In recent months, the Singapore stock market has shown resilience amidst global economic uncertainties, with investors keenly observing how local indices are performing. As income-focused investors look for stability and consistent returns, dividend stocks emerge as a compelling option due to their potential to provide regular income streams in such fluctuating environments.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.81% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.15% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.43% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.30% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.12% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.80% | ★★★★☆☆ |

| Genting Singapore (SGX:G13) | 4.79% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.76% | ★★★★☆☆ |

| United Overseas Bank (SGX:U11) | 5.43% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.64% | ★★★★☆☆ |

Click here to see the full list of 18 stocks from our Top SGX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited, with a market cap of SGD 644.72 million, operates in the prefabrication of steel reinforcement for concrete across Singapore and various international markets including Australia and Hong Kong.

Operations: BRC Asia Limited generates its revenue primarily from two segments: Trading, which accounts for SGD 319.71 million, and Fabrication and Manufacturing, contributing SGD 1.35 billion.

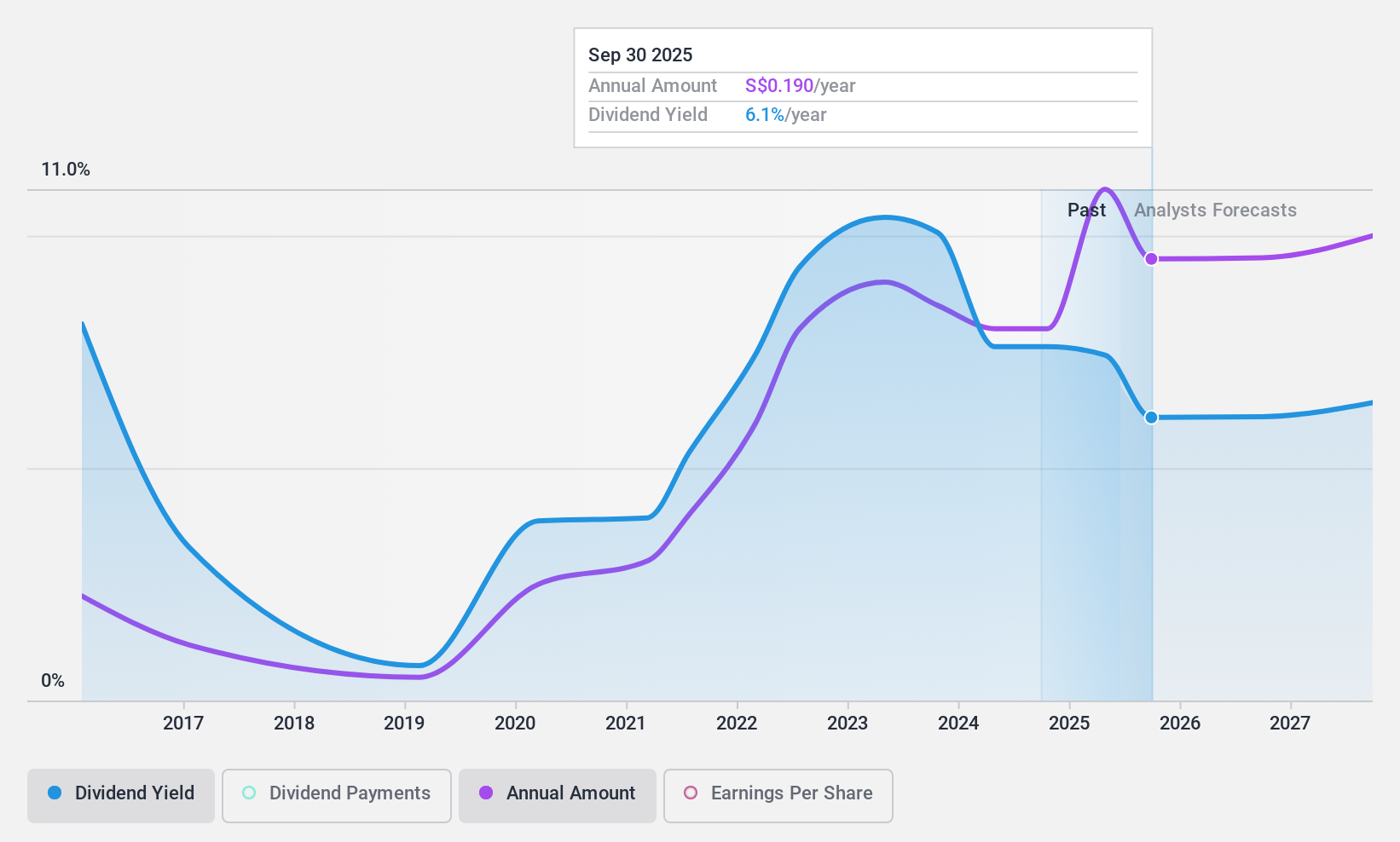

Dividend Yield: 6.8%

BRC Asia offers a compelling dividend yield of 6.81%, placing it in the top 25% of Singapore's market despite its historically volatile and unreliable dividend payments over the past decade. The company's dividends are well-covered by earnings, with a payout ratio of 35.9%, though cash flow coverage is tighter at 85.3%. Trading at a significant discount to estimated fair value, BRC Asia presents good relative value compared to peers and industry standards.

- Navigate through the intricacies of BRC Asia with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of BRC Asia shares in the market.

DBS Group Holdings (SGX:D05)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd is a leading financial services group offering commercial banking and financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally with a market cap of approximately SGD111.15 billion.

Operations: DBS Group Holdings Ltd generates revenue primarily from its Institutional Banking segment, which accounts for SGD9.18 billion, and its Consumer Banking/Wealth Management segment, contributing SGD9.34 billion.

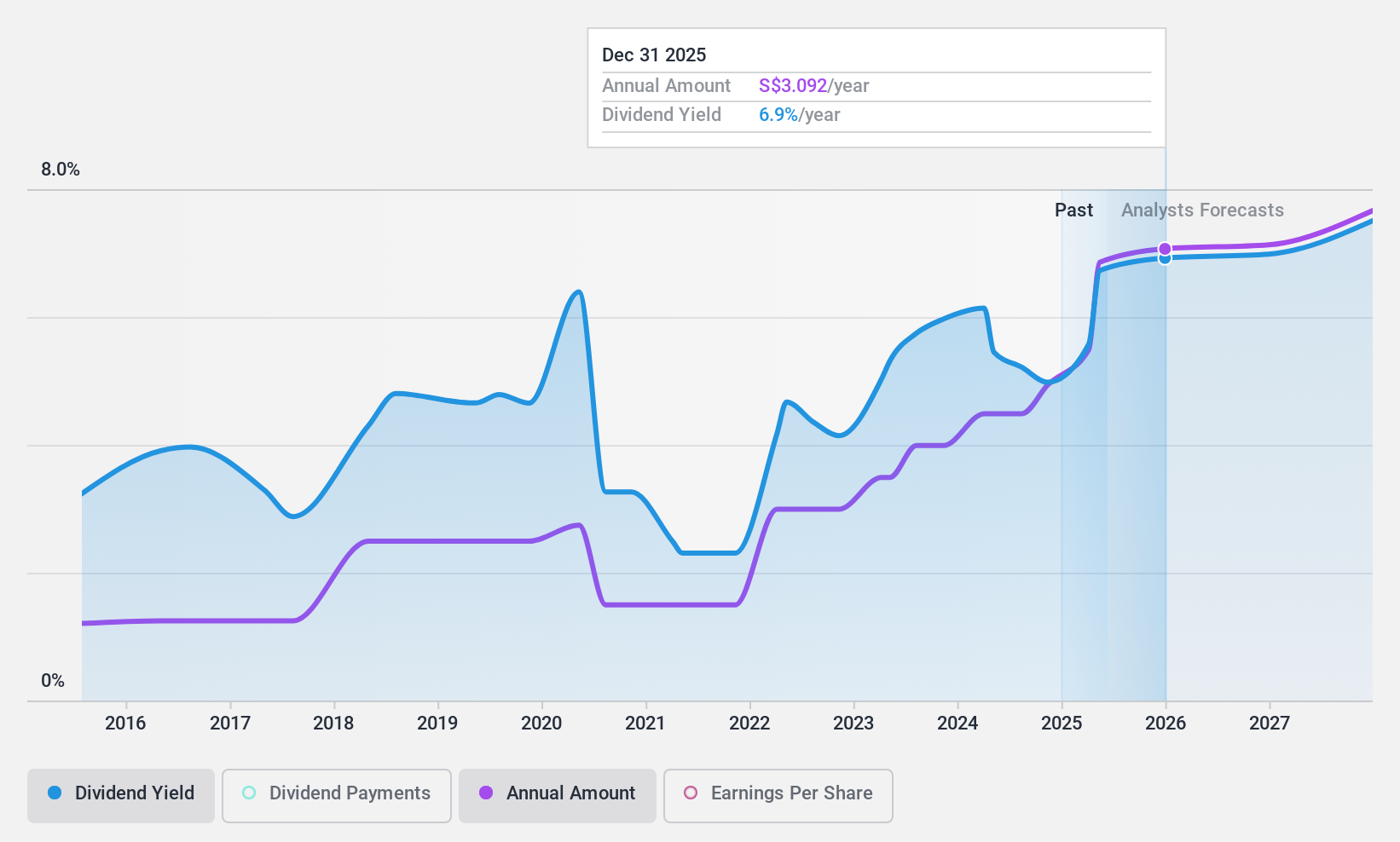

Dividend Yield: 5.5%

DBS Group Holdings' dividend payments are currently well-covered by earnings with a payout ratio of 54.1%, and this is expected to remain sustainable, though the dividend yield of 5.53% is below Singapore's top tier. Despite a history of volatility in dividends, DBS has shown consistent earnings growth, reporting net income of S$5.74 billion for the first half of 2024. Recent executive changes may influence future strategies but do not directly impact its current dividend outlook.

- Get an in-depth perspective on DBS Group Holdings' performance by reading our dividend report here.

- Our expertly prepared valuation report DBS Group Holdings implies its share price may be lower than expected.

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company involved in the production and trade of crude palm oil, palm kernel, and related products for refineries in Indonesia, with a market cap of SGD1.34 billion.

Operations: Bumitama Agri Ltd. generates its revenue primarily from its Plantations and Palm Oil Mills segment, which reported IDR15.55 trillion.

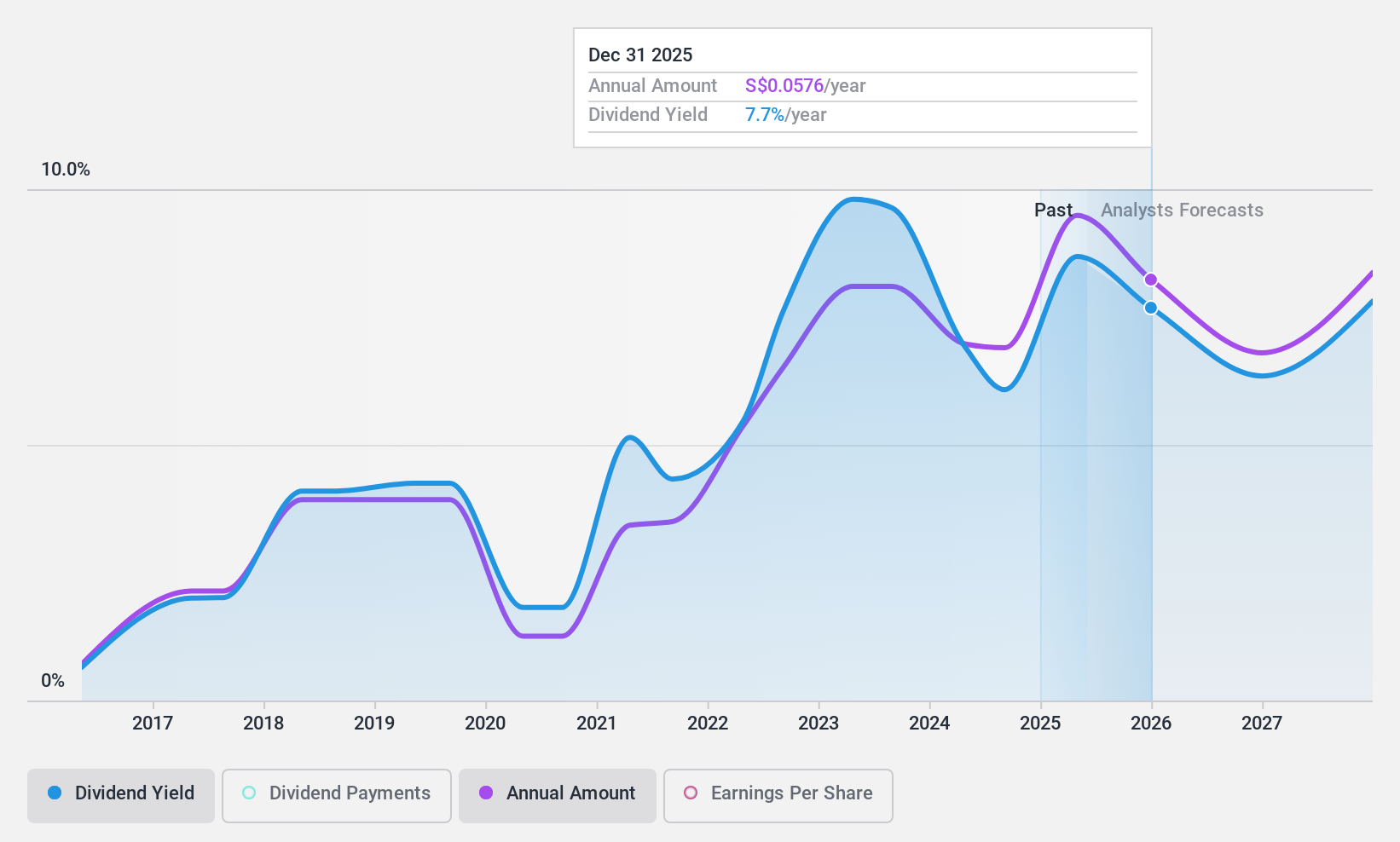

Dividend Yield: 6.2%

Bumitama Agri's dividend is well-covered by earnings and cash flows, with a payout ratio of 47.2% and a cash payout ratio of 54.8%. However, the dividend has been unstable over the past decade, recently decreasing to 1.20 Singapore cents from 1.25 cents for the first half of 2024. Despite trading below its estimated fair value and offering a competitive yield in Singapore's market, recent earnings declined with net income dropping to IDR 856 billion for H1 2024.

- Take a closer look at Bumitama Agri's potential here in our dividend report.

- According our valuation report, there's an indication that Bumitama Agri's share price might be on the cheaper side.

Where To Now?

- Get an in-depth perspective on all 18 Top SGX Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bumitama Agri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production and trade of crude palm oil (CPO), palm kernel (PK), and related products for refineries in Indonesia.

Flawless balance sheet, undervalued and pays a dividend.