- Hong Kong

- /

- Real Estate

- /

- SEHK:9909

Asian Penny Stocks: 3 Picks With Market Caps Over US$100M To Watch

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, investors are keenly observing how these factors influence Asian markets. Amid such volatility, penny stocks — a term that may seem outdated yet remains relevant — continue to attract attention for their potential to offer value and growth opportunities in smaller or newer companies. By focusing on those with solid financial foundations, these stocks can provide an intriguing mix of affordability and long-term potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.94 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.45 | HK$896.85M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.53 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.35 | SGD547.14M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.78 | THB2.87B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.095 | SGD49.73M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.28 | SGD12.91B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.13 | HK$3.26B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.80 | THB9.7B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 957 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Yunhong Guixin Group Holdings (SEHK:8349)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yunhong Guixin Group Holdings Limited is an investment holding company involved in the research, development, production, and sale of fiberglass reinforced plastic products in China with a market cap of HK$1.19 billion.

Operations: The company generates revenue from two primary segments: the Fiberglass Business, contributing CN¥9.95 million, and the Silica Sand Business, which adds CN¥13.64 million.

Market Cap: HK$1.19B

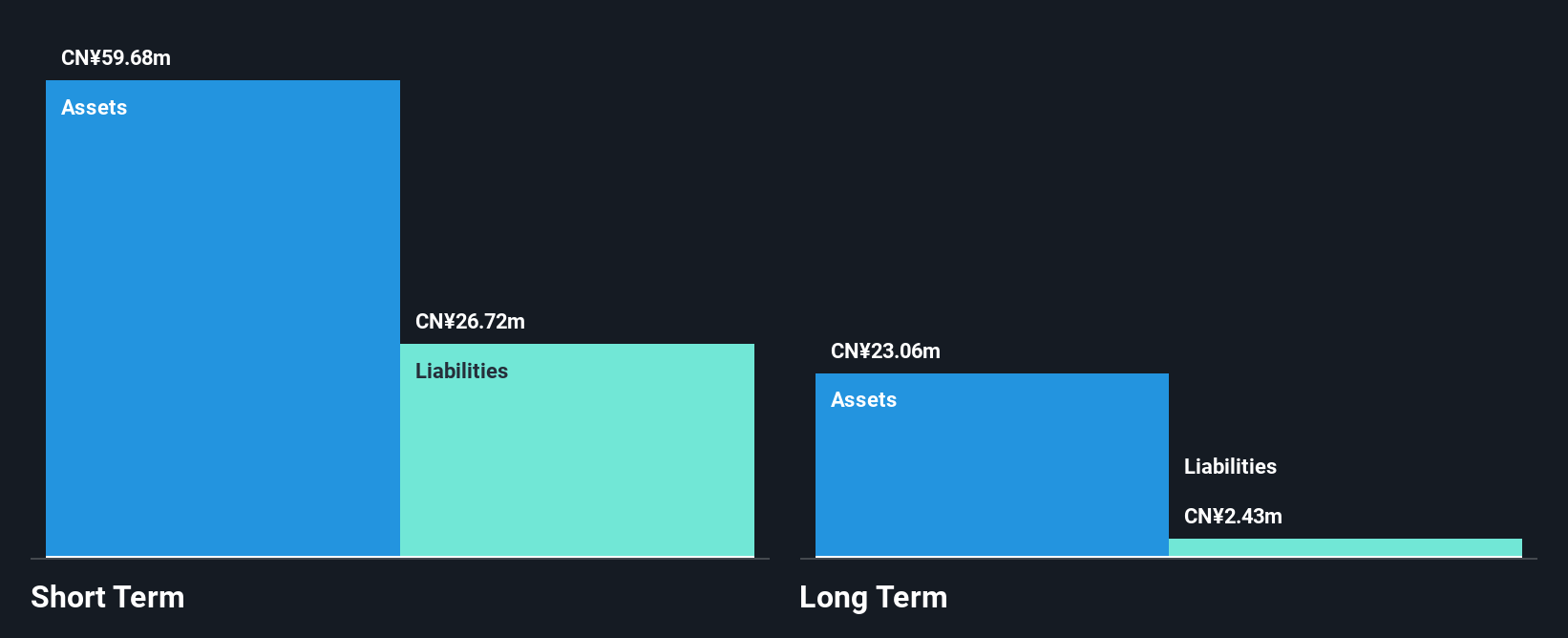

Yunhong Guixin Group Holdings Limited, with a market cap of HK$1.19 billion, operates in the fiberglass and silica sand segments, generating CN¥24 million in revenue. Despite being unprofitable with a net loss of CN¥4 million for the first half of 2025, it maintains a robust financial position with short-term assets exceeding both short- and long-term liabilities. The company is debt-free and has sufficient cash runway for over three years even as free cash flow diminishes slightly. Recent executive changes include the resignation of Ms. Jin Dan from the board due to other commitments.

- Unlock comprehensive insights into our analysis of Yunhong Guixin Group Holdings stock in this financial health report.

- Review our historical performance report to gain insights into Yunhong Guixin Group Holdings' track record.

Powerlong Commercial Management Holdings (SEHK:9909)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Powerlong Commercial Management Holdings Limited, with a market cap of HK$1.67 billion, offers commercial operational and residential property management services in the People’s Republic of China.

Operations: The company generates revenue from Commercial Operational Services amounting to CN¥2.11 billion and Residential Property Management Services totaling CN¥473.43 million.

Market Cap: HK$1.67B

Powerlong Commercial Management Holdings, with a market cap of HK$1.67 billion, is debt-free and has short-term assets of CN¥4.9 billion that exceed its liabilities. However, the company faces challenges with declining earnings—down 47.7% over the past year—and reduced net profit margins from 14.5% to 7.9%. Despite trading significantly below estimated fair value, recent financials show a slight drop in revenue and net income for the first half of 2025 compared to last year, impacted by large one-off items affecting earnings quality. The management team and board are experienced but face ongoing profitability hurdles.

- Take a closer look at Powerlong Commercial Management Holdings' potential here in our financial health report.

- Explore historical data to track Powerlong Commercial Management Holdings' performance over time in our past results report.

InnoTek (SGX:M14)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: InnoTek Limited is an investment holding company that manufactures precision metal components in Hong Kong, the People’s Republic of China, Thailand, and Vietnam, with a market cap of SGD172.33 million.

Operations: The company generates revenue from its Mansfield division, with SGD35.04 million from Precision Machining and SGD279.71 million from Precision Components and Tooling.

Market Cap: SGD172.33M

InnoTek Limited, with a market cap of SGD172.33 million, has faced declining earnings, reporting net income of SGD0.405 million for the first half of 2025 compared to SGD3.15 million a year ago. Despite this, its financial position remains robust as short-term assets significantly exceed both short and long-term liabilities, and cash flow covers debt well. The company completed a share buyback but still trades below estimated fair value amidst high share price volatility. Recent board changes introduce experienced leadership which may help navigate ongoing profitability challenges while maintaining high-quality earnings amid industry pressures.

- Get an in-depth perspective on InnoTek's performance by reading our balance sheet health report here.

- Examine InnoTek's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Explore the 957 names from our Asian Penny Stocks screener here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9909

Powerlong Commercial Management Holdings

Provides commercial operational and residential property management services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives