- Singapore

- /

- Capital Markets

- /

- SGX:S68

Top 3 SGX Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

The Singapore market has been navigating a dynamic landscape, influenced by global economic shifts and evolving investment trends. In this context, dividend stocks have emerged as a reliable option for investors seeking steady income and portfolio stability. A good dividend stock not only offers consistent payouts but also demonstrates resilience amidst market fluctuations, making it an attractive choice in today's environment.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.08% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.75% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.07% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.06% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.56% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.13% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.34% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.80% | ★★★★☆☆ |

| Delfi (SGX:P34) | 7.12% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multi-Chem Limited, an investment holding company with a market cap of SGD248.66 million, distributes information technology products in Singapore, Greater China, Australia, India, and internationally.

Operations: Multi-Chem Limited generates revenue from various segments including SGD407.17 million from Singapore - IT Business, SGD135.87 million from Others - IT Business, SGD54.17 million from India - IT Business, SGD50.04 million from Australia - IT Business, and SGD1.69 million from Singapore - PCB Business.

Dividend Yield: 9.6%

Multi-Chem offers a mixed dividend profile. While its recent interim tax-exempt dividend of 11.10 Singapore cents per share and earnings growth (SGD 16.42 million net income for H1 2024) are positives, its high cash payout ratio (1054.3%) indicates dividends are not well covered by free cash flows. Despite a reasonable payout ratio (74.6%), the company’s dividends have been volatile over the past decade, raising concerns about long-term reliability and sustainability for investors seeking stable income streams.

- Unlock comprehensive insights into our analysis of Multi-Chem stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Multi-Chem is priced higher than what may be justified by its financials.

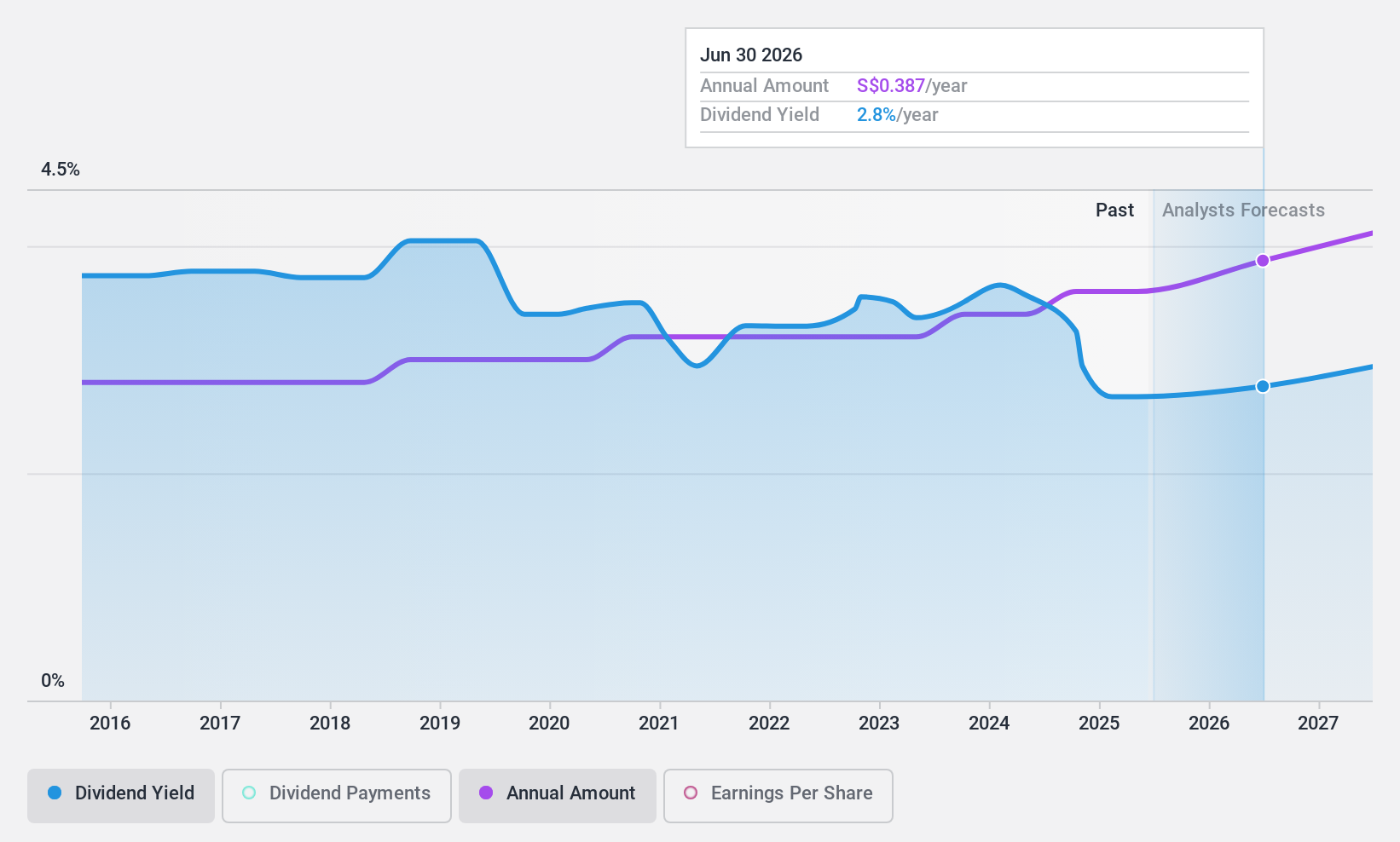

Sheng Siong Group (SGX:OV8)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd, with a market cap of SGD2.26 billion, operates a chain of supermarket retail stores in Singapore.

Operations: Sheng Siong Group Ltd generates revenue primarily through its supermarket operations, selling consumer goods amounting to SGD1.39 billion.

Dividend Yield: 4.2%

Sheng Siong Group has shown steady earnings growth, with net income rising to S$69.91 million for H1 2024. The company declared a recent cash dividend of S$0.032 per share. However, its dividend yield (4.17%) is lower than the top quartile in Singapore's market, and past volatility raises concerns about reliability despite a reasonable payout ratio (69.6%). Dividends are well-covered by both earnings and free cash flows, suggesting sustainability in the near term.

- Click to explore a detailed breakdown of our findings in Sheng Siong Group's dividend report.

- Our expertly prepared valuation report Sheng Siong Group implies its share price may be lower than expected.

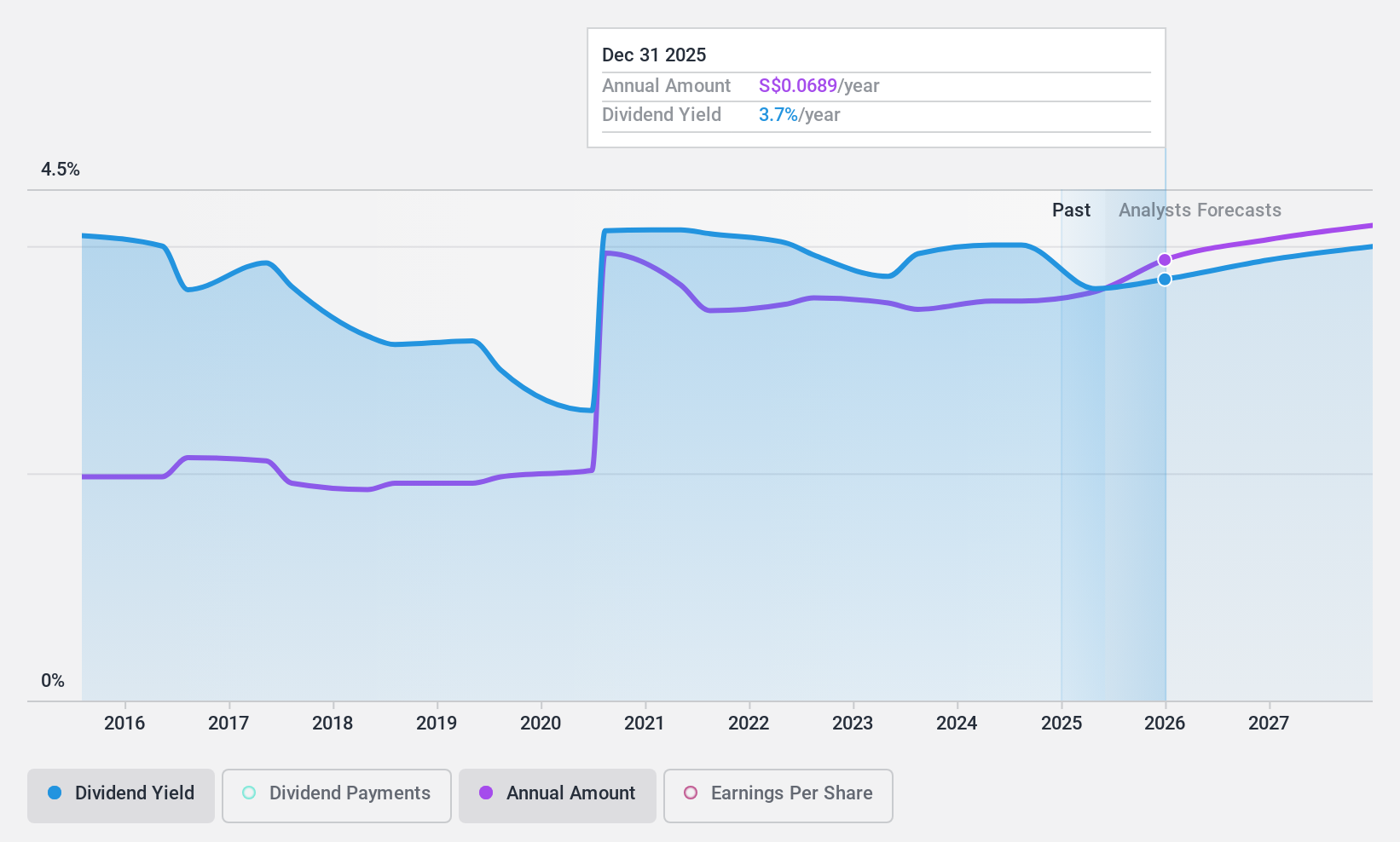

Singapore Exchange (SGX:S68)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited operates an integrated securities and derivatives exchange, related clearing houses, and an electricity market in Singapore, with a market cap of SGD12.06 billion.

Operations: Singapore Exchange Limited generates revenue from four primary segments: Equities - Cash (SGD334.94 million), Platform and Others (SGD240.20 million), Equities - Derivatives (SGD334.05 million), and Fixed Income, Currencies, and Commodities (SGD322.50 million).

Dividend Yield: 3.1%

Singapore Exchange's dividend payments are well-covered by earnings (payout ratio: 61.7%) and free cash flows (cash payout ratio: 70%). The company has a history of stable and growing dividends over the past decade, although its yield (3.06%) is lower than the top quartile in Singapore's market. Recent earnings for FY2024 showed revenue at S$1.23 billion and net income at S$597.91 million, indicating consistent profitability supporting its dividend policy.

- Get an in-depth perspective on Singapore Exchange's performance by reading our dividend report here.

- The analysis detailed in our Singapore Exchange valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Embark on your investment journey to our 19 Top SGX Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S68

Singapore Exchange

An investment holding, engages in the operation of integrated securities and derivatives exchange, related clearing houses, and an electricity market in Singapore.

Excellent balance sheet established dividend payer.