As global markets grapple with economic uncertainty and inflation concerns, the Asian market presents a unique landscape for investors seeking potential opportunities. Despite broader challenges, identifying stocks with strong fundamentals and growth potential can provide a strategic edge in navigating these turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sesoda | 62.26% | 10.62% | 16.47% | ★★★★★★ |

| Uoriki | NA | 3.85% | 9.40% | ★★★★★★ |

| Miwon Chemicals | 0.10% | 10.79% | 15.77% | ★★★★★★ |

| Nacity Property Service GroupLtd | NA | 8.88% | 3.51% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Suzhou Nanomicro Technology | 7.29% | 23.88% | -2.17% | ★★★★★★ |

| China Container Terminal | 45.76% | 2.82% | 16.98% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Hong Leong Asia (SGX:H22)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hong Leong Asia Ltd. is an investment holding company that manufactures and distributes powertrain solutions, building materials, and rigid packaging products across China, Singapore, Malaysia, and internationally, with a market cap of approximately SGD950.06 million.

Operations: Hong Leong Asia's primary revenue stream comes from powertrain solutions, generating SGD3.55 billion, followed by building materials at SGD682.33 million. The company focuses on these segments to drive its financial performance across its operational regions.

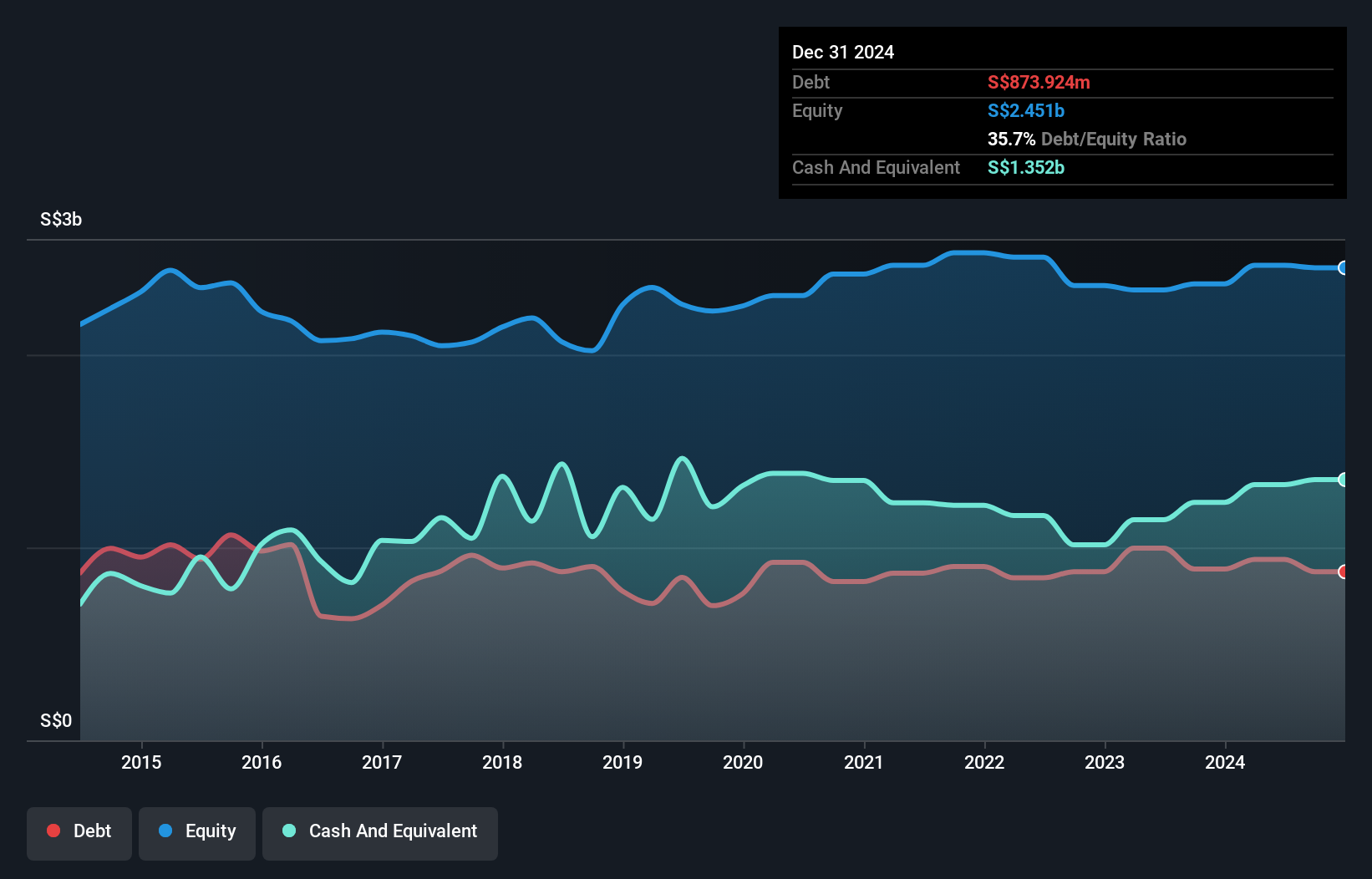

Hong Leong Asia, a small cap player in the machinery sector, has shown promising growth with earnings up 34.5% last year, surpassing industry averages. The company trades at a significant discount to its estimated fair value and boasts high-quality earnings. Its debt-to-equity ratio increased slightly from 33.8% to 35.7% over five years, yet interest payments are well covered by EBIT at 16 times coverage. Recent expansions into China with new subsidiaries in technology and auto parts signal strategic growth moves, while upcoming dividends reflect shareholder returns focus amidst board changes and subsidiary dissolutions.

- Click here and access our complete health analysis report to understand the dynamics of Hong Leong Asia.

-

Assess Hong Leong Asia's past performance with our detailed historical performance reports.

Shanghai YongLi Belting (SZSE:300230)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai YongLi Belting Co., Ltd focuses on the development, production, and sale of conveyor belts with a market capitalization of CN¥4.82 billion.

Operations: Shanghai YongLi Belting generates revenue primarily from the production and sale of conveyor belts. The company has a market capitalization of CN¥4.82 billion.

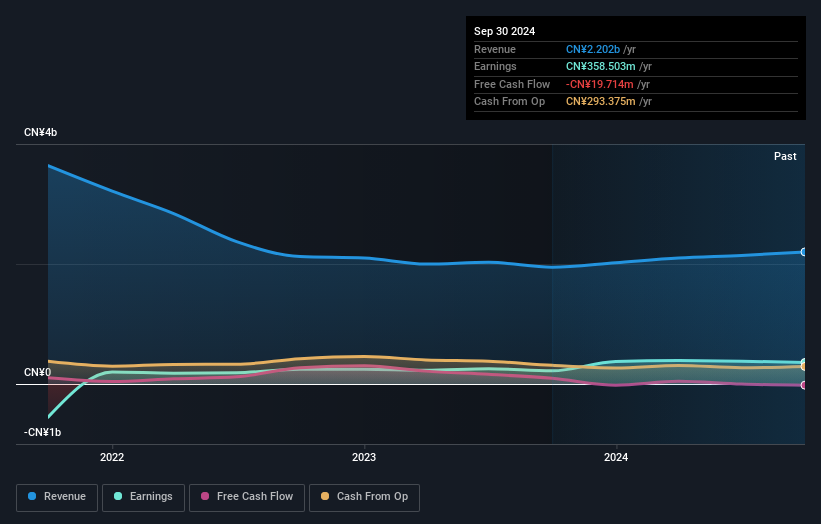

YongLi Belting, a smaller player in the industry, shows promising signs with a Price-To-Earnings ratio of 13.5x, significantly lower than the CN market average of 37.5x. Its earnings growth over the past year reached an impressive 63.6%, outpacing the Machinery industry's modest 0.1% increase. Despite this robust performance, it's worth noting that YongLi's debt to equity ratio has risen from 10.7% to 15% over five years, suggesting increased leverage. A notable one-off gain of CN¥157M influenced recent financial results, adding complexity to its earnings quality assessment but not impacting its profitability outlook negatively.

Zhejiang Huaye Plastics Machinery (SZSE:301616)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Huaye Plastics Machinery Co., Ltd. specializes in the production and sale of machinery components such as barrels, screws, and related products, with a market capitalization of CN¥3.56 billion.

Operations: Zhejiang Huaye's primary revenue stream is the production and sale of products like barrels and screws, generating CN¥891.88 million.

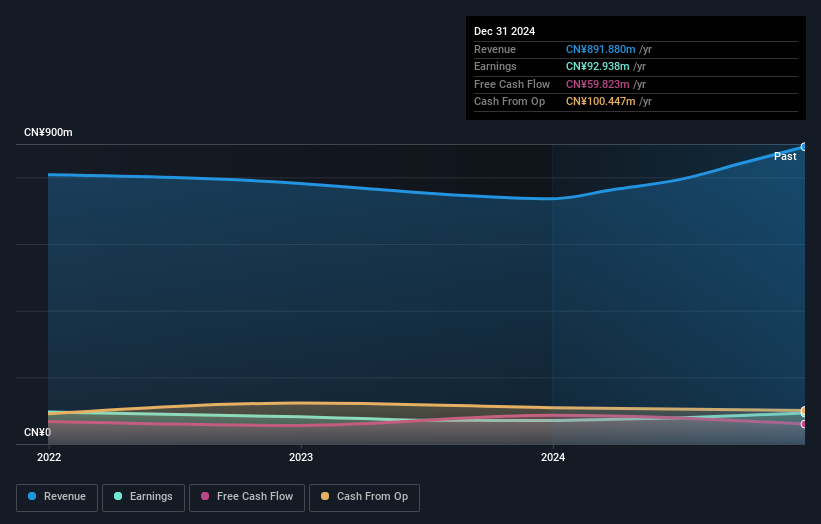

Zhejiang Huaye Plastics Machinery stands out with its recent IPO raising CNY 417.4 million, enhancing its market presence by joining the Shenzhen Stock Exchange indices. The company reported a significant earnings growth of 31.7% over the past year, surpassing the industry average of 0.1%. With net income climbing to CNY 92.94 million from CNY 70.29 million previously, it demonstrates robust financial health alongside a reduced debt-to-equity ratio from 38.7% to 21.3% over five years and an impressive EBIT coverage of interest payments at 14.3 times, indicating high-quality earnings despite share illiquidity challenges.

Taking Advantage

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2622 more companies for you to explore.Click here to unveil our expertly curated list of 2625 Asian Undiscovered Gems With Strong Fundamentals .

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huaye Plastics Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301616

Zhejiang Huaye Plastics Machinery

Zhejiang Huaye Plastics Machinery Co., Ltd.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives