- Singapore

- /

- Hospitality

- /

- SGX:M04

The three-year earnings decline has likely contributed toMandarin Oriental International's (SGX:M04) shareholders losses of 17% over that period

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Mandarin Oriental International Limited (SGX:M04) shareholders have had that experience, with the share price dropping 22% in three years, versus a market decline of about 17%. Unfortunately the share price momentum is still quite negative, with prices down 10% in thirty days.

Since Mandarin Oriental International has shed US$177m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Because Mandarin Oriental International made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Mandarin Oriental International saw its revenue grow by 15% per year, compound. That's a pretty good rate of top-line growth. Shareholders have endured a share price decline of 7% per year. This implies the market had higher expectations of Mandarin Oriental International. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

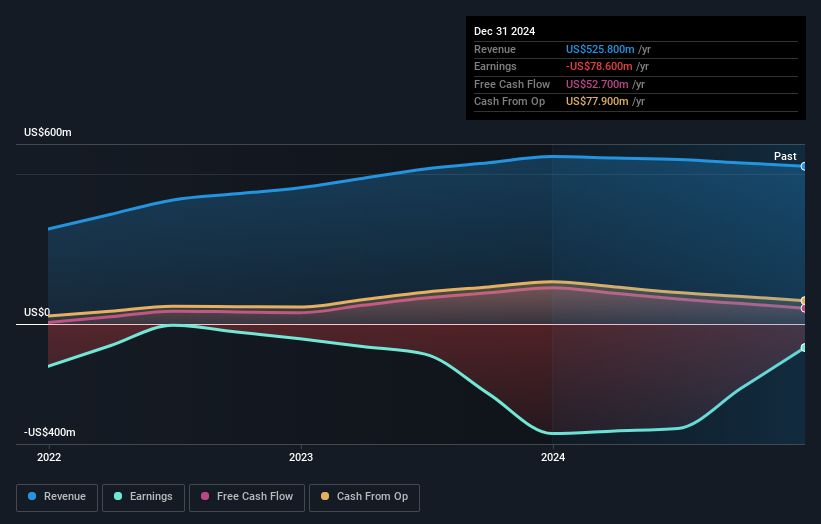

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic .

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Mandarin Oriental International the TSR over the last 3 years was -17%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 21% in the last year, Mandarin Oriental International shareholders lost 0.7% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 5%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Mandarin Oriental International better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Mandarin Oriental International you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:M04

Mandarin Oriental International

Engages in the ownership and operation of hotels, resorts, and residences in Asia, Europe, the Middle East, Africa, and the Americas.

Excellent balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives