- Singapore

- /

- Food and Staples Retail

- /

- SGX:OV8

3 Promising Penny Stocks With Market Caps Below US$2B

Reviewed by Simply Wall St

As global markets navigate through a period of volatility marked by AI competition fears and fluctuating interest rates, investors are seeking opportunities that balance risk with potential reward. Penny stocks, though often seen as speculative, can offer significant value when backed by strong financials and growth prospects. In this context, we explore three promising penny stocks that stand out for their robust fundamentals and potential to thrive amidst current market dynamics.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$42.39B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.61B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.39 | MYR1.1B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.89 | £482.95M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £178.85M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.12 | HK$698.27M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.25 | £83.91M | ★★★★☆☆ |

Click here to see the full list of 5,730 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

NagaCorp (SEHK:3918)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NagaCorp Ltd. is an investment holding company that manages and operates a hotel and casino complex in the Kingdom of Cambodia, with a market cap of HK$12.92 billion.

Operations: The company's revenue is primarily derived from casino operations, which generated $545.61 million, complemented by hotel and entertainment operations contributing $23.22 million.

Market Cap: HK$12.92B

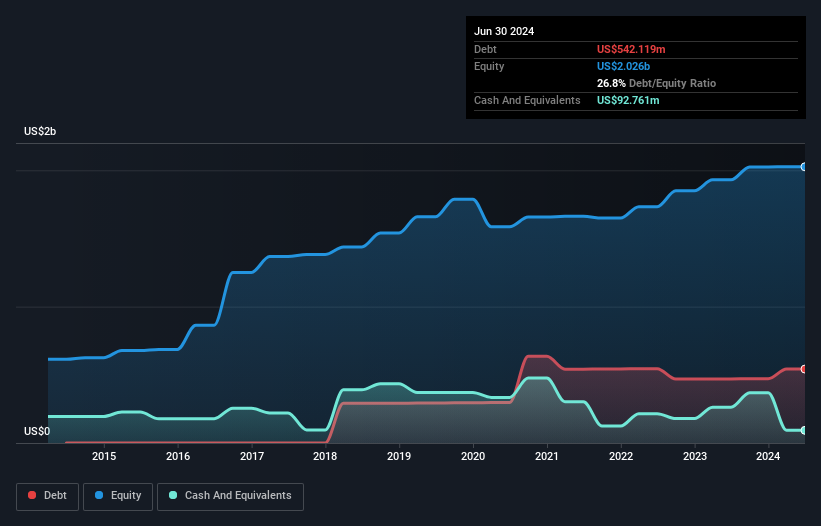

NagaCorp Ltd. faces challenges typical of penny stocks, with its short-term assets ($598.2M) not covering its short-term liabilities ($681M), and a low Return on Equity of 4.6%. Despite stable weekly volatility (4%), the company's earnings have declined by 36.2% annually over five years, impacted by a significant one-off loss of $48.9M as of June 2024. However, debt is well-managed with operating cash flow covering it at 60.2%, and interest payments are comfortably covered by EBIT at 9.1x coverage. Recent board changes include appointing Ms. Sophie Lam as Company Secretary, enhancing corporate governance experience.

- Unlock comprehensive insights into our analysis of NagaCorp stock in this financial health report.

- Assess NagaCorp's future earnings estimates with our detailed growth reports.

Boustead Singapore (SGX:F9D)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boustead Singapore Limited is an investment holding company offering energy engineering, real estate, geospatial, and healthcare technology solutions across various regions globally, with a market cap of SGD496.54 million.

Operations: The company's revenue is primarily generated from its Real Estate Solutions segment with SGD304.22 million, followed by Geospatial at SGD216.35 million, Energy Engineering at SGD161.11 million, and Healthcare at SGD12.79 million.

Market Cap: SGD496.54M

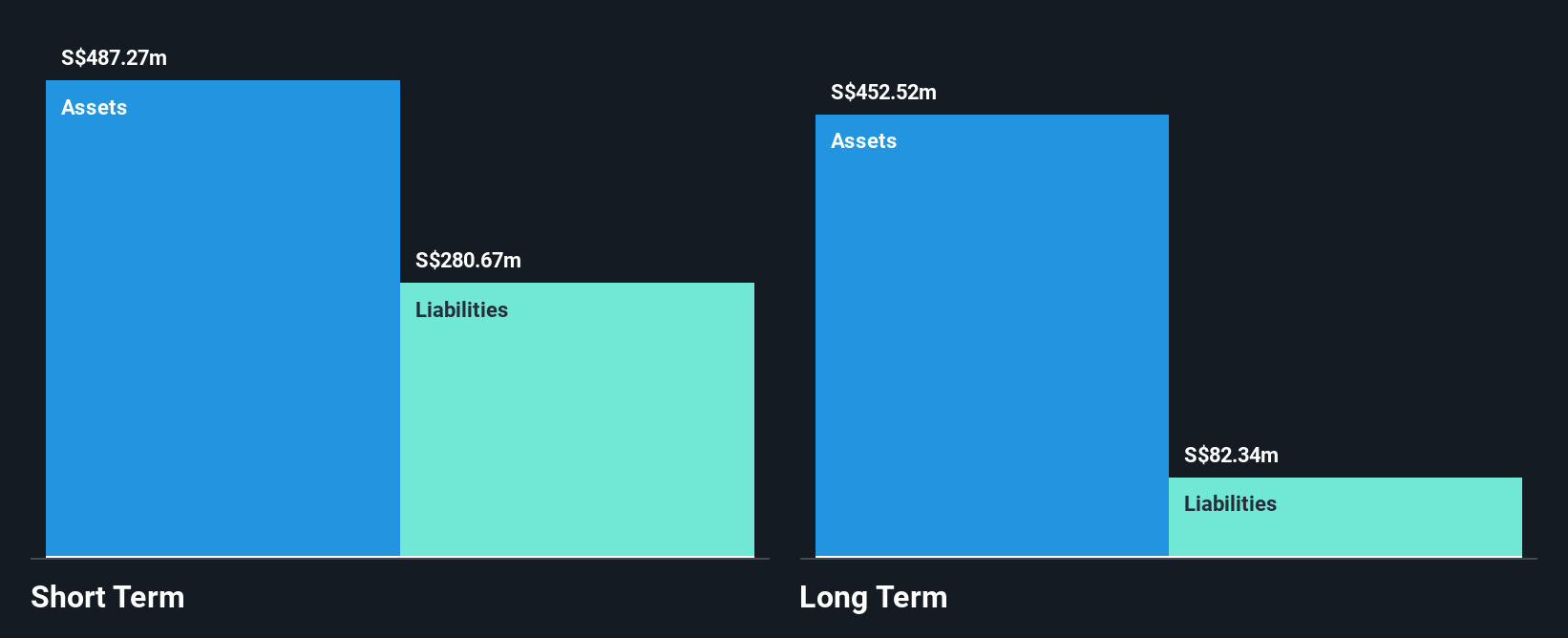

Boustead Singapore Limited demonstrates financial stability with short-term assets of SGD648.1 million exceeding both its long-term liabilities of SGD86.9 million and short-term liabilities of SGD419.2 million, highlighting a robust balance sheet uncommon among penny stocks. The company has achieved significant earnings growth over the past year at 47.9%, surpassing its five-year average growth rate of 4% annually, while maintaining a low price-to-earnings ratio of 6.9x compared to the market's 12.1x, suggesting potential undervaluation. Its recent MYR300 million contract in Malaysia boosts its order backlog but is not expected to materially impact near-term profitability or earnings per share.

- Click here to discover the nuances of Boustead Singapore with our detailed analytical financial health report.

- Gain insights into Boustead Singapore's past trends and performance with our report on the company's historical track record.

Sheng Siong Group (SGX:OV8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore with a market cap of SGD2.47 billion.

Operations: The company's revenue primarily comes from its supermarket operations, selling consumer goods, generating SGD1.41 billion.

Market Cap: SGD2.47B

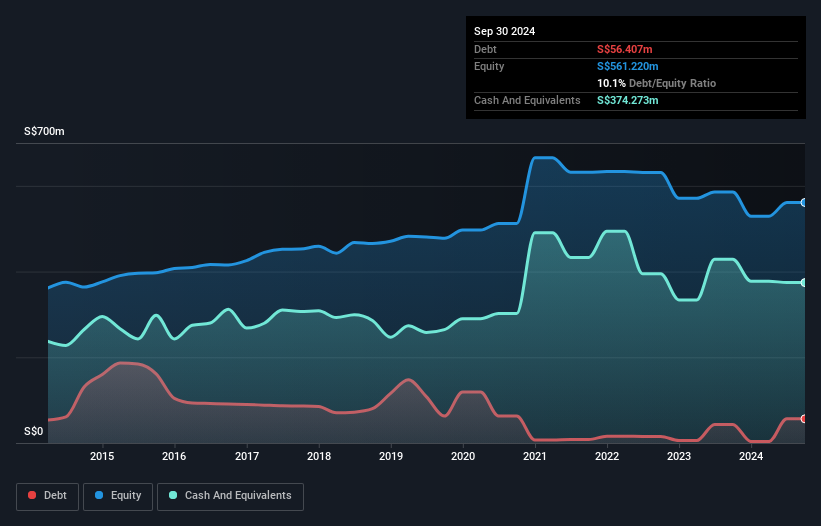

Sheng Siong Group Ltd boasts a stable financial position, with short-term assets of SGD464.4 million covering both its long-term liabilities of SGD58.7 million and short-term liabilities of SGD267.8 million, illustrating a solid balance sheet for its market segment. The company is debt-free, eliminating interest payment concerns and enhancing financial flexibility. Earnings have grown by 7.4% annually over the past five years, supported by high-quality earnings and a strong return on equity at 28%. Recent expansion through MDL Property Pte. Ltd., although unlikely to impact immediate financials significantly, indicates strategic growth initiatives in property management.

- Navigate through the intricacies of Sheng Siong Group with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Sheng Siong Group's future.

Make It Happen

- Gain an insight into the universe of 5,730 Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:OV8

Sheng Siong Group

An investment holding company, operates a chain of supermarket retail stores in Singapore.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives