As June 2024 approaches, the Singapore market continues to navigate through dynamic shifts and trends, reflecting broader economic currents and investor sentiments. In this context, identifying dividend stocks that offer potential stability and consistent returns becomes particularly compelling for investors looking to enhance their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.48% | ★★★★★☆ |

| Civmec (SGX:P9D) | 6.07% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.59% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 9.46% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.26% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.87% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.49% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.10% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.77% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited, primarily an investment holding company, operates in the distribution of information technology products across regions including Singapore, Greater China, Australia, and India, with a market capitalization of SGD 231.54 million.

Operations: Multi-Chem Limited generates revenue from its IT business in Singapore (SGD 372.78 million), Australia (SGD 54.60 million), India (SGD 40.56 million), Greater China (SGD 34.96 million), and other regions (SGD 153.93 million), along with a smaller contribution from its PCB business in Singapore (SGD 1.79 million).

Dividend Yield: 9.5%

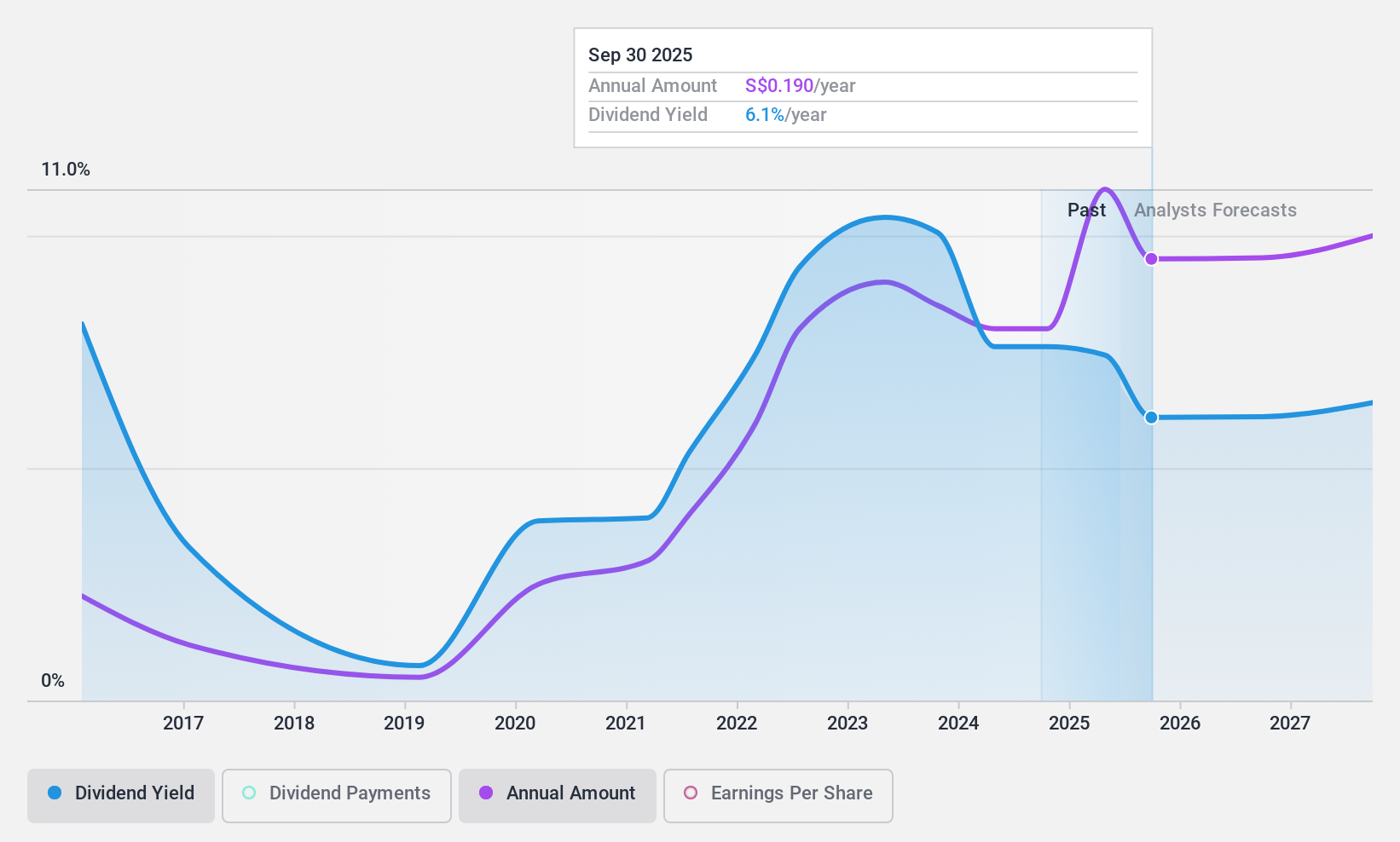

Multi-Chem Limited, with a dividend yield of 9.46%, ranks in the top 25% of dividend payers in the Singapore market. Despite this attractive yield, the company exhibits a volatile dividend history over the past decade, with no consistent growth pattern and significant fluctuations in annual payouts. Earnings coverage remains strong at an 80.7% payout ratio, supported by both earnings and cash flows (88.1% cash payout ratio). Recent board changes could signal strategic shifts but also introduce uncertainties regarding future dividend policies.

- Navigate through the intricacies of Multi-Chem with our comprehensive dividend report here.

- According our valuation report, there's an indication that Multi-Chem's share price might be on the cheaper side.

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for concrete, serving markets including Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and other international locations with a market capitalization of approximately SGD 587.11 million.

Operations: BRC Asia Limited generates revenue primarily through two segments: trading, which brought in SGD 319.71 million, and fabrication and manufacturing, contributing SGD 1.35 billion.

Dividend Yield: 7.5%

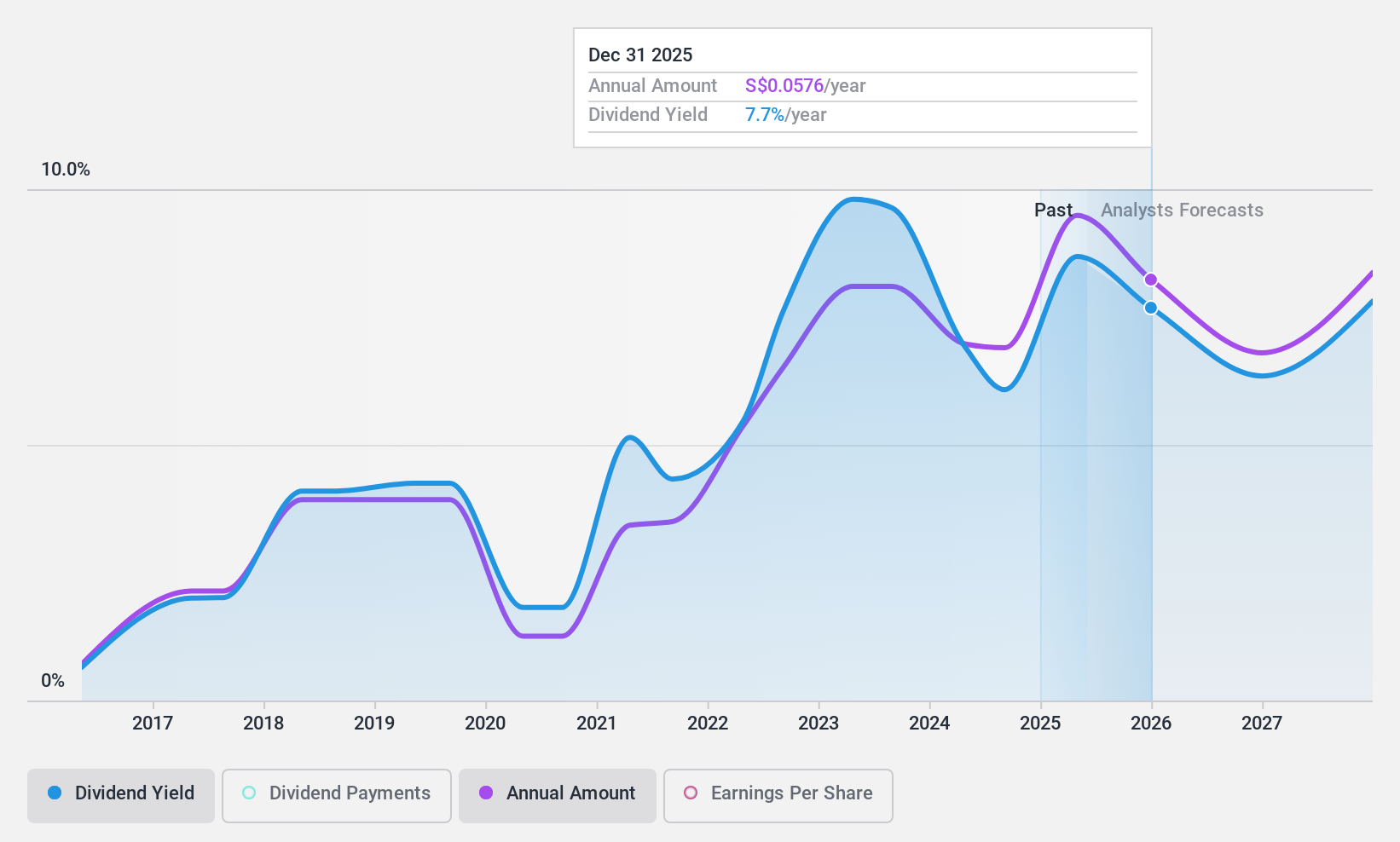

BRC Asia Limited, demonstrating a solid performance in its recent earnings with a notable increase in net income to SGD 38.53 million from SGD 26.24 million year-over-year, supports a dividend yield of 7.48%. This places it among the higher dividend payers in Singapore's market. The dividends are well-covered by earnings and cash flows, with payout ratios of 35.9% and 85.3%, respectively. However, the company's dividend history shows volatility over the past decade, which might concern stability-focused investors.

- Unlock comprehensive insights into our analysis of BRC Asia stock in this dividend report.

- Our valuation report here indicates BRC Asia may be undervalued.

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company based in Indonesia, specializing in the production and trade of crude palm oil and palm kernel, with a market capitalization of approximately SGD 1.25 billion.

Operations: Bumitama Agri Ltd. generates IDR 15.44 billion primarily through its plantations and palm oil mills segment.

Dividend Yield: 6.5%

Bumitama Agri Ltd. offers a dividend yield of 6.49%, ranking in the top 25% of Singapore's dividend payers. Despite its attractive yield, the company has a history of volatile dividends over the past decade, with recent special dividends announced at 1.92 SGD cents and an increase to 3.63 SGD cents for FY 2023, reflecting potential instability in payouts. Trading at a significant discount (54.6%) below estimated fair value suggests good relative value, though earnings are expected to decline by approximately 5.5% annually over the next three years.

- Click here and access our complete dividend analysis report to understand the dynamics of Bumitama Agri.

- Our comprehensive valuation report raises the possibility that Bumitama Agri is priced lower than what may be justified by its financials.

Make It Happen

- Navigate through the entire inventory of 21 Top SGX Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AWZ

Multi-Chem

An investment holding company, distributes information technology (IT) products in Singapore, Australia, India, Vietnam, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives