- Singapore

- /

- Construction

- /

- SGX:BBP

Discovering Opportunities: Ausnutria Dairy And 2 Other Asian Penny Stocks

Reviewed by Simply Wall St

As global markets navigate through a period of economic uncertainty, with consumer confidence dipping and trade tensions rising, investors are keenly observing potential opportunities in diverse regions. In Asia, penny stocks—often representing smaller or newer companies—continue to capture interest due to their affordability and growth potential. While the term 'penny stock' might seem outdated, these stocks can offer substantial value when backed by solid financials; we'll explore three such examples that stand out for their financial strength and promise.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.70 | HK$42.48B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.42 | SGD9.56B | ★★★★★☆ |

| T.A.C. Consumer (SET:TACC) | THB4.16 | THB2.5B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.20 | HK$761.75M | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.86 | HK$640.48M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.02 | CN¥3.5B | ★★★★★★ |

| Newborn Town (SEHK:9911) | HK$4.50 | HK$6.35B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ★★★★★★ |

| Hong Leong Asia (SGX:H22) | SGD0.93 | SGD695.72M | ★★★★★☆ |

| China Lilang (SEHK:1234) | HK$4.01 | HK$4.8B | ★★★★★☆ |

Click here to see the full list of 1,179 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Ausnutria Dairy (SEHK:1717)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ausnutria Dairy Corporation Ltd is an investment holding company involved in the research, development, production, marketing, processing, packaging, and distribution of dairy and nutrition products with a market cap of HK$3.49 billion.

Operations: The company generates revenue primarily from its Dairy and Related Products segment, which accounts for CN¥7.27 billion.

Market Cap: HK$3.49B

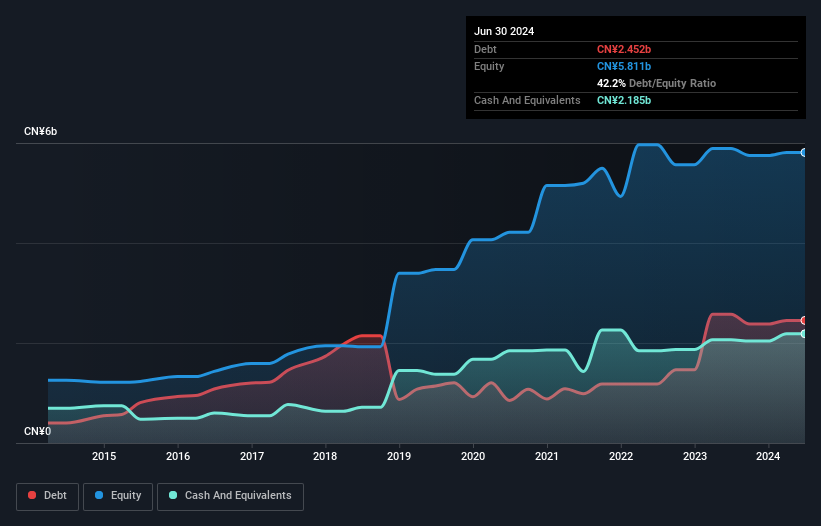

Ausnutria Dairy, with a market cap of HK$3.49 billion, primarily generates revenue from its Dairy and Related Products segment totaling CN¥7.27 billion. Despite negative earnings growth over the past year and a decline in profits by 32.2% annually over five years, the company's debt is well covered by operating cash flow (33.6%), with short-term assets exceeding liabilities significantly. Although trading at 72.9% below estimated fair value suggests potential undervaluation, challenges include low return on equity (2.4%) and an inexperienced management team with an average tenure of 1.8 years impacting strategic stability.

- Unlock comprehensive insights into our analysis of Ausnutria Dairy stock in this financial health report.

- Review our growth performance report to gain insights into Ausnutria Dairy's future.

Honma Golf (SEHK:6858)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Honma Golf Limited is an investment holding company that designs, develops, manufactures, and sells a variety of golf club equipment across Japan, Korea, Hong Kong, Macau, the rest of China, North America, Europe and other international markets with a market cap of HK$2.10 billion.

Operations: The company's revenue is derived from the manufacture and sales of golf-related products and rendering of services, totaling ¥22.84 billion.

Market Cap: HK$2.1B

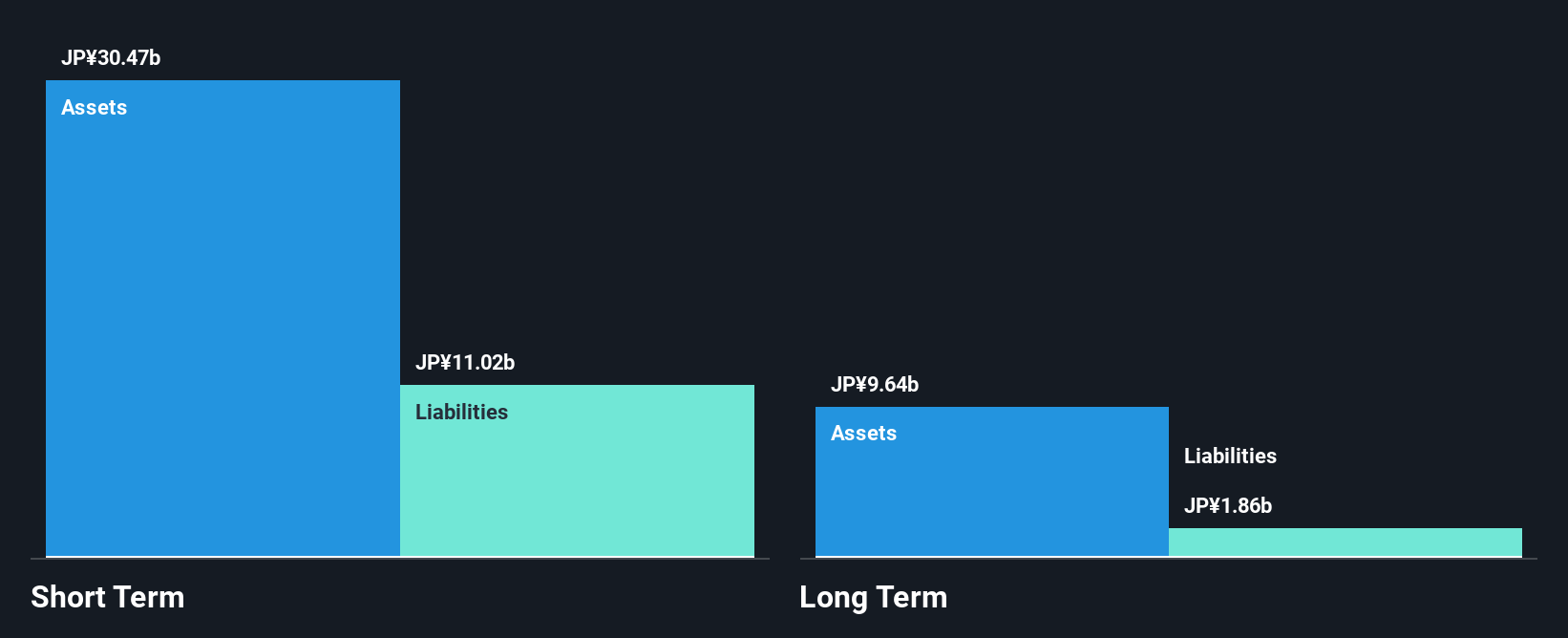

Honma Golf Limited, with a market cap of HK$2.10 billion, derives revenue from its golf-related products totaling ¥22.84 billion. Despite recent negative earnings growth and reduced profit margins (2.9% vs 12.6% last year), the company maintains strong financial health with short-term assets of ¥30.5 billion exceeding liabilities and debt well covered by cash flow (99.2%). Trading at 67.5% below estimated fair value indicates potential undervaluation, though challenges remain such as low return on equity (2.4%) and a significant one-off loss impacting recent financial results by ¥240.8 million.

- Navigate through the intricacies of Honma Golf with our comprehensive balance sheet health report here.

- Gain insights into Honma Golf's historical outcomes by reviewing our past performance report.

Hor Kew (SGX:BBP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hor Kew Corporation Limited is an investment holding company offering a range of integrated construction-related products and services in Singapore, with a market cap of SGD37.49 million.

Operations: Hor Kew Corporation Limited does not report any specific revenue segments.

Market Cap: SGD37.49M

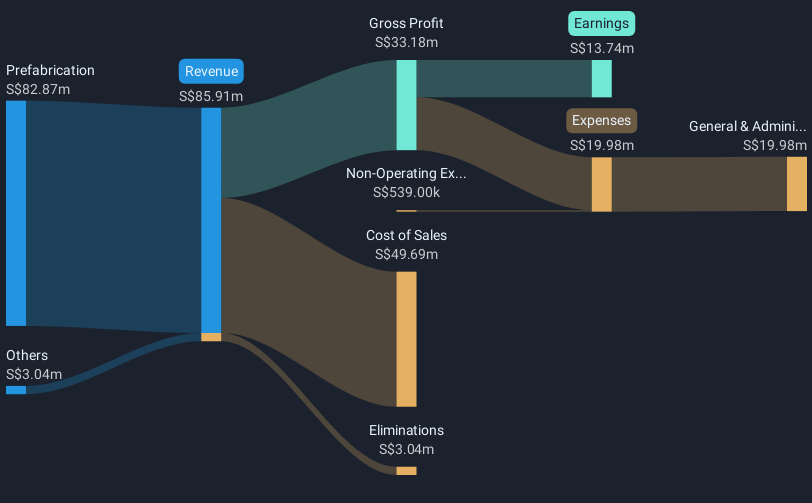

Hor Kew Corporation Limited, with a market cap of SGD37.49 million, has shown impressive earnings growth of 85.3% over the past year, surpassing industry averages. However, its financial results were impacted by a significant one-off loss of SGD8.3 million. The company's debt management is commendable with a net debt to equity ratio of 14.4% and interest payments well covered by EBIT (13.7x). Despite trading at 93.6% below estimated fair value and stable weekly volatility, challenges include an inexperienced board and low return on equity (15.9%). Recent auditor changes may also affect investor confidence moving forward.

- Take a closer look at Hor Kew's potential here in our financial health report.

- Review our historical performance report to gain insights into Hor Kew's track record.

Make It Happen

- Reveal the 1,179 hidden gems among our Asian Penny Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hor Kew might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BBP

Hor Kew

An investment holding company, provides an integrated range of construction related products and services in Singapore.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives