- Singapore

- /

- Electrical

- /

- SGX:500

If You Like EPS Growth Then Check Out Tai Sin Electric (SGX:500) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Tai Sin Electric (SGX:500). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Tai Sin Electric

How Fast Is Tai Sin Electric Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Tai Sin Electric managed to grow EPS by 9.3% per year, over three years. That's a pretty good rate, if the company can sustain it.

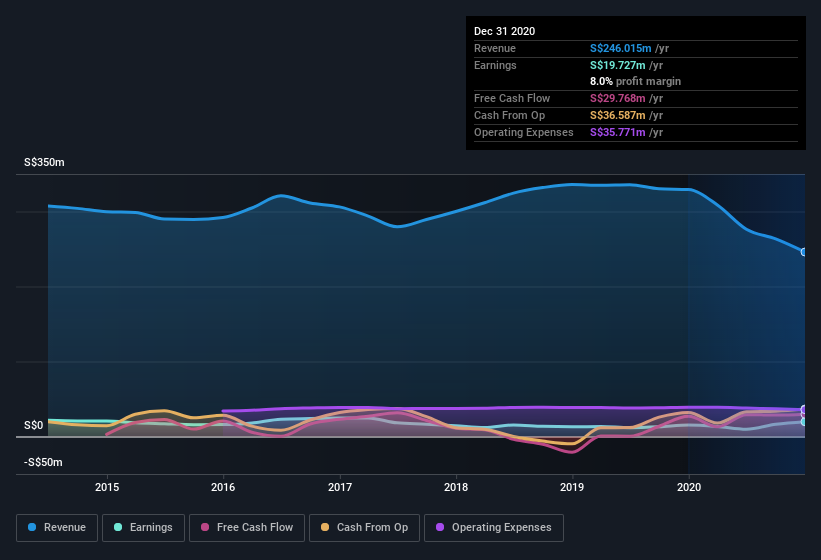

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Tai Sin Electric's EBIT margins are flat but, of some concern, its revenue is actually down. And that does make me a little more cautious of the stock.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Tai Sin Electric isn't a huge company, given its market capitalization of S$163m. That makes it extra important to check on its balance sheet strength.

Are Tai Sin Electric Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Tai Sin Electric shareholders can gain quiet confidence from the fact that insiders shelled out S$758k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. Zooming in, we can see that the biggest insider purchase was by CEO & Executive Director Boon Hock Lim for S$248k worth of shares, at about S$0.33 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Tai Sin Electric insiders own more than a third of the company. In fact, they own 62% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have S$102m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Tai Sin Electric To Your Watchlist?

One positive for Tai Sin Electric is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Tai Sin Electric (at least 1 which shouldn't be ignored) , and understanding these should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Tai Sin Electric, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Tai Sin Electric or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Tai Sin Electric, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tai Sin Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:500

Tai Sin Electric

Manufactures and deals in cable and wire products in Singapore, Malaysia, Brunei, Vietnam, Indonesia, Myanmar, Cambodia, Thailand, and internationally.

Solid track record with excellent balance sheet.