Asian Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by economic uncertainties and shifting monetary policies, Asian stock markets have shown resilience, with China's consumer sector poised for growth amid the Golden Week holiday. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.69 | 49.7% |

| Teikoku Sen-i (TSE:3302) | ¥3380.00 | ¥6752.89 | 49.9% |

| SRE Holdings (TSE:2980) | ¥3205.00 | ¥6371.11 | 49.7% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.29 | 49.8% |

| Samyang Foods (KOSE:A003230) | ₩1509000.00 | ₩3006664.22 | 49.8% |

| Malee Group (SET:MALEE) | THB5.55 | THB11.01 | 49.6% |

| Kuraray (TSE:3405) | ¥1762.50 | ¥3479.49 | 49.3% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.80 | CN¥79.42 | 49.9% |

| Devsisters (KOSDAQ:A194480) | ₩48200.00 | ₩95869.93 | 49.7% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.87 | ₱7.66 | 49.5% |

Here we highlight a subset of our preferred stocks from the screener.

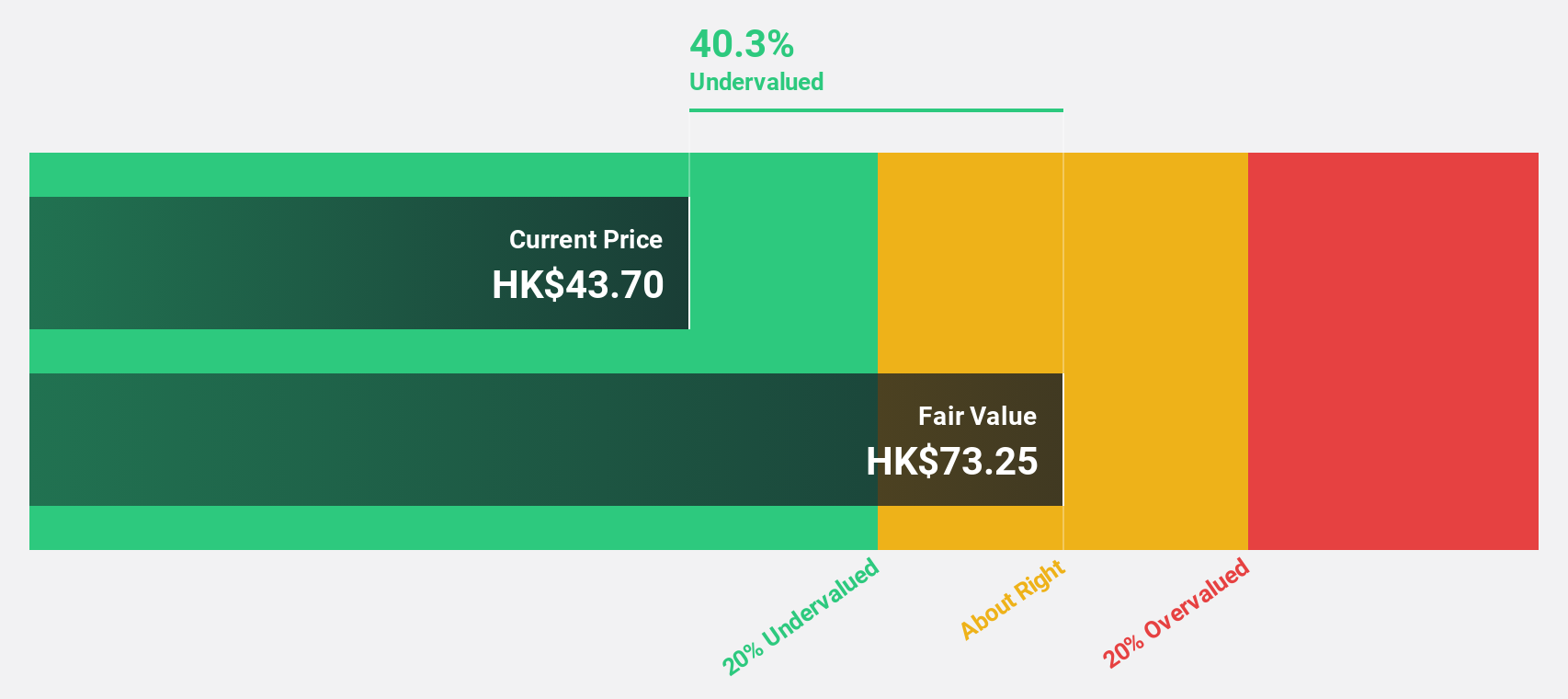

Yangtze Optical Fibre And Cable Limited (SEHK:6869)

Overview: Yangtze Optical Fibre And Cable Joint Stock Limited Company produces and sells optical fiber preforms, optical fibers, optical fiber cables, and integrated solutions both in China and internationally, with a market cap of HK$62.31 billion.

Operations: Yangtze Optical Fibre And Cable Limited generates revenue through the production and sale of optical fiber preforms, optical fibers, optical fiber cables, and integrated solutions across domestic and international markets.

Estimated Discount To Fair Value: 33.1%

Yangtze Optical Fibre And Cable Limited is trading at HK$49.84, significantly below its estimated fair value of HK$74.48, indicating it may be undervalued based on cash flows. Despite a volatile share price and declining profit margins from 9.1% to 4.5%, the company reported increased revenue of CNY 6,384.47 million for H1 2025 compared to last year and forecasts suggest significant earnings growth of 37.5% annually over the next three years, outpacing market expectations.

- Our earnings growth report unveils the potential for significant increases in Yangtze Optical Fibre And Cable Limited's future results.

- Click to explore a detailed breakdown of our findings in Yangtze Optical Fibre And Cable Limited's balance sheet health report.

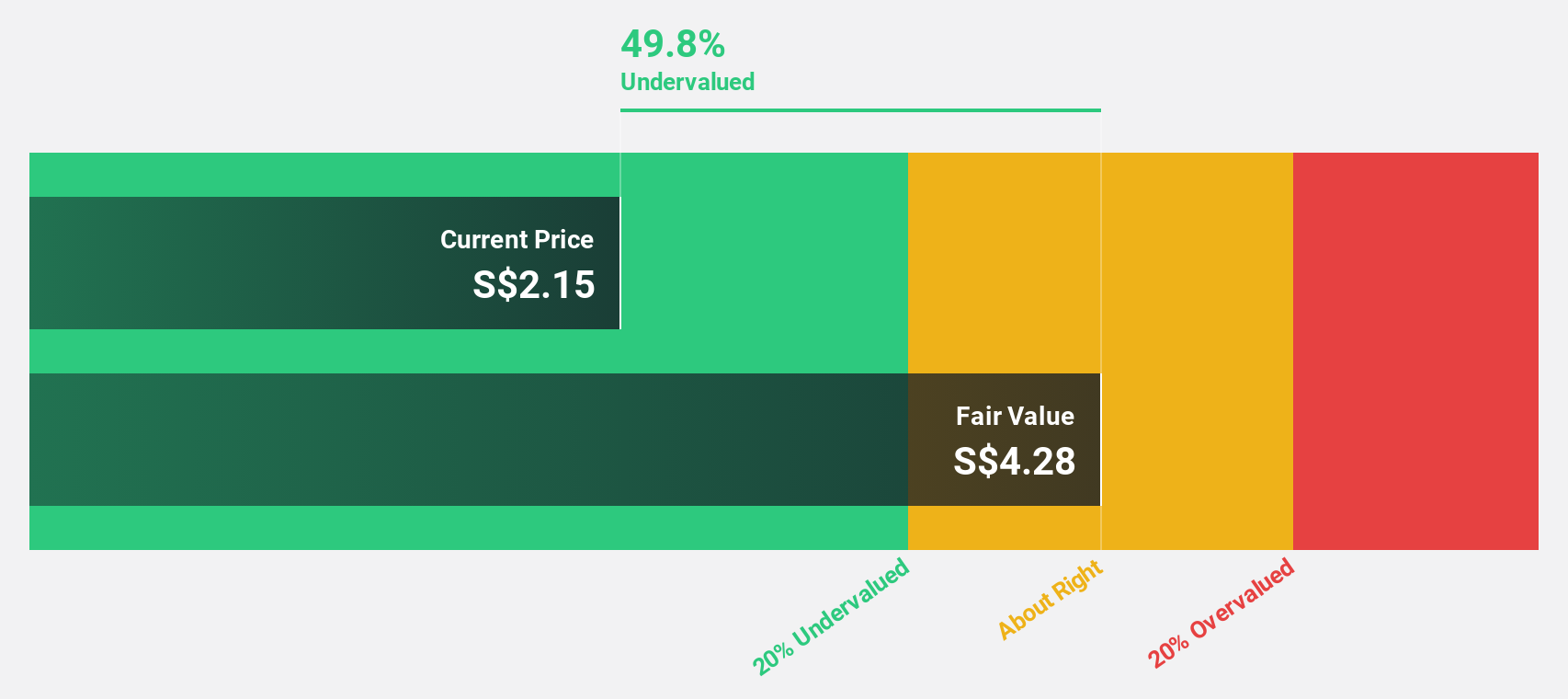

Sheng Siong Group (SGX:OV8)

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market cap of SGD3.23 billion.

Operations: The company's revenue primarily comes from its supermarket operations, selling consumer goods, amounting to SGD1.48 billion.

Estimated Discount To Fair Value: 49.8%

Sheng Siong Group is trading at SGD 2.15, significantly below its estimated fair value of SGD 4.29, highlighting potential undervaluation based on cash flows. The company reported H1 2025 sales of SGD 764.68 million and net income of SGD 72.35 million, both up from the previous year. Earnings are forecast to grow at 7.8% annually, surpassing the Singapore market's average growth rate, although dividend sustainability remains uncertain due to an unstable track record.

- Our growth report here indicates Sheng Siong Group may be poised for an improving outlook.

- Dive into the specifics of Sheng Siong Group here with our thorough financial health report.

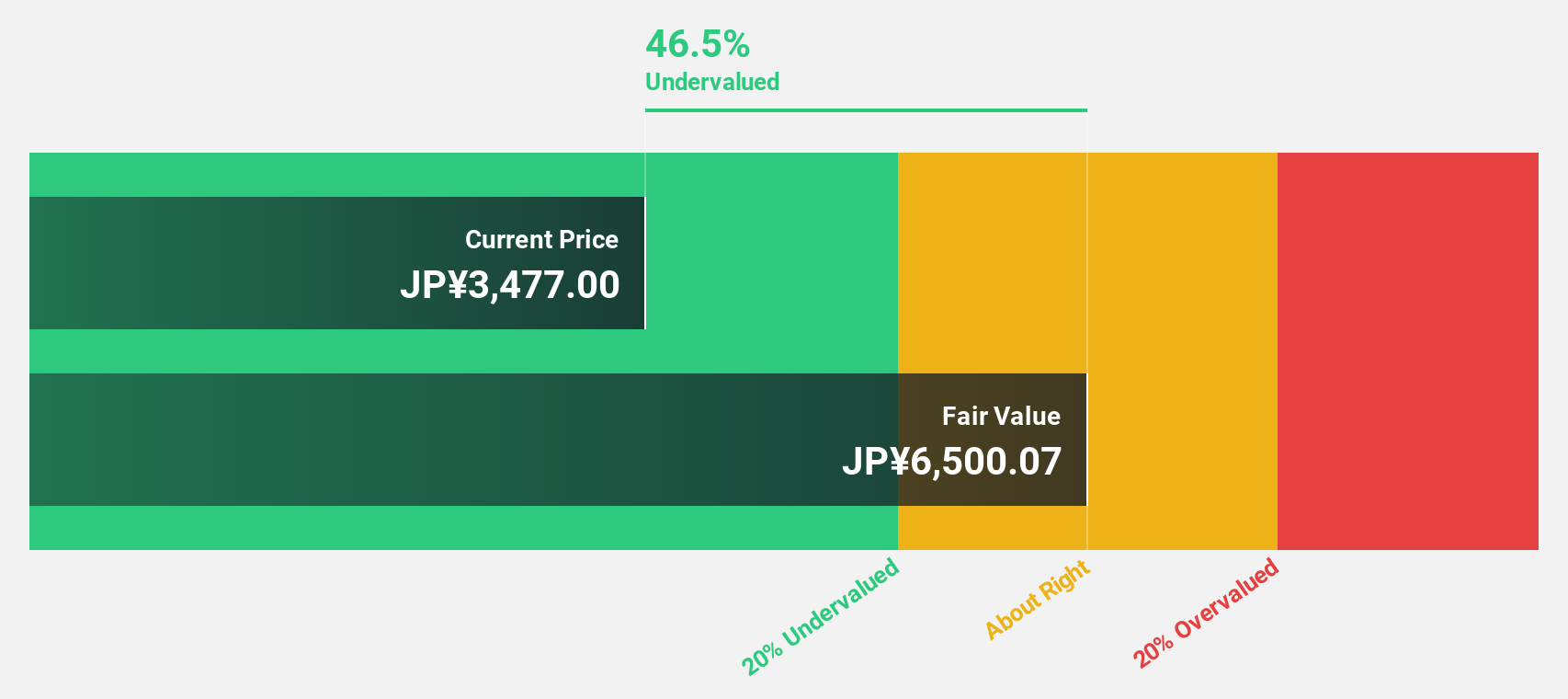

Daiichi Sankyo Company (TSE:4568)

Overview: Daiichi Sankyo Company, Limited is a pharmaceutical manufacturer and seller with operations in Japan, North America, Europe, and internationally, holding a market cap of approximately ¥7.41 trillion.

Operations: The company's revenue primarily stems from its Pharmaceutical Operation segment, which generated approximately ¥1.92 billion.

Estimated Discount To Fair Value: 36.5%

Daiichi Sankyo, trading at ¥4001, is notably undervalued with a fair value estimate of ¥6296.94 based on cash flows. Despite high share price volatility, its earnings are projected to grow by 12.38% annually, outpacing the Japanese market's average growth rate. Recent collaborations and product developments in oncology enhance its growth prospects. However, its dividend yield of 1.95% isn't fully supported by free cash flows, indicating potential sustainability concerns for income-focused investors.

- According our earnings growth report, there's an indication that Daiichi Sankyo Company might be ready to expand.

- Click here to discover the nuances of Daiichi Sankyo Company with our detailed financial health report.

Summing It All Up

- Click through to start exploring the rest of the 279 Undervalued Asian Stocks Based On Cash Flows now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4568

Daiichi Sankyo Company

Manufactures and sells pharmaceutical products in Japan, the United States, Europe, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.