- Singapore

- /

- Trade Distributors

- /

- SGX:BDU

Is Now The Time To Put Federal International (2000) (SGX:BDU) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Federal International (2000) (SGX:BDU), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Federal International (2000)

Federal International (2000)'s Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Commendations have to be given in seeing that Federal International (2000) grew its EPS from S$0.0024 to S$0.018, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

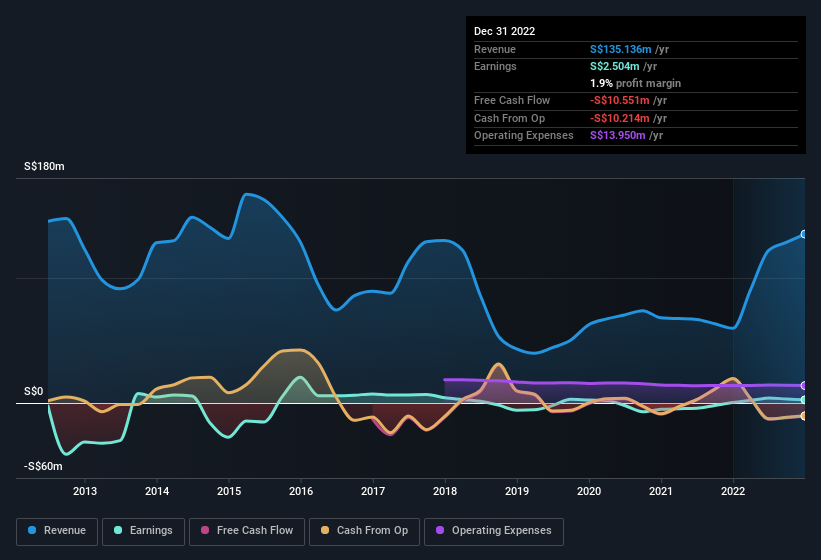

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Federal International (2000) shareholders is that EBIT margins have grown from -3.3% to 4.1% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Federal International (2000) is no giant, with a market capitalisation of S$19m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Federal International (2000) Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that Federal International (2000) insiders own a significant number of shares certainly is appealing. In fact, they own 49% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Of course, Federal International (2000) is a very small company, with a market cap of only S$19m. So this large proportion of shares owned by insiders only amounts to S$9.3m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Should You Add Federal International (2000) To Your Watchlist?

Federal International (2000)'s earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Federal International (2000) very closely. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Federal International (2000) , and understanding them should be part of your investment process.

Although Federal International (2000) certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BDU

Federal International (2000)

An investment holding company, operates as an integrated service provider and procurement specialist in the oil and gas, and energy industries in Indonesia, Japan, the People’s Republic of China, Singapore, Thailand, the United Kingdom, Vietnam, and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives