- China

- /

- Commercial Services

- /

- SHSE:603081

Asian Value Stocks Trading At Estimated Discounts In December 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape with mixed signals from major economies, Asian stock markets have shown resilience, buoyed by optimism in technology and AI sectors despite broader economic uncertainties. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities at estimated discounts; these stocks often possess strong fundamentals and potential for growth that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥156.00 | CN¥303.70 | 48.6% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥82.62 | CN¥162.30 | 49.1% |

| STI (KOSDAQ:A039440) | ₩25900.00 | ₩51536.57 | 49.7% |

| Nippon Thompson (TSE:6480) | ¥720.00 | ¥1399.87 | 48.6% |

| Morimatsu International Holdings (SEHK:2155) | HK$8.08 | HK$16.11 | 49.8% |

| Meitu (SEHK:1357) | HK$7.29 | HK$14.56 | 49.9% |

| Japan Eyewear Holdings (TSE:5889) | ¥1931.00 | ¥3851.42 | 49.9% |

| H.U. Group Holdings (TSE:4544) | ¥3397.00 | ¥6592.59 | 48.5% |

| China Ruyi Holdings (SEHK:136) | HK$2.41 | HK$4.82 | 50% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥27.31 | CN¥53.35 | 48.8% |

Let's review some notable picks from our screened stocks.

HAESUNG DS (KOSE:A195870)

Overview: HAESUNG DS Co., Ltd. manufactures and sells semiconductor components both in South Korea and internationally, with a market cap of ₩919.70 billion.

Operations: The company's revenue segments include the manufacture and sale of semiconductor components both domestically and internationally.

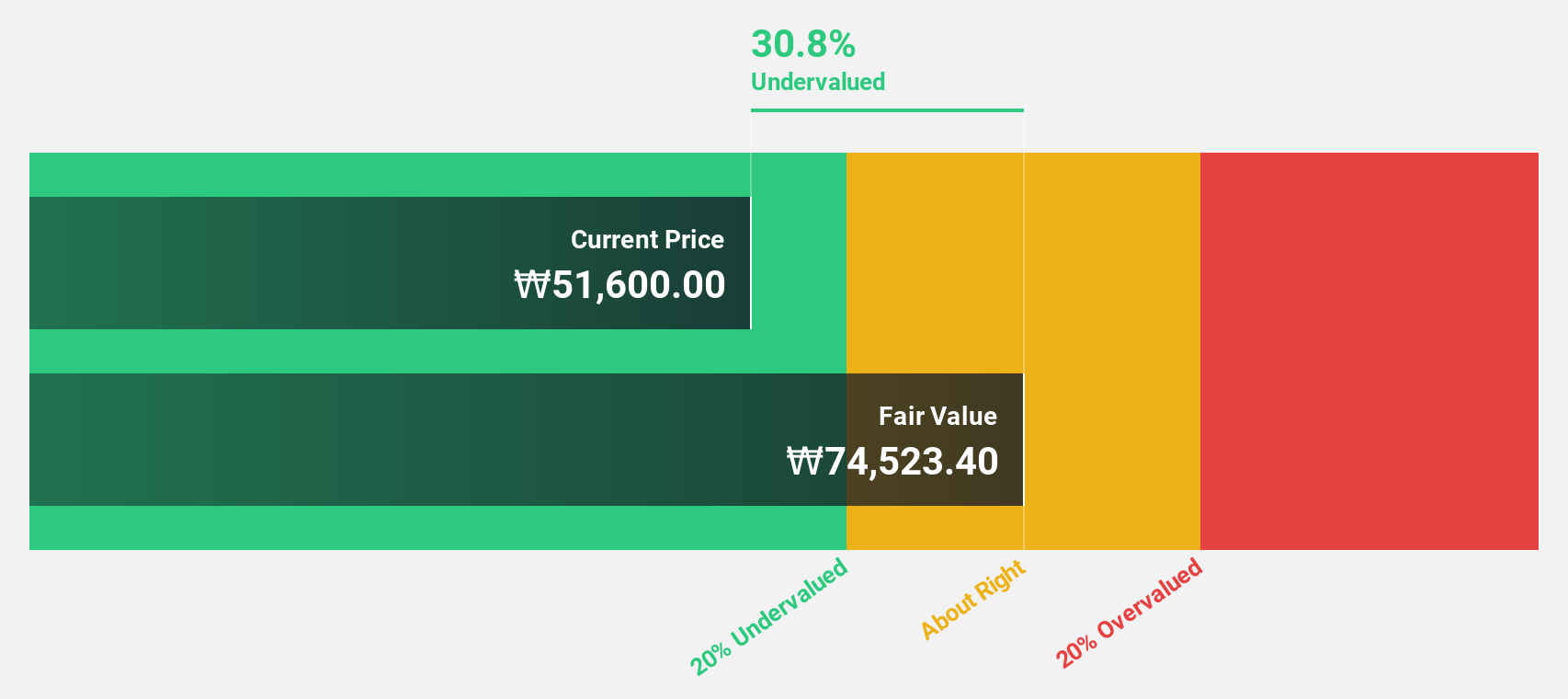

Estimated Discount To Fair Value: 20.7%

HAESUNG DS is trading at ₩54,100, approximately 20.7% below its estimated fair value of ₩68,183.14. Despite a volatile share price recently, the company shows promising earnings growth prospects at 53.34% annually over the next three years, outpacing the Korean market's average of 28.5%. However, its profit margins have declined from 9.5% to 4.3%, and its dividend yield of 1.48% is not well covered by free cash flows.

- Our earnings growth report unveils the potential for significant increases in HAESUNG DS' future results.

- Navigate through the intricacies of HAESUNG DS with our comprehensive financial health report here.

iFAST (SGX:AIY)

Overview: iFAST Corporation Ltd. operates as a digital banking and wealth management platform across Singapore, Hong Kong, Malaysia, China, and the United Kingdom with a market cap of SGD2.78 billion.

Operations: The company's revenue segments (in millions of SGD) are as follows: Wealth Management Platform - 213.45, Banking Services - 158.67, and Financial Advisory - 97.32.

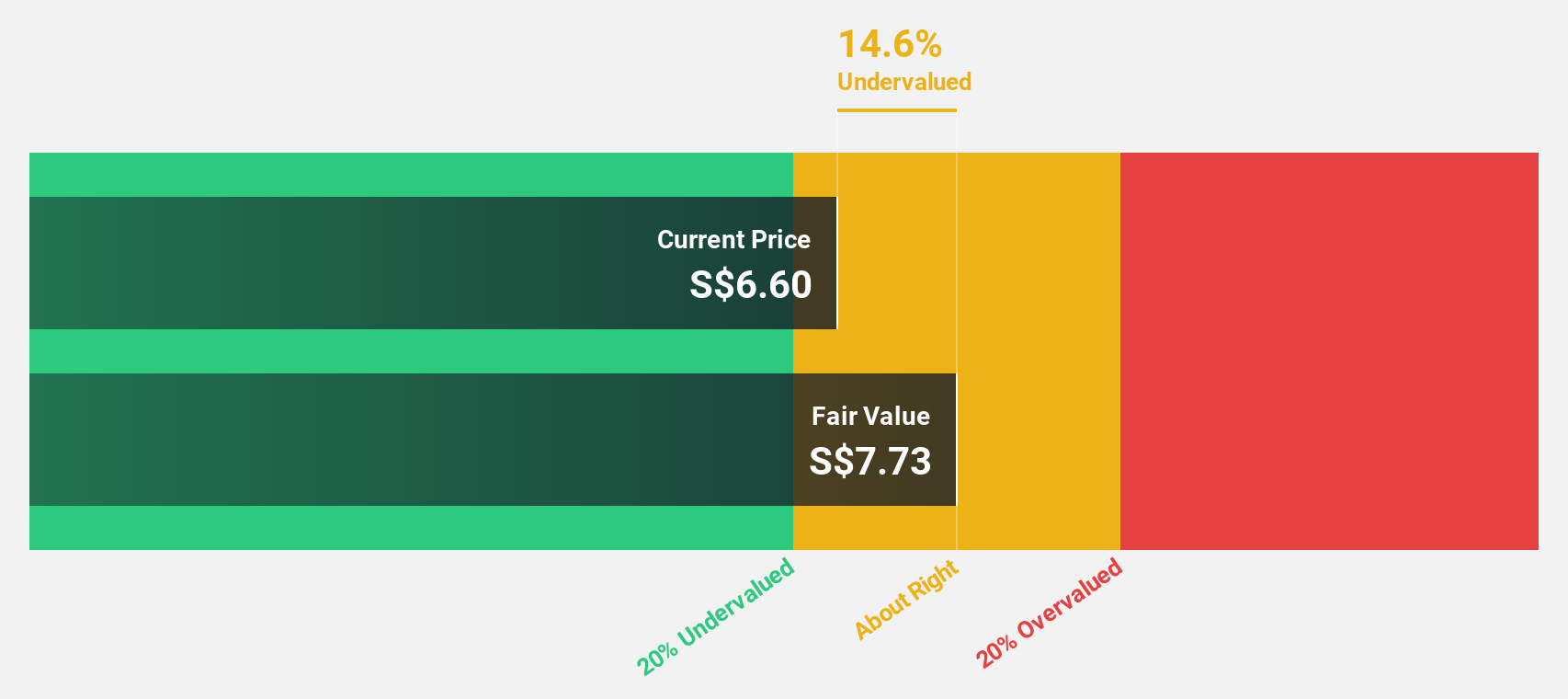

Estimated Discount To Fair Value: 12.5%

iFAST Corporation Ltd. trades at S$9.15, about 12.5% below its fair value of S$10.46, reflecting potential undervaluation based on cash flows despite not being significantly below fair value. Recent earnings growth is robust, with Q3 net income rising to S$26.01 million from S$16.81 million the previous year, and earnings are forecast to grow significantly over the next three years at 21.4% annually, surpassing Singapore's market average of 7.5%.

- The analysis detailed in our iFAST growth report hints at robust future financial performance.

- Click here to discover the nuances of iFAST with our detailed financial health report.

Zhejiang Dafeng Industry (SHSE:603081)

Overview: Zhejiang Dafeng Industry Co., Ltd operates in the smart stage, lighting, sound, decoration, seating, and construction fields both in China and internationally with a market cap of CN¥5.51 billion.

Operations: The company's revenue segments include smart stage, lighting, sound, decoration, seating, and construction services in both domestic and international markets.

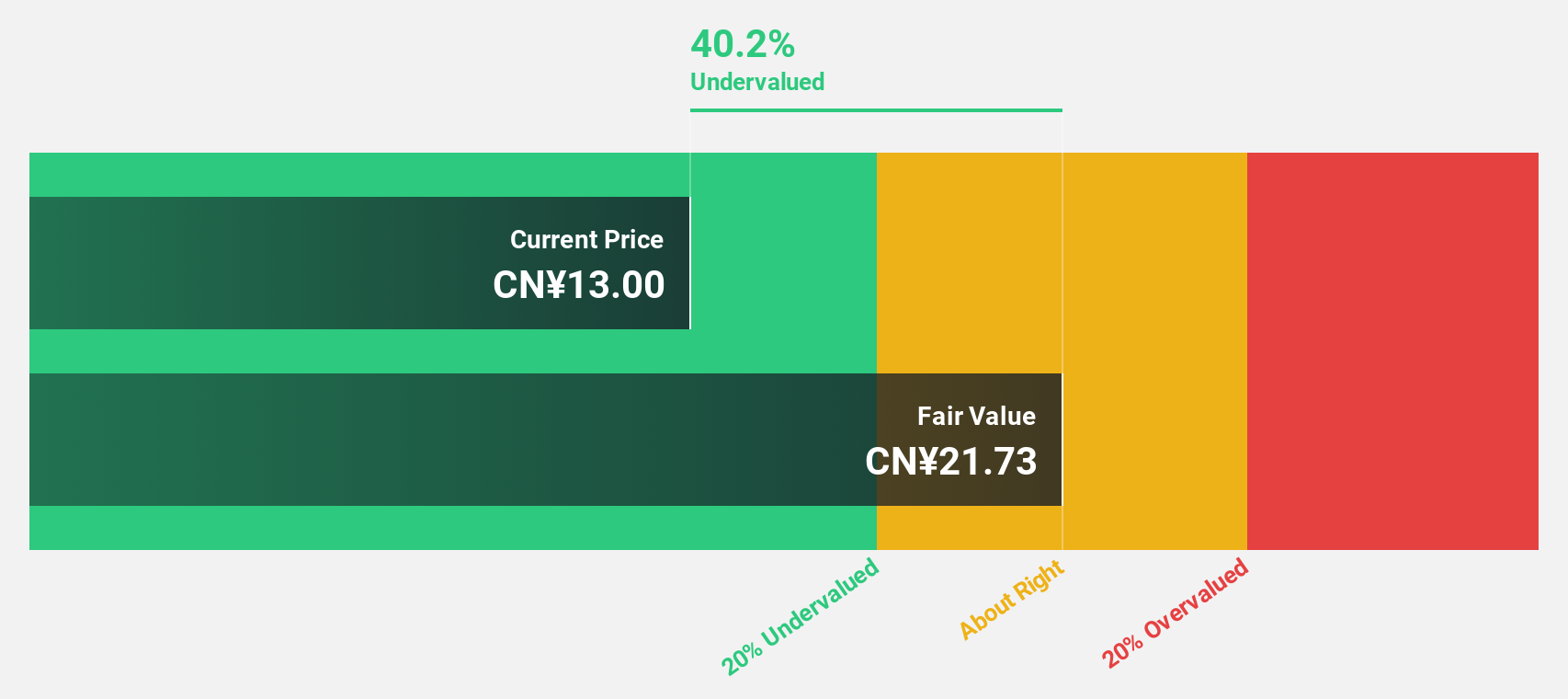

Estimated Discount To Fair Value: 40%

Zhejiang Dafeng Industry, trading at CN¥13.04, is significantly undervalued with a fair value estimate of CN¥21.74, suggesting a 40% discount based on cash flow analysis. The company reported strong earnings growth for the first nine months of 2025, with net income rising to CN¥92.08 million from CN¥52.61 million year-on-year. Despite an unstable dividend history and concerns about debt coverage by operating cash flow, earnings are expected to grow substantially above market averages over the next three years.

- Insights from our recent growth report point to a promising forecast for Zhejiang Dafeng Industry's business outlook.

- Take a closer look at Zhejiang Dafeng Industry's balance sheet health here in our report.

Make It Happen

- Investigate our full lineup of 270 Undervalued Asian Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Dafeng Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603081

Zhejiang Dafeng Industry

Operates in the smart stage, lighting, sound, decoration, seating, and construction fields in China and internationally.

High growth potential with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026