- Singapore

- /

- Capital Markets

- /

- SGX:YF8

Undiscovered Gems Three Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and consumer spending concerns, small-cap stocks have faced increased volatility, highlighted by recent declines in the S&P MidCap 400 and Russell 2000 indices. In this environment of uncertainty, identifying promising small-cap companies with strong fundamentals and growth potential can be a strategic move for investors seeking to uncover undiscovered gems that may thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gallantt Ispat | 15.54% | 34.24% | 41.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Dwi Guna Laksana | 138.37% | 17.37% | -4.02% | ★★★★★★ |

| Bengal & Assam | 4.72% | -3.69% | 46.32% | ★★★★★☆ |

| Rir Power Electronics | 21.19% | 21.54% | 38.94% | ★★★★★☆ |

| Kalyani Investment | NA | 25.45% | 12.48% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Monarch Networth Capital | 8.98% | 32.34% | 49.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Yangzijiang Financial Holding (SGX:YF8)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yangzijiang Financial Holding Ltd. is an investment holding company involved in investment-related activities in China and Singapore, with a market cap of SGD2.02 billion.

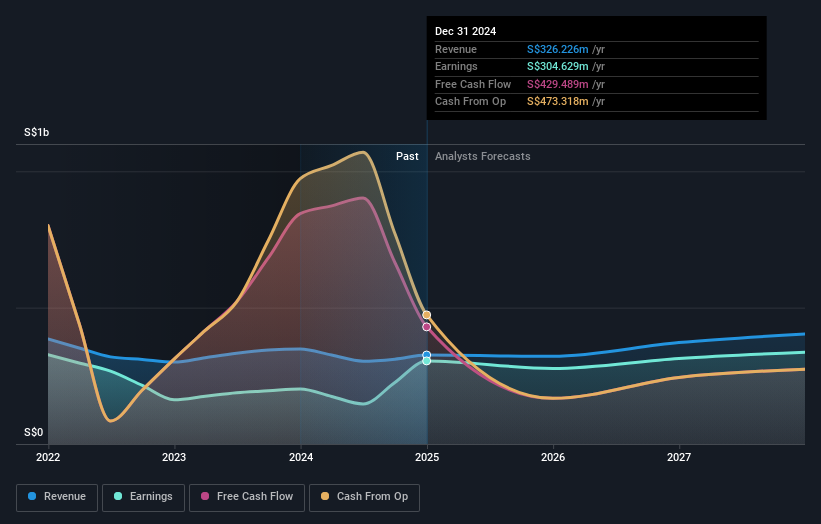

Operations: The company generates revenue primarily from its investment business, amounting to SGD326.23 million.

Yangzijiang Financial Holding, with a debt to equity ratio rising from 0% to 0.6% over five years, showcases a solid financial footing as its cash exceeds total debt. Despite earnings growth of 51% lagging behind the Capital Markets industry at 63.4%, it trades at a value 12.5% below estimated fair value, indicating potential upside. The company's EBIT covers interest payments by an impressive margin of 274 times, reflecting strong financial health. Recent results show net income climbing to SG$304 million from SG$202 million last year, highlighting robust profitability despite revenue dipping slightly to SG$326 million from SG$348 million.

Triductor Technology (Suzhou) (SHSE:688259)

Simply Wall St Value Rating: ★★★★★☆

Overview: Triductor Technology (Suzhou) Inc. is a semiconductor company that designs and provides mixed-signal integrated circuits along with related hardware and software applications, with a market cap of CN¥4.64 billion.

Operations: Triductor Technology generates revenue primarily from the sale of mixed-signal integrated circuits, supported by hardware and software applications. The company's financial performance is impacted by its cost structure, which includes expenses related to research and development, production, and distribution. Gross profit margin trends provide insight into the efficiency of its operations over time.

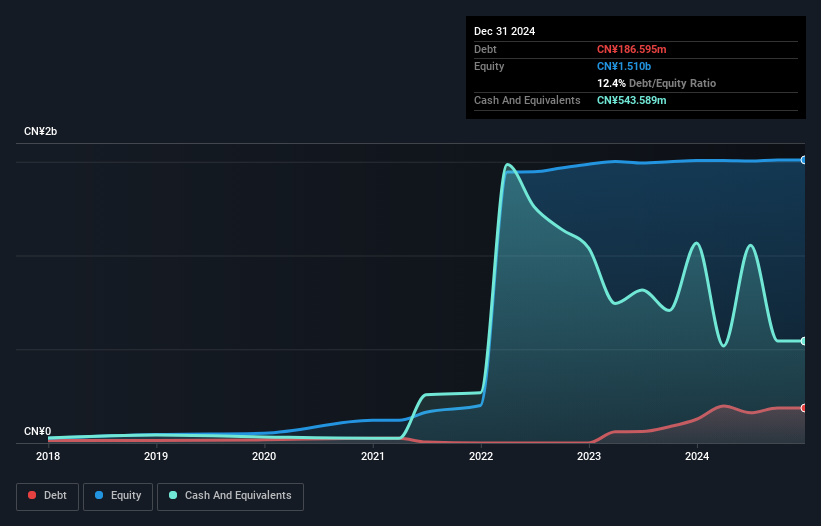

Triductor Technology, a smaller player in the semiconductor space, reported sales of CNY 592.81 million for 2024, down from CNY 661.11 million the previous year, yet net income saw a slight increase to CNY 60.24 million from CNY 58.44 million. Despite earnings declining by an average of 3% annually over five years and underperforming industry growth last year, the company boasts high-quality earnings and reduced its debt-to-equity ratio from 31.7% to 12.4%. With cash exceeding total debt and interest payments well-covered by profits, Triductor seems financially stable despite recent index exclusions impacting investor perception.

Changhong Huayi Compressor (SZSE:000404)

Simply Wall St Value Rating: ★★★★★★

Overview: Changhong Huayi Compressor Co., Ltd. engages in the research, development, manufacture, and sale of various compressors both within China and internationally, with a market capitalization of approximately CN¥5.10 billion.

Operations: The company generates revenue primarily from the sale of compressors. Its financial performance includes a net profit margin that has shown variability across different periods.

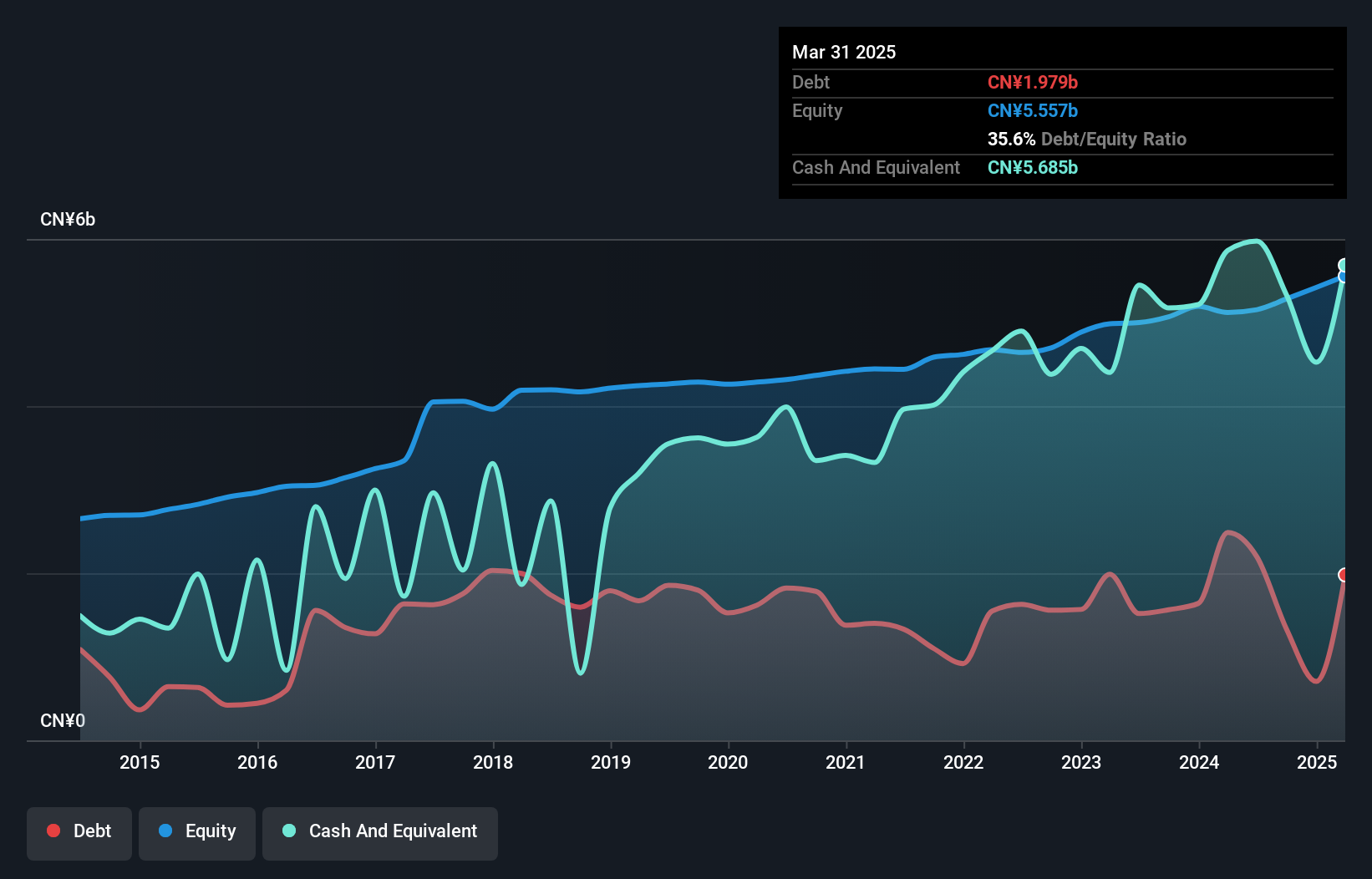

Changhong Huayi Compressor, a smaller player in the machinery sector, has shown impressive financial management with its debt to equity ratio decreasing from 41.9% to 25.1% over five years, suggesting improved financial stability. The company is trading at a significant discount of 54.9% below its estimated fair value and boasts high-quality earnings with a recent annual growth rate of 17.8%, outpacing the broader industry’s -0.4%. A recent shareholder meeting discussed strategic plans including performance incentives and potential investments in wealth management products, indicating proactive steps towards future growth opportunities and enhanced operational efficiency.

- Click here to discover the nuances of Changhong Huayi Compressor with our detailed analytical health report.

Gain insights into Changhong Huayi Compressor's past trends and performance with our Past report.

Key Takeaways

- Click here to access our complete index of 4756 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Yangzijiang Financial Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:YF8

Yangzijiang Financial Holding

An investment holding company, engages in the investment-related activities in the People's Republic of China and Singapore.

Excellent balance sheet and good value.

Market Insights

Community Narratives