- Singapore

- /

- Food and Staples Retail

- /

- SGX:VC2

Olam International (SGX:O32) Will Pay A Larger Dividend Than Last Year At S$0.04

Olam International Limited (SGX:O32) will increase its dividend on the 30th of August to S$0.04, which is 14% higher than last year. This makes the dividend yield about the same as the industry average at 5.1%.

See our latest analysis for Olam International

Olam International Is Paying Out More Than It Is Earning

Unless the payments are sustainable, the dividend yield doesn't mean too much. Before this announcement, Olam International was paying out 127% of what it was earning, and not generating any free cash flows either. This high of a dividend payment could start to put pressure on the balance sheet in the future.

EPS is set to grow by 10.6% over the next year if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could reach 135%, which probably can't continue without starting to put some pressure on the balance sheet.

Dividend Volatility

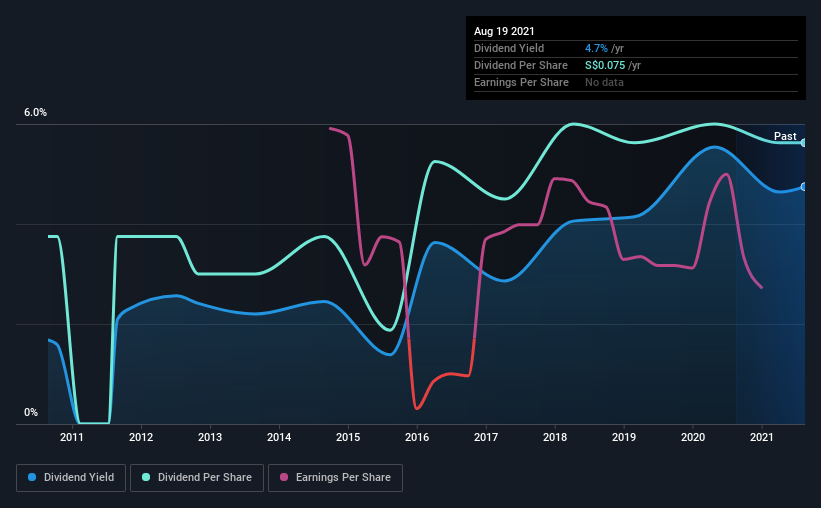

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2011, the dividend has gone from S$0.05 to S$0.075. This implies that the company grew its distributions at a yearly rate of about 4.1% over that duration. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

Olam International Might Find It Hard To Grow Its Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. We are encouraged to see that Olam International has grown earnings per share at 11% per year over the past five years. Although per-share earnings are growing at a credible rate, the massive payout ratio may limit growth in the company's future dividend payments.

We'd also point out that Olam International has issued stock equal to 15% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Olam International's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think Olam International will make a great income stock. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 5 warning signs for Olam International you should be aware of, and 1 of them is potentially serious. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading Olam International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:VC2

Olam Group

Engages in the sourcing, processing, packaging, and merchandising of agricultural products worldwide.

Moderate second-rate dividend payer.