- Singapore

- /

- Construction

- /

- SGX:ER0

These 4 Measures Indicate That KSH Holdings (SGX:ER0) Is Using Debt Extensively

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, KSH Holdings Limited (SGX:ER0) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for KSH Holdings

What Is KSH Holdings's Debt?

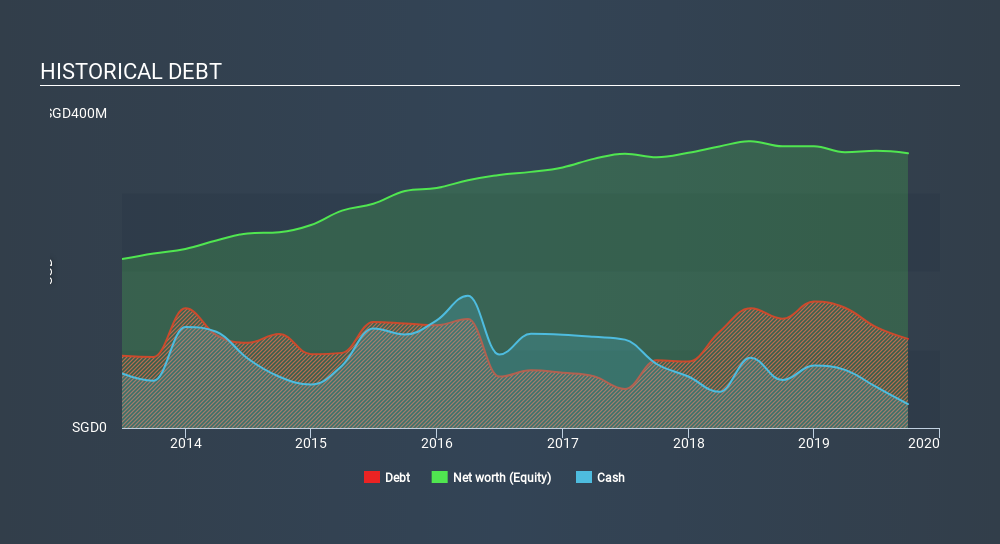

The image below, which you can click on for greater detail, shows that KSH Holdings had debt of S$113.6m at the end of September 2019, a reduction from S$139.2m over a year. On the flip side, it has S$30.6m in cash leading to net debt of about S$83.0m.

How Healthy Is KSH Holdings's Balance Sheet?

The latest balance sheet data shows that KSH Holdings had liabilities of S$129.3m due within a year, and liabilities of S$100.0m falling due after that. Offsetting these obligations, it had cash of S$30.6m as well as receivables valued at S$67.8m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by S$130.9m.

This deficit is considerable relative to its market capitalization of S$197.4m, so it does suggest shareholders should keep an eye on KSH Holdings's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

KSH Holdings has a debt to EBITDA ratio of 3.5 and its EBIT covered its interest expense 4.3 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Even worse, KSH Holdings saw its EBIT tank 21% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is KSH Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, KSH Holdings's free cash flow amounted to 29% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

We'd go so far as to say KSH Holdings's EBIT growth rate was disappointing. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. Overall, it seems to us that KSH Holdings's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for KSH Holdings you should be aware of, and 1 of them is a bit unpleasant.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SGX:ER0

KSH Holdings

Engages in the construction business in Singapore and the People’s Republic of China.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026