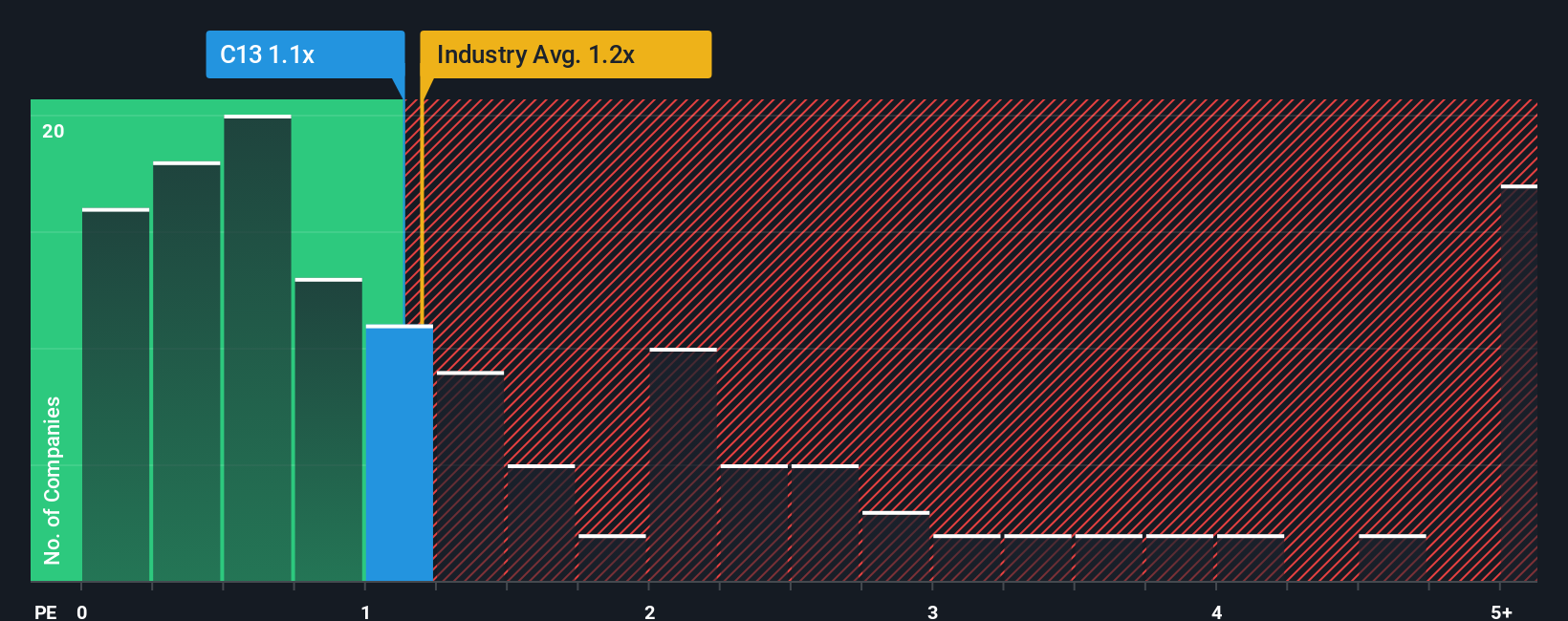

Even after such a large jump in price, it's still not a stretch to say that CH Offshore's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Energy Services industry in Singapore, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for CH Offshore

What Does CH Offshore's Recent Performance Look Like?

The revenue growth achieved at CH Offshore over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CH Offshore will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, CH Offshore would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.9% last year. This was backed up an excellent period prior to see revenue up by 69% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 9.6%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that CH Offshore is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

CH Offshore appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We didn't quite envision CH Offshore's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for CH Offshore (2 shouldn't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on CH Offshore, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:C13

CH Offshore

An investment holding company, owns and charters vessels in Singapore, Malaysia, Indonesia, Mexico, Africa, India, and Brunei.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives