AAC Technologies Holdings And 2 Other Asian Stocks Estimated To Be Trading Below Their Intrinsic Values

Reviewed by Simply Wall St

As global markets grapple with trade uncertainties and inflation concerns, Asian equities have shown resilience, with Japan's stock markets experiencing modest gains and China's indices rising on stimulus hopes. In such a fluctuating environment, identifying stocks that are potentially trading below their intrinsic values can offer investors opportunities to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Guizhou Space Appliance (SZSE:002025) | CN¥58.35 | CN¥115.75 | 49.6% |

| APAC Realty (SGX:CLN) | SGD0.43 | SGD0.85 | 49.5% |

| Takara Bio (TSE:4974) | ¥853.00 | ¥1686.88 | 49.4% |

| Food & Life Companies (TSE:3563) | ¥4349.00 | ¥8695.25 | 50% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$131.50 | NT$262.21 | 49.8% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.67 | SGD1.33 | 49.6% |

| Intellian Technologies (KOSDAQ:A189300) | ₩38200.00 | ₩75949.64 | 49.7% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.53 | CN¥16.91 | 49.6% |

| Shenzhen Anche Technologies (SZSE:300572) | CN¥18.60 | CN¥37.18 | 50% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15880.00 | ₩31498.51 | 49.6% |

Let's dive into some prime choices out of the screener.

AAC Technologies Holdings (SEHK:2018)

Overview: AAC Technologies Holdings Inc. is an investment holding company that offers solutions for smart devices across various regions including Mainland China, Hong Kong, Taiwan, other Asian countries, the United States, and Europe with a market cap of HK$61.88 billion.

Operations: The company's revenue is derived from several segments, including Optics Products (CN¥4.07 billion), Acoustics Products (CN¥7.64 billion), Sensor and Semiconductor Products (CN¥920.28 million), and Electromagnetic Drives and Precision Mechanics (CN¥8.28 billion).

Estimated Discount To Fair Value: 21.2%

AAC Technologies Holdings appears undervalued based on cash flows, trading over 20% below its fair value estimate of HK$66.02. The company's earnings have grown significantly, with a recent increase in net income to CNY 1.80 billion from CNY 740.37 million the previous year, driven by improved operational efficiency and strategic acquisitions like Acoustics Solutions International B.V., enhancing its automotive market potential. However, forecasted revenue growth remains moderate compared to the broader market expectations.

- Insights from our recent growth report point to a promising forecast for AAC Technologies Holdings' business outlook.

- Click here to discover the nuances of AAC Technologies Holdings with our detailed financial health report.

Akeso (SEHK:9926)

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on researching, developing, manufacturing, and commercializing antibody drugs with a market cap of approximately HK$66.82 billion.

Operations: The company's revenue segment consists of the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1.87 billion.

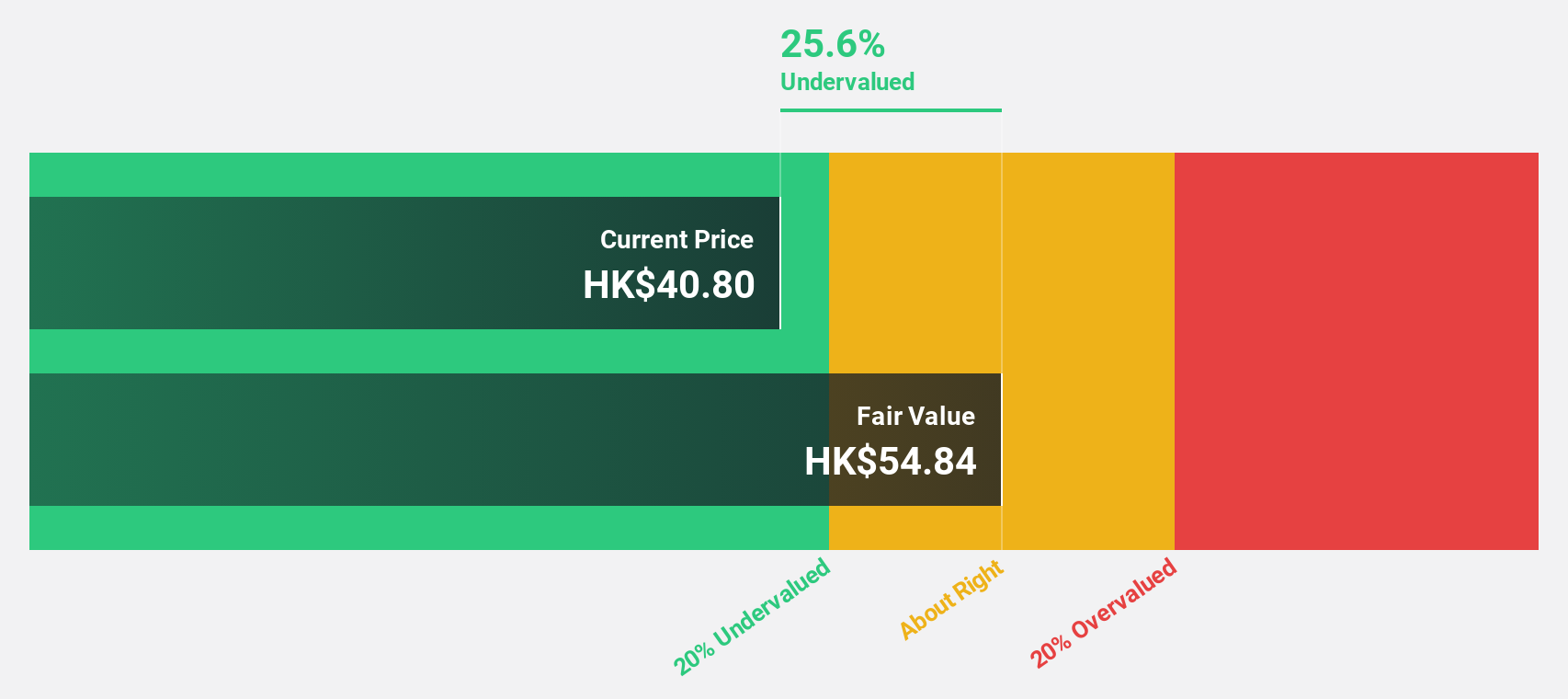

Estimated Discount To Fair Value: 49%

Akeso is trading significantly below its fair value estimate of HK$146.1, with a current price of HK$74.45, highlighting its undervaluation based on cash flows. The company's revenue growth is projected at 28.1% annually, outpacing the Hong Kong market's 7.8%, and it is expected to become profitable within three years. Recent drug approvals and ongoing clinical trials bolster Akeso's position in the immunotherapy sector, potentially enhancing future cash flows and profitability prospects.

- Upon reviewing our latest growth report, Akeso's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Akeso.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China, Canada, Japan, Italy, Greece, other European countries and internationally with a market cap of SGD9.24 billion.

Operations: The company's revenue primarily comes from its shipbuilding segment, generating CN¥25.22 billion, followed by its shipping operations which contribute CN¥1.24 billion.

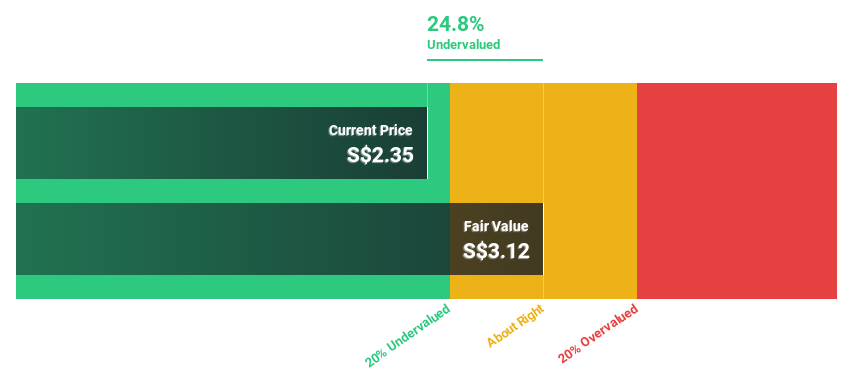

Estimated Discount To Fair Value: 24.3%

Yangzijiang Shipbuilding is trading at S$2.34, below its estimated fair value of S$3.09, indicating significant undervaluation based on cash flows. Its earnings grew 61.7% last year and are forecast to grow 12.53% annually, outpacing the Singapore market's 10.4%. Revenue growth is expected at 15.4% per year, supported by strong recent financial results with net income rising to CNY6.63 billion from CNY4.10 billion the previous year.

- The analysis detailed in our Yangzijiang Shipbuilding (Holdings) growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Yangzijiang Shipbuilding (Holdings) stock in this financial health report.

Key Takeaways

- Click this link to deep-dive into the 275 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Yangzijiang Shipbuilding (Holdings), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BS6

Yangzijiang Shipbuilding (Holdings)

An investment holding company, engages in the shipbuilding activities in the Greater China, Canada, Japan, Italy, Greece, other European countries, and internationally.

Outstanding track record, undervalued and pays a dividend.