- Singapore

- /

- Hospitality

- /

- SGX:H18

CNMC Goldmine Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating interest rates and geopolitical tensions, investors are closely watching for opportunities amid the volatility. Penny stocks, often representing smaller or newer companies, continue to capture attention despite being seen as a niche area in today's market. These stocks can offer intriguing prospects when backed by strong financial health and potential for growth. In this article, we examine three penny stocks that may provide both stability and opportunity in the current economic climate.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.08B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$143.12M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.75 | £178.85M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.40 | £83.91M | ★★★★☆☆ |

| Starflex (SET:SFLEX) | THB2.82 | THB2.19B | ★★★★☆☆ |

Click here to see the full list of 5,713 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

CNMC Goldmine Holdings (Catalist:5TP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CNMC Goldmine Holdings Limited is an investment holding company involved in the exploration, processing, and mining of gold and mined ores in Malaysia, with a market cap of SGD119.56 million.

Operations: The company generates revenue primarily from its mining operations, amounting to $55.62 million.

Market Cap: SGD119.56M

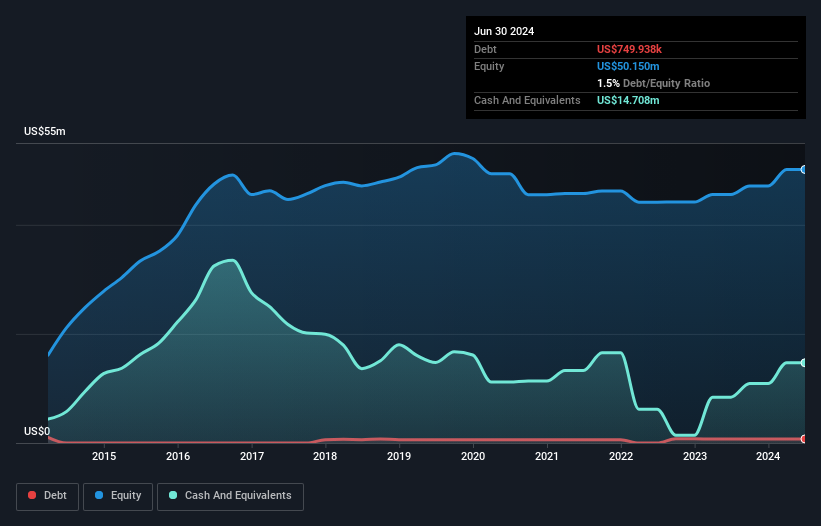

CNMC Goldmine Holdings has demonstrated robust earnings growth, with a 292% increase over the past year, surpassing industry averages. The company's short-term assets of $22.9M comfortably cover both its short and long-term liabilities, reflecting strong financial health. Despite a low Return on Equity of 16.9%, CNMC maintains high-quality earnings and stable weekly volatility at 5%. Recent guidance indicates significant profit improvement for 2024, driven by increased sales of gold and other concentrates. Additionally, CNMC's experienced management team and board contribute to its operational stability without shareholder dilution in the past year.

- Take a closer look at CNMC Goldmine Holdings' potential here in our financial health report.

- Examine CNMC Goldmine Holdings' past performance report to understand how it has performed in prior years.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC operates and invests in education services within the United Arab Emirates, with a market cap of AED4.23 billion.

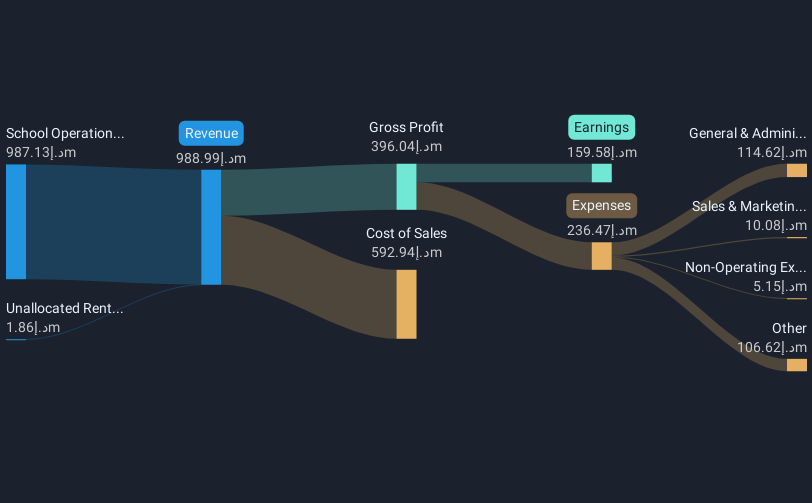

Operations: The company's revenue primarily comes from school operations, which generated AED987.13 million.

Market Cap: AED4.23B

Taaleem Holdings PJSC has shown solid financial performance, with recent earnings growth of 41.1% surpassing industry averages. The company's strong management team and experienced board support its operational stability. Short-term assets of AED733.9 million exceed short-term liabilities, though they fall short against long-term liabilities. Taaleem's debt is well-covered by operating cash flow, and it maintains more cash than total debt, indicating prudent financial management despite an increased debt-to-equity ratio over five years. The company reported net income growth to AED68.2 million for the recent quarter, with improved profit margins from the previous year without shareholder dilution concerns.

- Unlock comprehensive insights into our analysis of Taaleem Holdings PJSC stock in this financial health report.

- Gain insights into Taaleem Holdings PJSC's future direction by reviewing our growth report.

Hotel Grand Central (SGX:H18)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hotel Grand Central Limited, with a market cap of SGD528.69 million, owns, operates, and manages hotels across Singapore, Malaysia, Australia, New Zealand, and China.

Operations: The company's revenue is primarily derived from hotel operations at SGD132.77 million, supplemented by commercial property investments generating SGD11.46 million.

Market Cap: SGD528.69M

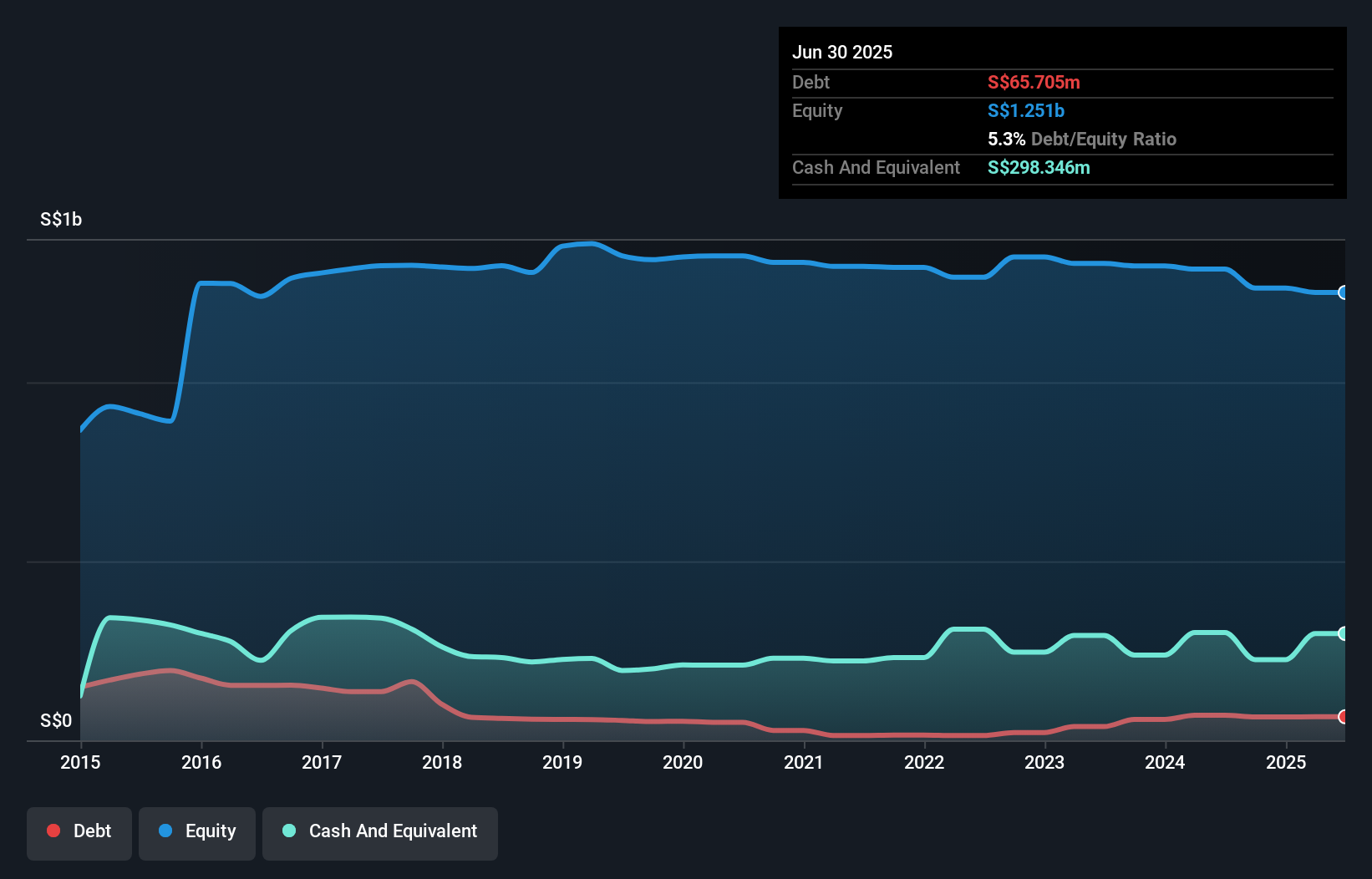

Hotel Grand Central Limited has demonstrated an improvement in net profit margins, rising from 3.8% to 6.2% over the past year, with earnings growth of 52.4%, surpassing both its historical performance and industry averages. Despite a low return on equity at 0.7%, the company maintains financial stability with more cash than total debt and strong short-term asset coverage of liabilities (SGD309.4M vs SGD89.9M). However, a significant one-off loss of SGD7.9 million impacted recent results, and its dividend yield is not well covered by earnings or free cash flows, suggesting caution for income-focused investors.

- Get an in-depth perspective on Hotel Grand Central's performance by reading our balance sheet health report here.

- Explore historical data to track Hotel Grand Central's performance over time in our past results report.

Key Takeaways

- Click this link to deep-dive into the 5,713 companies within our Penny Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hotel Grand Central might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H18

Hotel Grand Central

Owns, operates, and manages hotels in Singapore, Malaysia, Australia, New Zealand, and China.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives