Here's Why We Think Grand Venture Technology (SGX:JLB) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Grand Venture Technology (SGX:JLB). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Grand Venture Technology

How Fast Is Grand Venture Technology Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Impressively, Grand Venture Technology has grown EPS by 25% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

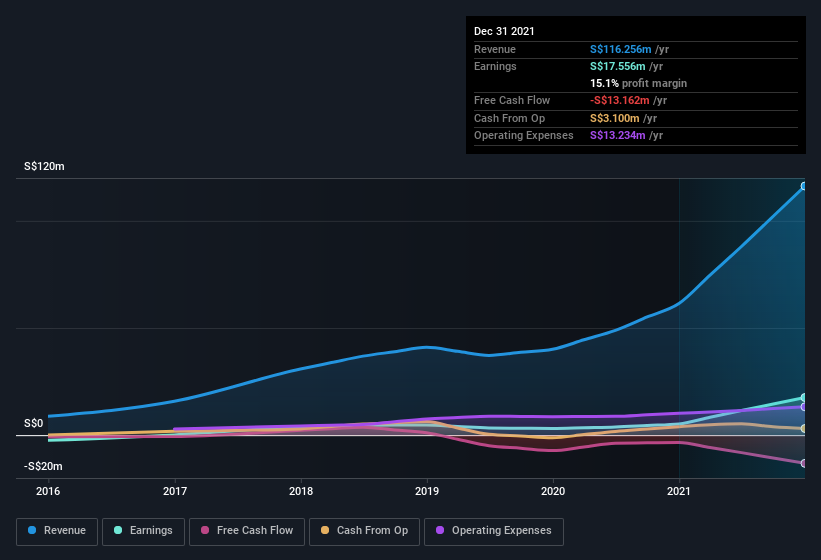

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Grand Venture Technology is growing revenues, and EBIT margins improved by 8.6 percentage points to 19%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Grand Venture Technology's future profits.

Are Grand Venture Technology Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Grand Venture Technology top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Executive Chairman, Tiam Nam Lee, paid S$120k to buy shares at an average price of S$1.19.

Along with the insider buying, another encouraging sign for Grand Venture Technology is that insiders, as a group, have a considerable shareholding. Given insiders own a small fortune of shares, currently valued at S$123m, they have plenty of motivation to push the business to succeed. That holding amounts to 34% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

Does Grand Venture Technology Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Grand Venture Technology's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Grand Venture Technology (1 is concerning!) that you need to be mindful of.

As a growth investor I do like to see insider buying. But Grand Venture Technology isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Grand Venture Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:JLB

Grand Venture Technology

Offers precision manufacturing solutions for the semiconductor, life sciences, electronics, aerospace, and medical industries in Singapore, Malaysia, the United States, China, and internationally.

Solid track record with reasonable growth potential.