BII Railway Transportation Technology Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate rate cuts and shifting economic indicators, the Nasdaq Composite has reached a record high while smaller-cap indexes like the Russell 2000 continue to underperform. Against this backdrop, investors may find opportunities in penny stocks, which often represent smaller or newer companies with potential for growth. Despite their somewhat outdated name, penny stocks remain relevant as they can offer surprising value and financial strength in today's market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.065 | £783.67M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.10 | HK$45.15B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.22M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.75M | ★★★★☆☆ |

Click here to see the full list of 5,802 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

BII Railway Transportation Technology Holdings (SEHK:1522)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BII Railway Transportation Technology Holdings Company Limited is an investment holding company offering intelligent rail transit system services in the People’s Republic of China, with a market cap of approximately HK$566.23 million.

Operations: The company's revenue is derived from three main segments: Intelligent Infrastructure (HK$360.51 million), Data and Integration Services (HK$614.30 million), and Intelligent Passenger Information Services (HK$705.38 million).

Market Cap: HK$566.23M

BII Railway Transportation Technology Holdings has shown promising financial metrics, with short-term assets of HK$3.0 billion exceeding both its short and long-term liabilities, indicating strong liquidity. The company's earnings have grown by 17.8% over the past year, surpassing its five-year average growth rate of 11.5%, and outperforming industry averages. However, the recent management change could introduce some uncertainty given the board's relatively low average tenure of 2.2 years. Despite trading significantly below estimated fair value and having high-quality earnings, challenges include a dividend not covered by free cash flow and a low return on equity at 6.7%.

- Unlock comprehensive insights into our analysis of BII Railway Transportation Technology Holdings stock in this financial health report.

- Understand BII Railway Transportation Technology Holdings' track record by examining our performance history report.

CASH Financial Services Group (SEHK:510)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CASH Financial Services Group Limited is an investment holding company that operates in the online and traditional brokerage of securities, futures, and options in Hong Kong, with a market cap of HK$135.82 million.

Operations: The company generates revenue primarily from its investment management segment, amounting to HK$4.71 million.

Market Cap: HK$135.82M

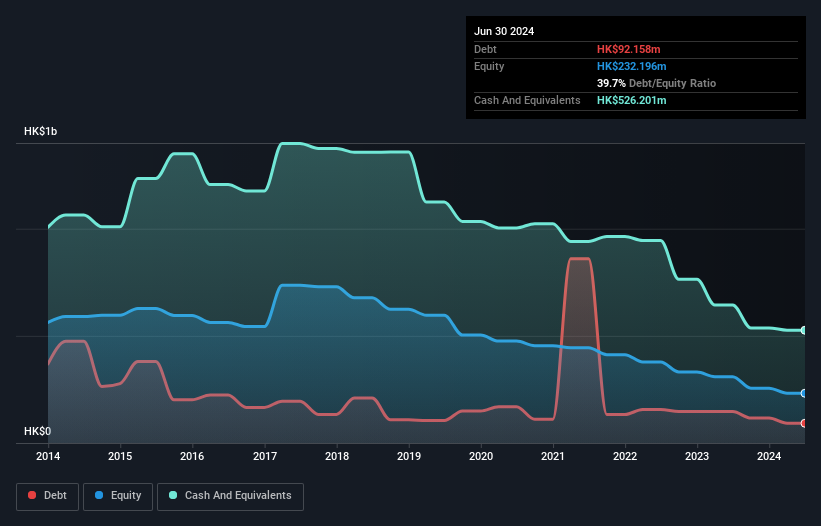

CASH Financial Services Group, while unprofitable, maintains a strong cash position with short-term assets of HK$762.2 million exceeding both short and long-term liabilities, ensuring liquidity. The company has more cash than debt and a positive free cash flow that supports a runway exceeding three years. However, it faces challenges with high volatility in share price and negative return on equity at -39.76%. Despite reducing losses over the past five years by 7.2% annually, its revenue of HK$33 million is not deemed meaningful in the context of its operations. Recent increases in debt-to-equity ratio and an inexperienced management team add to potential risks for investors.

- Get an in-depth perspective on CASH Financial Services Group's performance by reading our balance sheet health report here.

- Examine CASH Financial Services Group's past performance report to understand how it has performed in prior years.

Singapura Finance (SGX:S23)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Singapura Finance Ltd offers finance services in Singapore and has a market cap of SGD109.49 million.

Operations: The company generates revenue of SGD20.70 million from its financing business segment.

Market Cap: SGD109.49M

Singapura Finance Ltd, with a market cap of SGD109.49 million, operates in the finance sector and generates revenue of SGD20.70 million. Despite being debt-free, it faces challenges such as declining earnings growth and reduced profit margins over the past year. The dividend yield of 4.35% is not well covered by free cash flows, indicating potential sustainability issues. However, its experienced management team and board provide stability amidst these challenges. Recent leadership changes include appointing Mr. Melvin Yeo as Chief Operating Officer to enhance operational strategy and align with ESG values, potentially influencing future performance positively.

- Dive into the specifics of Singapura Finance here with our thorough balance sheet health report.

- Assess Singapura Finance's previous results with our detailed historical performance reports.

Where To Now?

- Discover the full array of 5,802 Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade BII Railway Transportation Technology Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BII Railway Transportation Technology Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1522

BII Railway Transportation Technology Holdings

An investment holding company, provides intelligent rail transit system services in the People’s Republic of China.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives