Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies OKP Holdings Limited (SGX:5CF) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for OKP Holdings

What Is OKP Holdings's Net Debt?

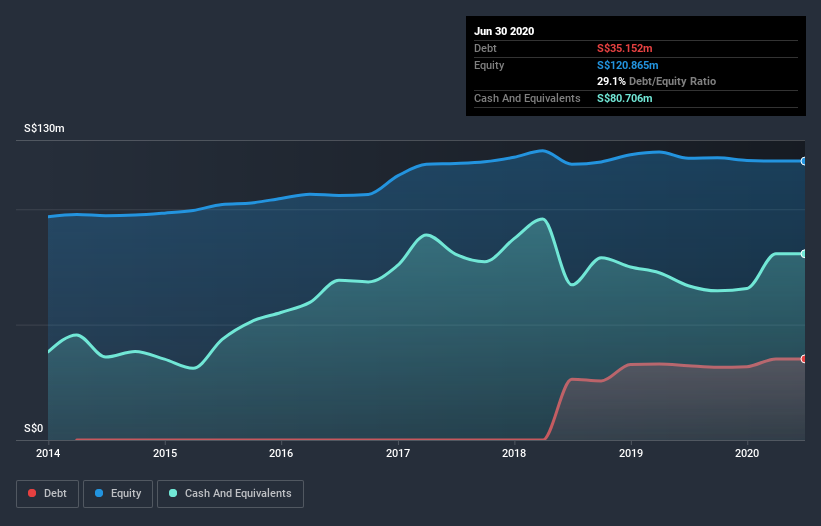

You can click the graphic below for the historical numbers, but it shows that as of June 2020 OKP Holdings had S$35.2m of debt, an increase on S$32.2m, over one year. However, it does have S$80.7m in cash offsetting this, leading to net cash of S$45.6m.

How Healthy Is OKP Holdings's Balance Sheet?

We can see from the most recent balance sheet that OKP Holdings had liabilities of S$30.7m falling due within a year, and liabilities of S$35.0m due beyond that. Offsetting these obligations, it had cash of S$80.7m as well as receivables valued at S$11.8m due within 12 months. So it actually has S$26.8m more liquid assets than total liabilities.

This excess liquidity is a great indication that OKP Holdings's balance sheet is just as strong as racists are weak. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino. Succinctly put, OKP Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is OKP Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year OKP Holdings had a loss before interest and tax, and actually shrunk its revenue by 4.5%, to S$75m. That's not what we would hope to see.

So How Risky Is OKP Holdings?

Although OKP Holdings had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of S$9.2m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. The next few years will be important as the business matures. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with OKP Holdings (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading OKP Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:5CF

OKP Holdings

Together with its subsidiary, operates as a transport infrastructure and civil engineering company in Singapore and Australia.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026