- Singapore

- /

- Industrials

- /

- SGX:J36

Why Investors Shouldn't Be Surprised By Jardine Matheson Holdings Limited's (SGX:J36) Low P/S

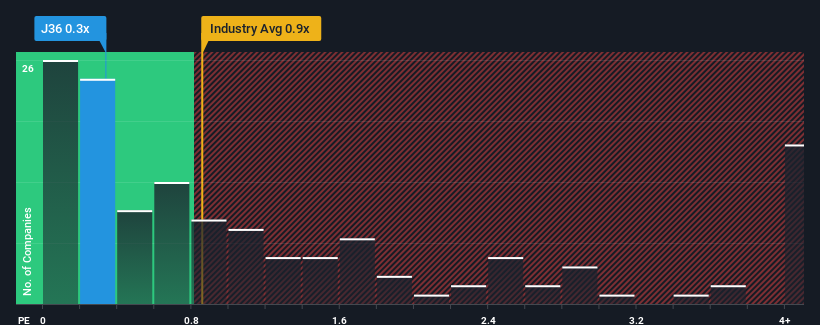

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Jardine Matheson Holdings Limited (SGX:J36) is a stock worth checking out, seeing as almost half of all the Industrials companies in Singapore have P/S ratios greater than 0.9x and even P/S higher than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Jardine Matheson Holdings

How Jardine Matheson Holdings Has Been Performing

Jardine Matheson Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Jardine Matheson Holdings will help you uncover what's on the horizon.How Is Jardine Matheson Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Jardine Matheson Holdings' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.2%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 0.8% during the coming year according to the six analysts following the company. With the industry predicted to deliver 8.2% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Jardine Matheson Holdings is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Jardine Matheson Holdings' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Jardine Matheson Holdings' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 4 warning signs for Jardine Matheson Holdings that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:J36

Jardine Matheson Holdings

Operates in motor vehicles and related operations, property investment and development, food retailing, health and beauty, home furnishings, engineering and construction, and transport businesses in China, Southeast Asia, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives