- Singapore

- /

- Construction

- /

- SGX:MR7

SGX Dividend Stocks Spotlight Featuring BRC Asia And 2 More

Reviewed by Simply Wall St

Despite the Singapore stock market hovering near record highs, recession indicators are emerging as companies report that consumers are tightening their budgets and opting for more affordable alternatives. In this environment, dividend stocks can offer a degree of stability and income potential, making them an attractive option for investors seeking to navigate uncertain economic conditions.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.84% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.33% | ★★★★★☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.91% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.27% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.36% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.08% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.02% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.80% | ★★★★☆☆ |

| Genting Singapore (SGX:G13) | 4.52% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.51% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

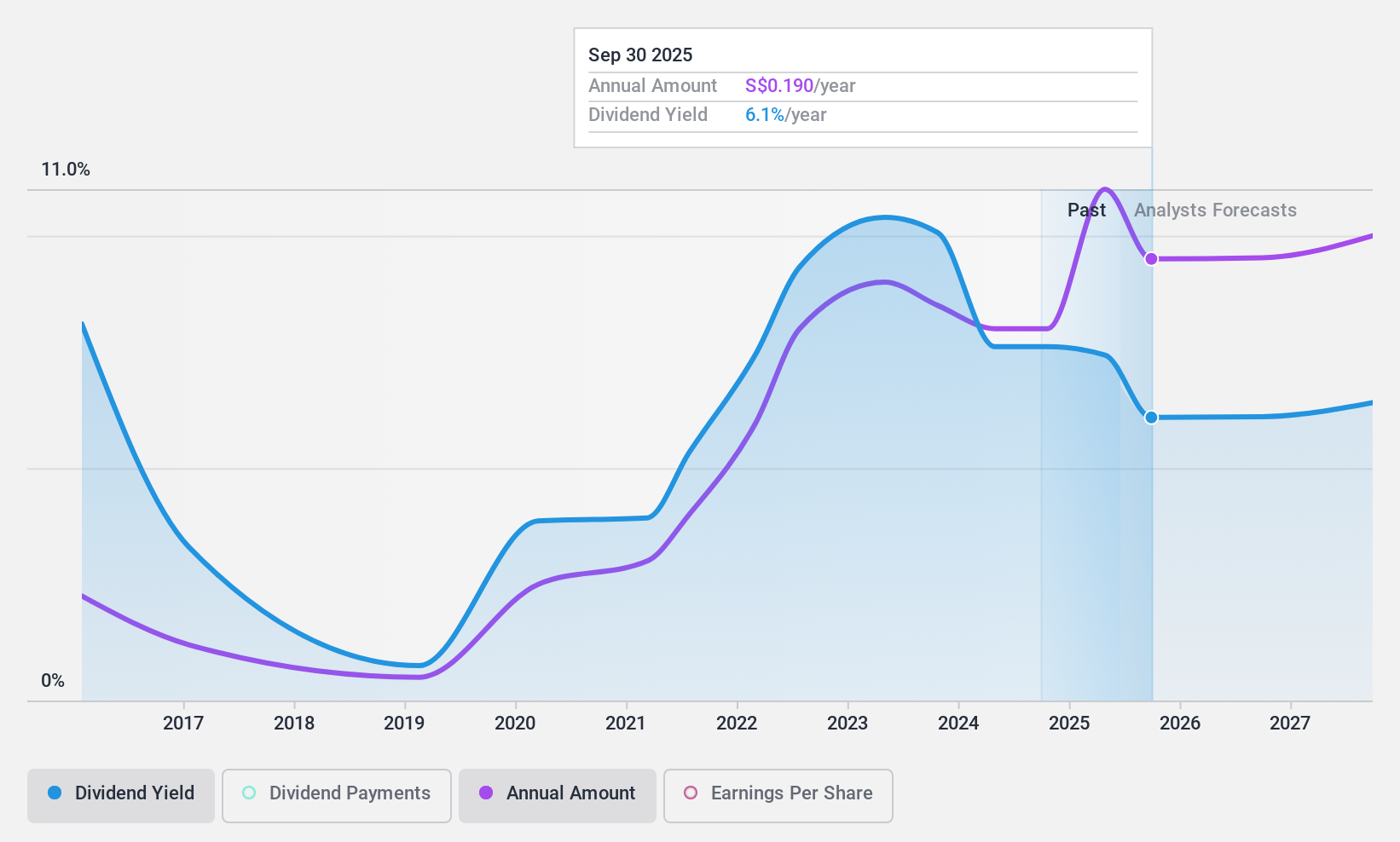

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited, with a market cap of SGD641.98 million, specializes in the prefabrication of steel reinforcement for concrete, serving markets in Singapore and several other countries internationally.

Operations: BRC Asia Limited generates revenue from two main segments: Trading, which contributes SGD319.71 million, and Fabrication and Manufacturing, which accounts for SGD1.35 billion.

Dividend Yield: 6.8%

BRC Asia's dividend yield of 6.84% ranks in the top 25% of Singapore's market, yet its dividends have been volatile over the past decade with occasional declines exceeding 20%. Despite this, current dividends are well-covered by earnings (payout ratio: 35.9%) and cash flows (cash payout ratio: 85.3%). The company is trading at a significant discount to estimated fair value, although future earnings are expected to decline by an average of 3.5% annually over the next three years.

- Dive into the specifics of BRC Asia here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that BRC Asia is priced lower than what may be justified by its financials.

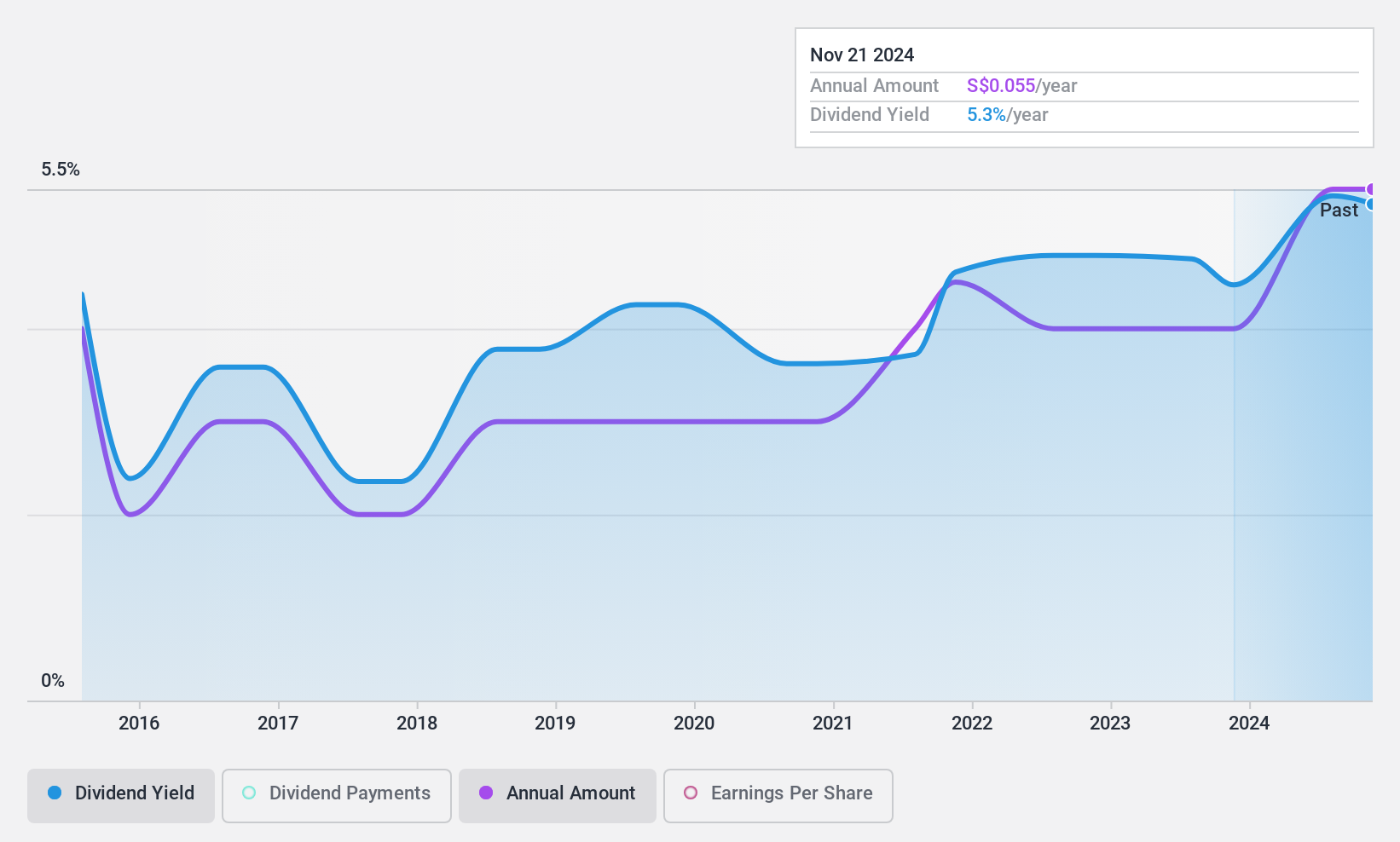

Boustead Singapore (SGX:F9D)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boustead Singapore Limited is an investment holding company that offers energy engineering, real estate, geospatial, and healthcare technology solutions across various global markets including Singapore and has a market cap of SGD506.37 million.

Operations: Boustead Singapore Limited generates revenue through its segments in geospatial (SGD212.67 million), healthcare (SGD10.58 million), energy engineering (SGD174.41 million), and real estate solutions (SGD369.46 million).

Dividend Yield: 5.3%

Boustead Singapore's dividend payments are well-supported by both earnings and cash flows, with payout ratios of 40.9% and 29.6%, respectively. Despite a history of volatility in dividends over the past decade, the company has managed to increase its dividend payouts over ten years. However, its current yield of 5.34% falls short compared to the top quartile in Singapore's market. The stock trades at a significant discount to its estimated fair value, enhancing its appeal for value-conscious investors.

- Click here to discover the nuances of Boustead Singapore with our detailed analytical dividend report.

- According our valuation report, there's an indication that Boustead Singapore's share price might be on the expensive side.

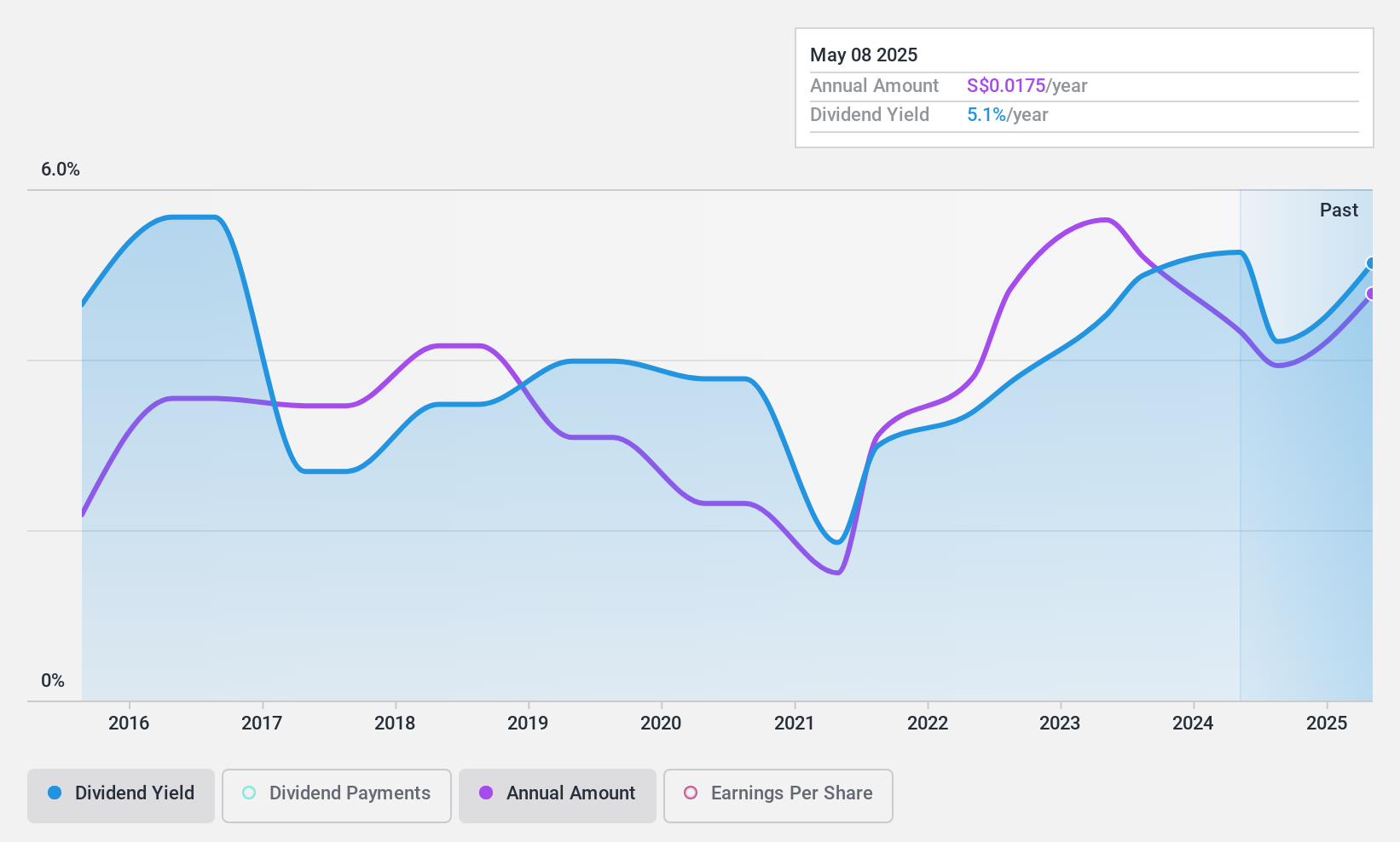

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited is an investment holding company that provides a range of services including system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering as well as cleanroom and air and water engineering globally; it has a market cap of SGD141.68 million.

Operations: Nordic Group Limited generates revenue primarily from its Project Services and Maintenance Services segments, with contributions of SGD69.93 million and SGD83.13 million respectively.

Dividend Yield: 4.1%

Nordic Group's dividend payments, while covered by earnings and cash flows with payout ratios of 40% and 29.6%, have been volatile over the past decade. The company's recent interim dividend decreased to S$0.008526 per share, reflecting a cautious approach amid declining sales and net income for the first half of 2024. Although dividends have grown over ten years, its yield of 4.06% is below Singapore's top quartile dividend payers.

- Unlock comprehensive insights into our analysis of Nordic Group stock in this dividend report.

- The valuation report we've compiled suggests that Nordic Group's current price could be quite moderate.

Key Takeaways

- Explore the 20 names from our Top SGX Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nordic Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nordic Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MR7

Nordic Group

An investment holding company, offers solutions in the areas of system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering, cleanroom, air, and water engineering worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives