- Singapore

- /

- Capital Markets

- /

- SGX:S68

Does SGX’s Liquidity Push And Nasdaq Dual-Listing Plan Reshape The Bull Case For Singapore Exchange (SGX:S68)?

Reviewed by Sasha Jovanovic

- In recent months, Singapore Exchange Ltd (SGX) has reported higher securities turnover, particularly in index stocks and REITs, while rolling out new offerings such as institutional-only crypto perpetual futures and preparing a simplified dual-listing framework with Nasdaq targeted for mid-2026.

- These moves suggest SGX is seeking to deepen market liquidity and broaden its role as a regional hub by linking global equity and digital-asset investors more closely to Singapore’s capital markets.

- We’ll now examine how SGX’s stronger trading activity and upcoming Nasdaq dual-listing bridge could influence its existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Singapore Exchange Investment Narrative Recap

To own SGX, you generally need to believe in its ability to grow as a multi asset marketplace that benefits when trading activity and listings stay healthy. The latest jump in securities turnover supports the near term catalyst of higher volumes, while the main risk remains that this strength could fade if market conditions or competitive pressures shift. Overall, the November numbers look helpful, but do not fully remove concerns about volume normalization.

The planned SGX–Nasdaq dual listing bridge, targeting mid 2026, feels particularly relevant here because it speaks directly to SGX’s effort to defend and potentially expand its role as a regional capital raising venue. If successfully executed, it could support future equity listing interest and connectivity, which matters for both liquidity and how SGX is positioned against larger regional exchanges.

Yet while trading volumes are improving, investors should still pay close attention to the risk that...

Read the full narrative on Singapore Exchange (it's free!)

Singapore Exchange's narrative projects SGD1.6 billion revenue and SGD776.8 million earnings by 2028. This requires 7.2% yearly revenue growth and an earnings increase of about SGD129 million from SGD648.0 million today.

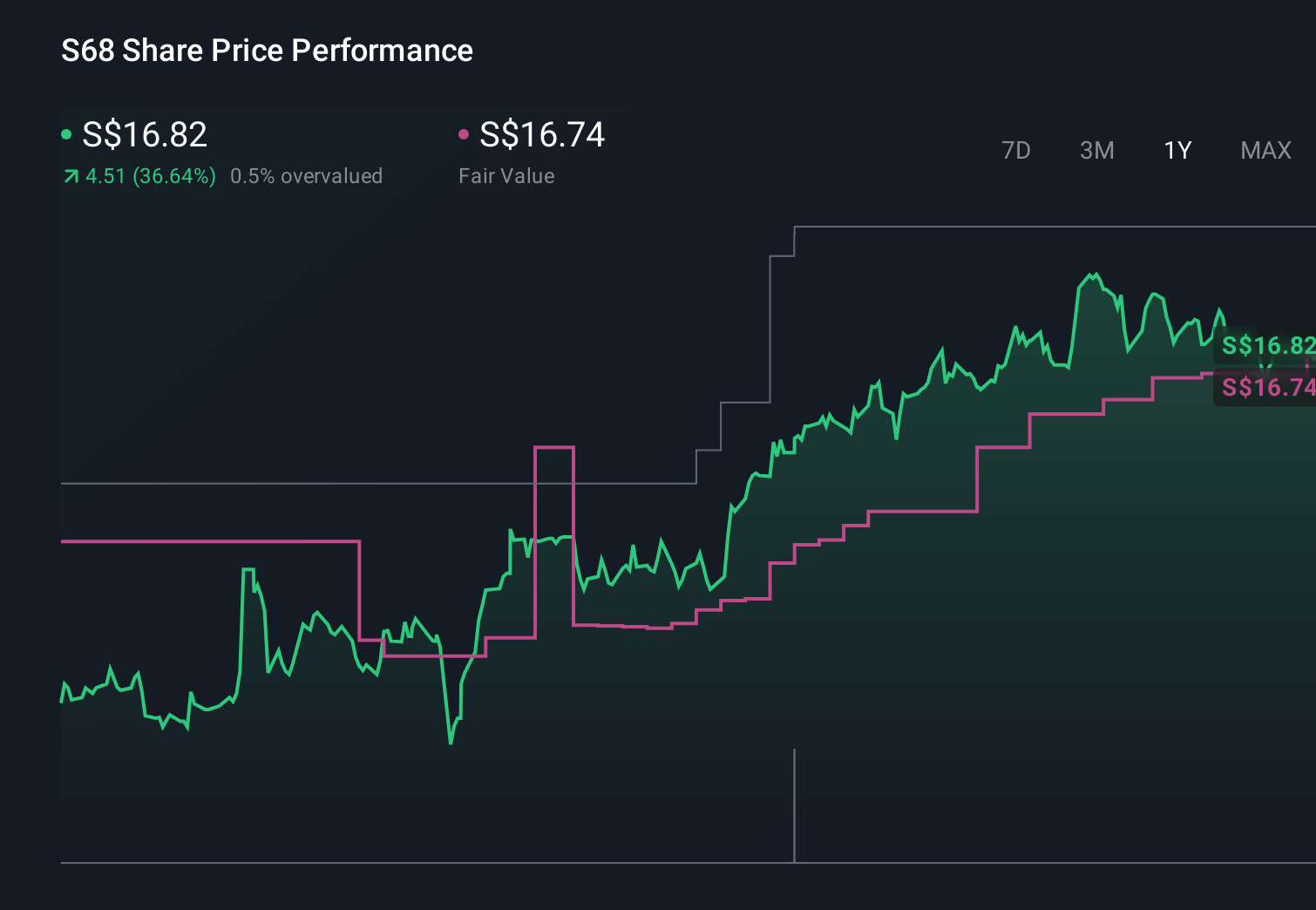

Uncover how Singapore Exchange's forecasts yield a SGD16.74 fair value, in line with its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span a wide S$8.10 to S$16.74 range, underscoring how differently SGX’s prospects are viewed. When you set that against the recent uplift in trading volumes as a key catalyst, it becomes even more important to weigh how sustainable those conditions might be for SGX’s longer term performance.

Explore 6 other fair value estimates on Singapore Exchange - why the stock might be worth less than half the current price!

Build Your Own Singapore Exchange Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Singapore Exchange research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Singapore Exchange research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Singapore Exchange's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S68

Singapore Exchange

An investment holding, engages in the operation of integrated securities and derivatives exchange, related clearing houses, and an electricity market in Singapore.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)